Advisory: Be careful of what you read on social media. The algorithms used by these platforms have no regard for Biblical truth. They target your emotions to keep you engaged on their site so their advertisers can drop more ads. These platforms exist to enrich their stockholders. Consider God’s promise to Believers in James 1:5, “If any of you lacks wisdom, you should ask God, who gives generously to all without finding fault, and it will be given to you.”

Featured Story

toilet paper run is any indication, US depositors will soon shift their attention to that other “paper”…what An American Bank Run Would Look Like, Once a bank run gets going, even a healthy bank can have a hard time stopping it because just giving everyone their money right then and there usually isn’t an option.

Bank run (bank panic)

A series of unexpected cash withdrawals caused by a sudden decline in depositor confidence or fear that the bank will be closed by the charteringagency, i.e. many depositors withdraw cash almost simultaneously. Since the cash reserve a bank keeps on hand is only a small fraction of its deposits, a large number of withdrawals in a short period of time can deplete available cash and force the bank to close and possibly go out of business.

Technically the title of this post is wrong: the truth is that nobody could possibly know or predict what a bank run would look like in detail suffice to say that it would have terminal and devastating results on the global economy. One needs only remember what happened when the Reserve Fund broke the buck and the $3 billion money market industry was at risk of unwinding (for those who do not, Paul Kanjorski does a good summary here). What we do, however, wish to demonstrate is the tenuous balance between physical money – yes, just like precious metals, there is actual “physical money”, better known as currency in circulation – and more abstract, confidence-based, “electronic money.” Now when it comes to talking about systemic instability, pundits often enjoy bringing up the case of the $600+ trillion (recently discussed here in a different capacity) in synthetic derivatives, whose implosion would “wipe out the world.” While that may indeed be the case (the memory of the CDS-precipitated AIG implosion is still all too fresh), since nobody really can comprehend the side effects of the collapse of the global derivative system, which by some estimates is over $1 quadrillion when combining exchange and OTC based derivatives, it is largely based on pure conjecture. And, as we demonstrate below, one doesn’t even need to do get that high up in the pyramid of credit money.

The truth is that should there be an American bank run, what would happen is the conversion of all electronic dollars into physical dollars, as retail Americans rush to empty their checking and savings accounts, exit their money markets, while institutional America converts all “shadow” liabilities into hard dollar assets (Zero Hedge has a specific methodology of defining what liabilities make up the shadow banking system). The truth is that should there be a D-Day in the American banking system and there is a global scramble for the physical paper (ignore gold) the conversion ratio for binary dollars into hard ones could be as high as 30 to 1. Which begs the question: should one apply a 90% discount when evaluating their electronic dollar exposure? That, and many other questions too…

Physical dollars

When looking at actual “hard” dollars, there is just one place: the Fed’s weekly H.6 statement which shows what the total amount of currency in circulation at any given moment is. The H.6 is the statement that breaks down the two forms of monetary stock tracked by the Fed: M1 and M2. Currency is at the very top. As a reminder, currency, together with Fed bank reserves are the only two actual forms of money “printed” into circulation. Yes, there is much polemic over the nature of bank reserves, but they, together with currency in circulation are the only two actual liabilities on the Fed’s balance sheet, backed by such assets as Treasurys, Mortgage-Backed Securities and, questionably, gold (questionably, because as Ron Paul has been crusading, the existence of gold on the Fed’s asset side is taken on faith and is based on promises by the Fed that it in fact exists, but nobody is allowed to actually see it).

So how many actual physical dollars are there? Well according to the H.6, as of June 27, there was $967.3 billion in currency currently circulating within the US economy, while the H.4.1 tells us that as of July 6 there was $1.66 trillion in bank reserves with the Fed, which if need be can be promptly released as currency to the wider public on-demand (granted the dynamics of this release are completely unclear). This adds up to just over $2.6 trillion in “physical currency” (which also happens to be the “record” asset side of the Fed’s balance sheet).

So that’s what the ‘supply’ side of money looks like in a dollar bank run. What about the demand. In other words, who will have the non-contractual “right” to pursue these $2.6 trillion in cold, hard cash?

Let’s start with the M1, which is where the first tranche of electronic dollars is situated.

M1, in addition to currency in circulation, also contains demand and checkable deposits. The most recent number for these two is $982.9 billion. So far so good: if only demand and checkable deposits were pulled, the currency in circulation would be sufficient, although there would be a small impairment of just about 1.5%.

Next up, we go to the M2, which in addition to the M1 components, also contains such abstract concepts as Savings Deposits, Small-Denomination Time Deposits and Retail Money Funds. The dollar values associated with these assorted claims on cash are $5,662.8 billion, $827.9 billion, and $698.7 billion respectively, or a total of just under $7.2 trillion. Add to this the roughly $1 trillion in non-cash M1 and you get $8.2 trillion. And this is where things start getting interesting. Because should every retail saver who has documented paper claims in America’s checking, savings, time deposits, and money market pull their money, they would find that there is just $2.6 trillion in cash available to actually satisfy said claims.

But wait, there’s more.

While the M2 conveniently ignores it, another major component of monetary aggregates is institutional money funds, which adds another $1.833.2 trillion in claims to physical fiat. Added across and we get just over $10 trillion.

But wait, there’s more.

Remember how on March 23, 2006, the Fed discontinued the M3 because it was “too expensive” to keep track of all this “money.” Well, courtesy of various replication loophole Zero Hedge has been able to track a far more comprehensive indicator of the broadest money stock in the US economy: the shadow banking system, which for all intents and purposes is the same as above: namely claims on actual money however more by institutional accounts than retail.

The breakdown, based on the most recent Z.1 (through March 31, 2011) is as follows:

- GSE Liabilities: $6,577.8 billion

- Agency Mortgage Pools: $1,166.3 billion

- Asset-backed securities Issues: $2,280.6 billion

- Securities Loaned by Funding Corporations: $709.0 billion

- Liabilities in Fed Funds and Security Repo agreements: $1,263.3 billion

- Total Outstanding Open Market Paper: $1,131.2 billion

Whipping out the calculator, and we get… $13.1 trillion in shadow banking system claims. Adding across with the M1 and M2 stock noted above and one gets $23.1 trillion. As a quick reminder, the physical money, in a best-case scenario, is $2.6 trillion when adding reserves, and in a worst-case, $967 billion. In other words, the paper to physical dilution is anywhere between 8.8 times and 24 times.

But wait, there’s more.

Observant readers will recall that in our 2009 piece which before anyone else had even considered it, explained how the Fed bailed out the world with FX liquidity swaps, one of the key take-home messages was that there was a synthetic short on the USD to the tune of about $6.5 trillion courtesy of the USD carry trade and other considerations. In other words, this is how many dollars would have to be conjured up into existence to satisfy existing electronic claims (and why the Fed had to scramble to implement the FX swaps when it did). One thing that is certain is that in an American (and thus global) bank run, all of the dollar shorts would cover in milliseconds as the carry trade would collapse instantaneously.

The take-home is that courtesy of this latest and greatest demand on cash, there is up to another $6.5 trillion in potential claims on underlying hard dollars (and likely much greater as this BIS study was conducted at a time before ZIRP, and before the USD was new, step aside JPY, carry currency of the world).

Summing it all up

Putting together all of the above, there are anywhere between $967.3 billion and $2.6 trillion in physical claim satisfying pieces of paper that everyone would scramble to grab if the sky was falling, and against these, there are just under $30 trillion in paper claims on said hard paper. This can be seen visually on the indicative chart below:

Do readers see now why it is irrelevant to add X trillions or even quadrillions in derivatives? Because when just taking the plain vanilla electronic claims on circulating dollars there would have to be between an 11x and 31x haircut when everyone rushes to procure the suddenly all too precious pieces of paper with the picture of a dead president on the face.

For all intents and purposes, this has been more of a thought experiment than any indicative scientific evaluation as there are many other nuances when analyzing all of the above. However, for the sake of esthetic purity, the truth is that no matter how one slices and dices it, there will be an unimaginable scramble to get out of electronic dollars and into physical ones. The amusing thing is that there are many who are worried that physical silver claims may be diluted by outstanding paper. This is true, however, ironically, it is very true when dealing with the heart of the fiat system. And recall that we refused to look at the $1 quadrillion in credit money at the derivative level. We believe that for illustration purposes, knowing that at best 10% of electronic money is covered in a worst-case scenario should be sufficiently enlightening. As for those who say that all the Fed would need to do is merely hit the print button and not stop, remember: this money would simply flow to bank reserves. How it gets from there to outright currency in circulation is something the Fed has been bashing its head over the past 3 years, so far, unsuccessfully. And any money para dropped into circulation directly, would not do anything to alleviate the dilution factor as it would add to both sides of the “claim” and “deliverable” ledger (not to mention that it would also lead to instantaneous hyperinflation).

So, in the loosely paraphrased immortal words of Troy Mclure, now that you know, roughly, what a bank run would look like, don’t do it.

GLOBAL ECONOMY HEADS FOR MAJOR RECESSION AS CENTRAL BANKS INCREASE EMERGENCY MEASURES TO PREVENT COLLAPSE OF FINANCIAL SYSTEM

Written by Dr. Leon Tressell exclusively for SouthFront

You can taste the fear as global central banks panic and introduce emergency measures to prevent a systemic collapse of the global financial system. On Sunday the U.S. Federal Reserve launched another financial bazooka at stock and bond markets when it announced the start of QE 4. This will involve the purchase of $700 billion of government bonds/mortgage-backed securities and a 1% interest rate cut taking them to zero.

Today the ECB has announced another $112 billion to be made available to banks while the Bank of Japan has declared that it will spend trillions more on purchasing bonds and exchange-traded funds.

This gigantic package of stimulus measures comes on top of the panic measures introduced last week as the meltdown in stock and bond markets began to get out of control. Last Thursday, as the bond market melted down and lines of credit were under threat the Fed announced an intervention in the short term debt markets (repo) that will run into April and amounts to over $4.5 trillion.

Last Thursday’s panic measure backfired as the Dow Jones plunged over 2000 points.

Financial analyst Wolf Richter, who has recently shorted the markets with some success, commented:

“This is the Fed’s latest effort to bail out Wall Street, the cherished asset holders that are so essential to the Fed’s “wealth effect,” all repo market participants, the banks, and the Treasury market that suddenly has gone haywire. Lots of things have gone haywire as the Everything Bubble unwinds messily.”

Flash forward to today and markets are reacting badly to the latest panic measure. At the opening of trading, today stocks immediately crashed triggering circuit breakers that halted trading. The S&P 500 -9.8% 220 points or 8.1% down while the Dow Jones -10.5% plummeted 2, 250 points or 9.7% down. Meanwhile, the Nasdaq -9.83 dropped 482 points or 6.1% down.

The epic collapse of U.S. stock markets is shown in the chart below from Marketwatch:

This meltdown has been repeated on stock markets around the world. As if this wasn’t bad enough oil prices have fallen below $30 dollars a barrel while the scramble for cash has led haven assets such as gold to tumble in price today.

Sven Heinrich of Northman Trader has called this market to perfection and explained how global central banks are responsible for the current financial crisis through their reckless money printing measures since the 2008 economic crisis.. On twitter today he warned:

“If they can’t control markets today they should just shut it down until things can get sorted. They’re risking major fund blow ups and irreparable damage with consequences felt for a long time even if coronavirus gets sorted.”

The Federal Reserves announcement of QE4 on Sunday illustrates how frightened the central banks are of the major economic recession ahead. Highly respected economist Mohammed El-Arian, Allianz Chief Economic Advisor, has explained the Fed’s decision to launch massive monetary stimulus in simple terms:

“The fundamentals went from flashing red to constant red over the weekend.”

Market trader Mike O’Rourke, the chief market strategist at financial brokerage Jones Trading, rather aptly describes the current market mayhem as “Bearmaggedon”. This refers to a situation when the economy collapses at a time of easy monetary policy with historically low-interest rates and paper assets like stocks and bonds are still expensive and overvalued. In a note to clients, he said ominously, “That combination of events becomes toxic because investors begin to express concern that the [Federal Reserves] monetary policy has become impotent.”

O’Rourke puts the failure of central bank intervention into its historical context:

“We thought the panic peaked on Thursday, when most of the country started to shut down, but that was eclipsed tonight by the Federal Reserve. All of us have just witnessed a central bank expend all of its conventional and unconventional tools to support an equity market that is less than a month from all time highs.”

Howard Gold of Marketwatch sums up why markets across the world continue to collapse:

“Bottom line: Investors don’t think the Fed’s moves are enough.”

The political and economic elites of the American empire have boxed themselves into a corner and created an economic hurricane that threatens an economic depression similar to the 1930s.

Since 2008 the Federal Reserve has presided over a gigantic wealth transfer as its massive money printing led to massive price inflation in paper assets across the board from stocks to bonds. The 1% have raked in massive profits while income levels for the majority have stood still or declined.

It has kept interest rates at historically low levels enabling banks, hedge funds, and corporations to gorge themselves on cheap debt and engage in a frenzy of stock buybacks to the tune of several trillion dollars. These stock buybacks have artificially inflated the price of stock market shares while insiders sell at high prices.

Despite the current turmoil in financial markets, the largesse of the Fed knows no bounds as it bails out its corporate masters.

The U.S. government which acts on behalf of corporate America, just like the Fed, is bankrupt and has a $23 trillion deficit that is growing exponentially. Trump’s $1 trillion tax giveaway in 2017 that largely benefited the super-rich and corporate America has left the U.S. government with annual trillion-dollar deficits. Many economists argue that Washington has little room for the massive stimulus needed to combat the impacts of the current pandemic.

Howard Gold of Marketwatch sums up the predicament of the American empire in rather somber terms:

“As investors clamor for some kind of certainty — or at least leadership —the Fed is out of ammo, the federal government is fiscally tapped out, and the factionalism Washington and Madison warned about is tearing the country apart. Yes, indeed, the chickens are coming home to roost, but this time they’re infected by a deadly virus.”

Buckle up, for we have entered an unprecedented period of turmoil and volatility which will shake the global economy to its foundations.

The current panic rate cuts and massive money printing by global central banks and the stimulus measures of governments everywhere are just the beginning of this crisis. Expect bailouts galore as industry after industry screams for government/central bank assistance.

It would appear that the solution to $250 trillion of unpayable global debt is to hit the printing presses hard and create a whole load more cash out of thin air.

As businesses of all sizes go bankrupt while job losses and pay cuts rise over the next period I wonder if central banks’ generosity will extend to ordinary citizens?

As the global economy shuts down we will rapidly slide towards a major recession that will shake up geopolitics and lead us into even more uncertain times. The 2020s threaten to be a repeat of the 1930s when international relations broke down and the economic crisis was of such severity it left the major powers with no other recourse but the war to try and solve their intractable problems.

A bank run occurs when a large number of people withdraw their money from a bank because they believe the bank may cease to function in the near future.

Paul, too, described the Tribulation as birth pains. First Thessalonians 5:3 says, “While people are saying, ‘Peace and safety,’ destruction will come on them suddenly, as labor pains on a pregnant woman, and they will not escape.” This event follows the Rapture and the removal of the Church, in 4:13-18. In 5:9, Paul reemphasizes the absence of the Church from this time period by saying, “For God has not destined us for wrath, but for obtaining salvation through our Lord Jesus Christ.” The wrath spoken of here is God’s judgment on the unbelieving world and His discipline of Israel during the Tribulation.

There is a reason James Simons’ RenTec is the world’s best-performing hedge fund – it spots trends (even if they are glaringly obvious) well ahead of almost everyone else, and certainly long before the consensus.

That’s what happened with Deutsche Bank, when as we reported two weeks ago, the quant fund pulled its cash from Deutsche Bank as a result of soaring counterparty risk, just days before the full – and to many, devastating – extent of the German lender’s historic restructuring was disclosed, and would result in a bank that is radically different from what Deutsche Bank was previously (see “The Deutsche Bank As You Know It Is No More“).

In any case, now that RenTec is long gone, and questions about the viability of Deutsche Bank are swirling – yes, it won’t be insolvent overnight, but like the world’s biggest melting ice cube, there is simply no equity value there anymore – everyone else has decided to cut their counterparty risk with the bank with the €45 trillion in derivatives, and according to Bloomberg Deutsche Bank clients, mostly hedge funds, have started a “bank run” which has culminated with about $1 billion per day being pulled from the bank.

As a result of the modern version of this “bank run”, where it’s not depositors but counterparties that are pulling their liquid exposure from DB on fears another Lehman-style lock up could freeze their funds indefinitely, Deutsche Bank is considering how to transfer some €150 billion ($168 billion) of balances held in it prime-brokerage unit – along with technology and potentially hundreds of staff – to French banking giant BNP Paribas.

One problem, as Bloomberg notes, is that such a forced attempt to change prime-broker counterparties would be like herding cats, as the clients had already decided they have no intention of sticking with Deutsche Bank, and would certainly prefer to pick their own PB counterparty than being assigned one by the Frankfurt-based bank. Alas, the problem for DB is that with the bank run accelerating, pressure on the bank to complete a deal soon is soaring.

Here are the dynamics in a nutshell, (via Bloomberg): Deutsche Bank CEO Christian Sewing is pulling back from catering to risky hedge-fund clients, i.e. running a prime brokerage, as he attempts to radically overhaul the troubled German lender while BNP CEO Jean-Laurent Bonnafe wants to expand in the industry. A deal of this magnitude would be a stark example of the German firm’s retreat from global investment banking while potentially transforming its French rival from a small player in the so-called prime-brokerage industry to one of Europe’s biggest.

Of course, publicly telegraphing that DB is in dire liquidity straits and needs an in-kind transfer of its prime brokerage book would spark an outright panic, and so instead the story has been spun far more palatably, i.e., “BNP is providing “continuity of service” to Deutsche Bank’s prime-brokerage and electronic-equity clients as the two companies discuss transferring over technology and staff“, according to a July 7 statement. The ultimate goal of the talks is for BNP to take over the vast majority of client balances, which are slightly less than $200 billion currently.

There is just one problem: nothing is preventing those clients who would be forcibly moved from a German banking giant to a French banking giant from redeeming their funds. And that’s just what they are doing. Or rather, nothing is preventing them from moving their exposure for now, which is why they are suddenly scrambling to do it before they are suddenly gated.

This is why the final shape of the deal remains, pardon the pun, fluid, and it is unclear how it will proceed, facing a multitude of complexities, including departing clients.

In an attempt to stop the bank run, BNP executives are meeting with U.S. hedge-fund clients this week to convince them to stay following similar sit-downs with European funds last week, Bloomberg sources said.

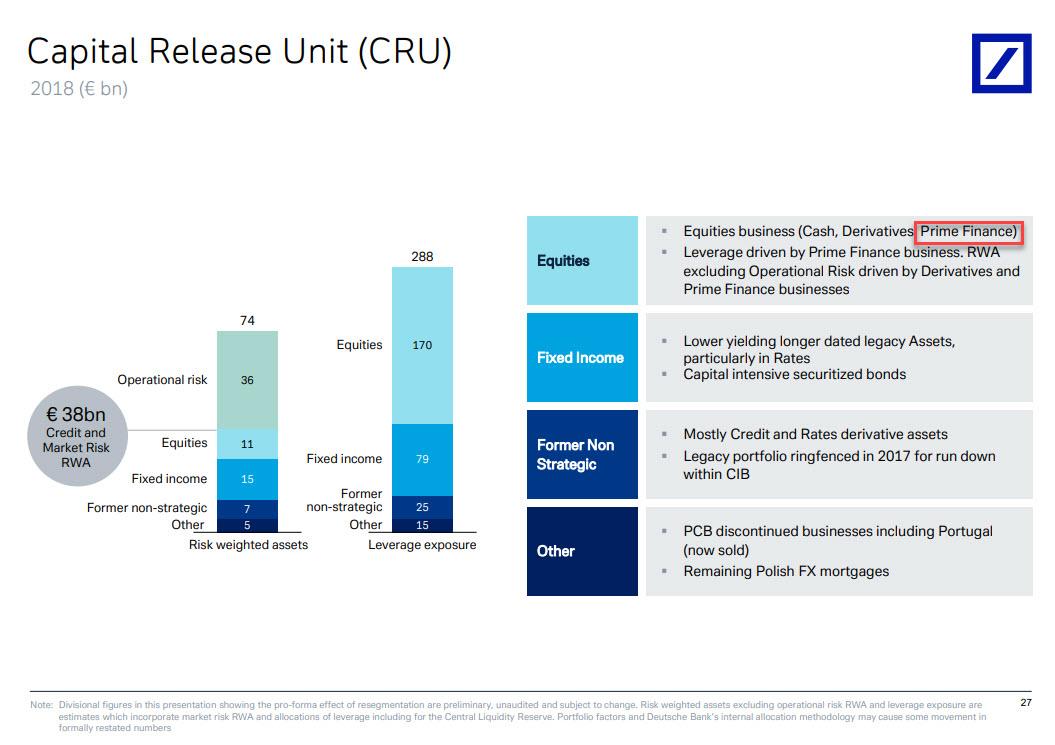

However, if this gambit fails, and hedge funds keep moving their business elsewhere, officials at the German bank may just relegate its assets tied to the prime finance division into the newly formed Capital Release Unit, i.e. the infamous “bad bank” which is winding down unwanted assets totaling 288 billion euros ($324 billion) of leverage exposure, and the prime brokerage is responsible for much of the 170 billion euros of leverage exposure that’s coming from the equities division into the division, also known as CRU a presentation shows.

It also means that countless hedge funds are suddenly at risk of being gated on whatever liquid exposure they have toward Deutsche Bank.

To be sure, Deutsche Bank’s hedge fund balances have been declining throughout the year as speculation swirled around Sewing’s intentions for the prime brokerage, but the rate of redemptions was far lower than $1 billion per day. Now that the bank jog has become a bank run, the next question is how much liquidity reserves does DB really has and what happens if hedge funds clients – suddenly spooked they will be the last bagholders standing – pull the remaining €150 billion all at once.

We are confident we will get the answer in a few days if not hours, until then please enjoy this chart which compares DB’s stock decline to that of another bank which was gripped by a historic liquidity run in its last days too… Source

Bank runs are contagious and hard to stop

Even worse, bank runs can be contagious, quickly spreading from truly broke banks to banks that are perfectly solvent. During panics like the Wall Street crash of 1929, healthy and shaky institutions alike were besieged by account holders demanding their money back.

“The problem with bank runs is it can cause a breakdown of the entire (banking) system, even though there’s no hard evidence of a bank being insolvent,” says Levine. “You can have a perfectly solvent situation, everything is going OK, and for some reason people get nervous, and all of a sudden the system can come crashing down.”

Once a bank run gets going, even a healthy bank can have a hard time stopping it because just giving everyone their money right then and there usually isn’t an option.

Banks don’t keep everyone’s money sitting in a giant vault somewhere ready to hand out when depositors ask for it. Instead, they’re taking consumers’ deposits and using them to make longer-term investments, such as loans to consumers and businesses, so they can make money — and pay depositors interest.

“Many depositors line up to take out their savings from a bank, but the bank, as it normally does, makes investments that cannot be turned into cash quickly enough to satisfy all of those savers immediately,” Levine says.

StevieRay Hansen

Editor, HNewsWire.com Bankster Crime

The Bill and Melinda Gates Foundation Have NOT Got The Memo Yet, “Pestilences” Has No Cure

“America has become China on Steroids” Set Down and SHUT-UP, Our Social Media Platforms (Reprobates) Continue to Hide the Truth From the American People, by Shadow Banning Alt News Sources. The Blood of the People Is on Their Hands…

The truth is that all of the warnings of alleged ‘conspiracy theorists’ have turned out to be correct The word translated “pestilence” is often translated as “plague” or “disaster” …

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

HNewsWire, StevieRay Hansen, Bank Run, Tribulation Fraud, Banks, AntiChrist, Money, Corruption, Bankers

Tagged In

Newsletter

Must Read

Other Sources

Latest News

Watchman: False Prophets Make Huge Profits. They’ll Do Anything to Scam You.

(HNewsWire) This is a story about heresy, lunacy, and the crazy world of false religion. Religious predators feed on naïve and ignorant souls. The most…

Read MoreWatchman: The Most Deadly Domestic Terrorists Have Taken up Residence in the White House, Senate, House of Representatives, Pentagon, and Crystal City

Politicians should all be wearing ankle monitors-if not shackles. The U.S. government is covertly recruiting Google, which maintains access to swaths of Americans’ personal data…

Read MoreAmerican Health Care as We Call It Today, and For All Its High-Tech Miracles, Has Evolved Into One of the Most Atrocious Rackets the World Has Ever Seen, by Racket… I Mean an Enterprise Organized Explicitly to Make Dishonest Money

HNewsWire: Scientific propaganda about vaccines has reached dizzying heights, as officials point the uninformed public toward the Day of Liberation, when a COVID shot, otherwise…

Read MoreWe Are Drowning in Information While Starving for Wisdom

Wisdom and knowledge, both recurring themes in the Bible, are related but not synonymous. The dictionary defines wisdom as “the ability to discern or judge what is…

Read More

We make every effort to acknowledge sources used in our news articles. In a few cases, the sources were lost due to a technological glitch. If you believe we have not given sufficient credit for your source material, please contact us, and we will be more than happy to link to your article.