Advisory: Be careful of what you read on social media. The algorithms used by these platforms have no regard for Biblical truth. They target your emotions to keep you engaged on their site so their advertisers can drop more ads. These platforms exist to enrich their stockholders. Consider God’s promise to Believers in James 1:5, “If any of you lacks wisdom, you should ask God, who gives generously to all without finding fault, and it will be given to you.”

Featured Story

Evictions Could Make 28 Million Americans Homeless This Year Alone, FEMA Has A Plan, Tribulation Hell On Earth…

This Is a Plan Event People.

Even though we know our elected officials with eyes wide open started this Plandemic, they KNEW it would increase homelessness, hunger, and a multitude of people’s lives. We are still commanded to help those in need, those that purposely harmed innocent people will be judged accordingly,Enjoy…

With the Supreme Court officially striking down Biden’s eviction moratorium and with most state-level restrictions set to expire over the next month, Goldman has calculated how sharply evictions could rise under current policy in order to estimate the potential impact on the economy.

First some big picture details:

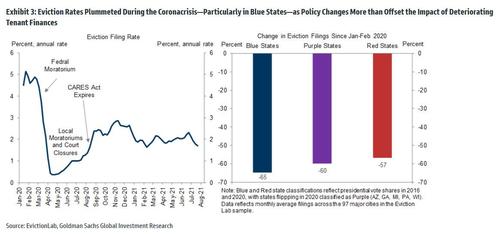

- Despite the severe recession, evictions actually declined during the coronacrisis due to the national eviction moratorium, with eviction filings declining 65% in Blue states and 61% nationwide.

- Using rent delinquency data from real estate companies, the National Multifamily Housing Council, and the Census Pulse survey, the bank estimates that 2½-3½ million households are behind on rent, with $12-17bn owed to landlords.

- Despite the $25bn dispersed from the Treasury to state and local governments, the process of providing these funds to households and landlords has been slow. Only 350k households received assistance in July, and at this pace, 1-2 million households will remain without aid and at risk of eviction when the last 2021 eviction bans expire on September 30.

Next, we jump right to Goldman’s findings before digging deeper into the analysis. According to the bank:

- The strength of the housing and rental market suggests landlords will try to evict tenants who are delinquent on rent unless they obtain federal assistance. And evictions could be particularly pronounced in cities hardest hit by the coronacrisis, since apartment markets are actually tighter in those cities.

- Taken together, Goldman believes roughly 750k households will ultimately be evicted later this year under current policy.

- Goldman expects that a small drag on consumption and job growth will result from an eviction episode of this magnitude, but the implications for covid infections and public health are probably more severe.

- The end of the moratoriums would also exert downward pressure on shelter inflation as vacancy rates rise. Under our baseline estimates, post-moratorium evictions will raise the vacancy rate by about 1pp, which on its own would lower shelter inflation by 0.3pp in 2022, partially offsetting the intense upward pressure from the housing shortage.

With that in mind, we next look closer at the underlying causes behind the coming “Rental Policy Shock”, as well as what comes next.

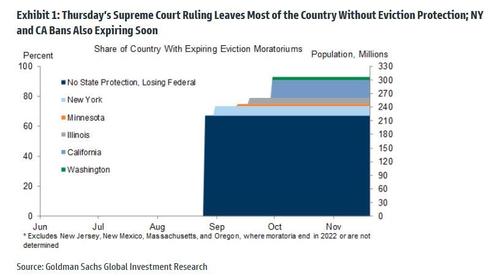

On Thursday, the Supreme Court overturned the federal eviction moratorium that had constrained the ability of landlords to evict tenants adversely affected by the pandemic recession. As shown in the chart below, because most states do not currently have eviction bans in place and because those that do are also set to expire by September, roughly 90% of the country will lose access to these emergency protections by the start of the fourth quarter.

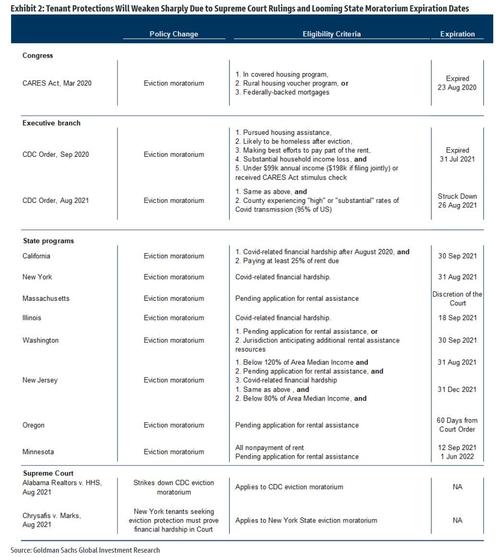

The coming end of the eviction moratorium will result in a sharp and rapid increase in eviction rates in coming months unless Emergency Rental Assistance (ERA) funding is distributed at a much faster pace or Congress addresses the issue, for example in the upcoming reconciliation package. These key deadlines are summarized in the table below.

The tenant protection policies listed above significantly reduced evictions during the first 18 months of the pandemic, with eviction rates actually falling instead of rising as typically happens during a recession. Because of the legal gray area and income-eligibility requirements of the federal eviction bans, state and local moratoriums have often been more effective in preventing evictions. As shown in the left panel of the next chart, eviction rates plummeted to near-zero while the strictest eviction bans of spring 2020 were in effect, and on average, eviction filing rates remain less than half their pre-crisis pace.

The right panel above shows that eviction filings have generally fallen more dramatically in liberal states and cities adopting more stringent protections like California and New York (-65% across Blue States). These states are also more likely to interpret the federal moratoriums more generously than Red States.

Economic Impact of the Moratoriums

The eviction moratoriums primarily affected the real economy through their impact on tenant-occupied housing consumption and consumer cash flows, both of which were highly positive: the housing consumption category continued to rise during the crisis in spite of the surge in unemployment (+0.9% in 2020 and +0.8% in 1H21, real basis). However, the category represents only 2.5% of GDP, so the direct impact on GDP levels through this channel was probably small (0.1-0.2% of GDP).

Eviction Backlog

Obviously, the eviction moratorium had extremely favorable consequences for the economy – after all it delayed the realization of true supply and demand at the expense of taxpayers and massive debt monetization. However, this period of involuntary taxpayer generosity is coming to an end and as of this moment, estimates of rental delinquencies run the gamut from under 1mn units to upwards of 15mn, with the wide range reflecting the rapid changes in the labor and rental markets over the last year, as well as the lack of timely and representative data on the subject. Goldman’s estimates, shown below, indicate 1-2mn households at risk of eviction even after next month’s federal aid distributions, of which roughly 750k households would be evicted under the status quo.

As shown in the exhibit above, Goldman estimates that the number of housing units at risk of eviction, based on uncollected tenant revenues in 2021Q2 for large property managers, representing 20mn tenant-occupied housing units, and based on survey data reporting the share of consumers who owe back rent and also “lost employment income” during the pandemic, representing the remaining 25mn units. Because the moratoriums also deferred hundreds of thousands of evictions unrelated to the pandemic, one should also add an additional backlog to reflect these missing filings.

Together, the bank estimates that 2½-3½ million households are significantly behind on rent and at risk of eviction without policy support. Since roughly half of eviction filings historically result in eviction (47% over 2006-2016), Goldman assumes that barring a new eviction ban from Congress or a much faster pace of ERA distribution, 750k households will face eviction in the fall and winter months. With 8-9 million Americans currently unemployed and emergency unemployment programs winding down, the sudden loss of tenant protections could plausibly generate an eviction episode of this magnitude.

Translating these figures to a dollar amount of back rent based on the stock and flow of bad tenant debt among residential REITs, implies 4.4 months of rent payments outstanding on average across tenants who are behind on rent. This is consistent with research from the Center for Budget and Policy Priorities estimating average tenant debt at 3 months’ rent. Taken together, some $12-17 billion of bad tenant debt accumulated during the crisis.

Yet Another Bottleneck

With $25bn already dispersed from the Treasury to state and local governments and another $20bn available, the size of the Congressional allocation would appear more than sufficient to prevent an eviction crisis. But so far, the process of recovering back rents has been disappointingly slow, in part because doing so requires a significant amount of matching of information from the renter and the landlord. After doubling month-over-month in June to $1.5bn, the pace of distributions plateaued at $1.7bn in July (and $4.5bn cumulatively). Because of this and because utilities and electric bills are absorbing a significant minority of these funds, under current policy, a significant share of the 2½-3½ million households behind on rent could ultimately face eviction later this year.

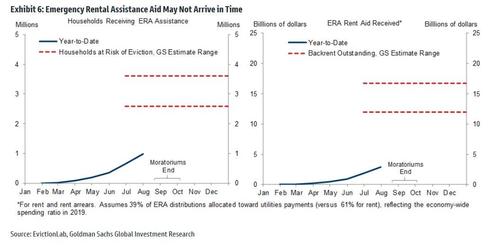

As shown in Exhibit 6, at the current monthly processing pace of 350k households, 1-2 million delinquent households would remain without ERA aid at the start of Q4 when the last 2021 eviction bans are set to expire (NY, WA).

At the same time, the strength of the housing and rental market suggests landlords will try to evict delinquent units unless they can obtain federal funding. In fact, as shown in the next chart, apartment markets are actually tighter in cities hardest hit by the coronacrisis. This reduces the incentive for landlords to negotiate with delinquent tenants or wait for federal aid.

Economic Consequences

The final question is what would the coming surge in evictions mean for employment, consumption, and inflation?

Here Goldman’s economists write that eviction increases the likelihood of a subsequent unemployment spell by around 2%. Based on 750k units and 1.17 payroll jobs per household, Goldman estimates 20k incremental job losses over the next year as a result of the end of the moratoriums (naturally, that number is far too low).

While the consumption effects of such job losses would be small for economy as a whole, the end of the moratoriums also means that households who skipped rent payments would need to cut back in other areas. Based on a marginal propensity to consume of 0.7 for delinquent units during Q2, Goldman estimates a ¼% drag on Q4 consumption growth from this channel.

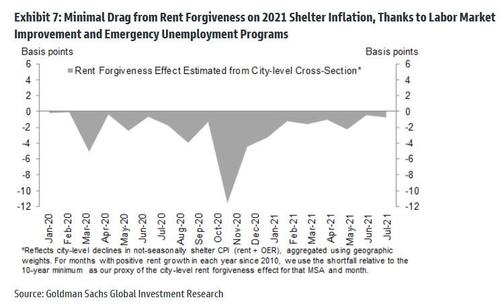

We conclude by analyzing the inflation implications of these developments. While small in GDP terms, housing rental prices provide the source data for 17% of the core PCE inflation basket and 40% of the core CPI basket. Here Goldman writes that in its view, eviction moratoriums reduced shelter inflation early in the crisis by increasing the prevalence of rent forgiveness: the CPI statisticians impute a 95% price reduction for such housing units. Updating its previous proxy based on city-level rent declines, Goldman estimates rent forgiveness lowered PCE shelter prices by 0.32% during 2020 and by another 0.1% in 2021.

There is a silver lining: a surge in evictions should create new inventory of available rental housing, partially offsetting rapidly rising housing costs,.

So looking ahead, the end of the moratoriums will likely boost the market supply of rental units, because evicted tenants often move in with family members or leave the urban rental market entirely. Based on the historical relationship between vacancies and shelter inflation (holding unemployment constant), a 500k rise in vacancies would boost the rental vacancy rate by 1pp and exert 0.3pp of downward pressure on shelter inflation in 2022.

Despite this “benefit”, based on the continued improvement in the labor market, robust housing market fundamentals, and the sharp pickup in mid-year rental prices, Goldman still forecast PCE housing inflation to pick up from 2.2% currently to 3.5% at year-end and 4.6% in 2022. That means that housing is about to become completely unaffordably to virtually anyone outside of the top 1%. As for the original American Dream (i.e. owning a house), of all those who are about to get evicted, our advice: aim lower…

The Plandemic Cares Not Who It Hurts…

There is no indication in Acts or his letters that Paul owned a house in Tarsus, Jerusalem, Antioch, or any other city for that matter. Like Jesus, Paul didn’t see the lack of assets, possessions, and wealth as a problem. Instead, he was passionate about giving financial aid to the truly poor and needy (Acts 24:17, Romans 15:26, 2 Corinthians 9:1-15, and Galatians 2:10).

It’s no wonder that Jesus promised eternal blessings for those who care for the homeless and destitute (Matthew 19:21, Matthew 25:31-40, Mark 10:21, Luke 11:41, Luke 12:33, Luke 14:13, Luke 18:22, and Luke 19:8).

Jesus also warned about eternal losses for those who spurn the needs of the poor (Matthew 25:41-46; see also Proverbs 19:17 and Proverbs 28:27). Later, Jesus’ half-brother, James, echoed a similar stern warning (James 2:1-9).

The threat of looming evictions could result in 28 million people being homeless in the U.S. as a result of the coronavirus pandemic, one expert contends.

Emily Benfer, who has spent her career representing homeless families, was recently interviewed by CNBC where she went into detail about what could be a stark reality for homelessness in the country as a result of the coronavirus. She is currently the chair of the American Bar Association’s Task Force Committee on Eviction and co-creator of the COVID-19 Housing Policy Scorecard with the Eviction Lab at Princeton University.

“We have never seen this extent of eviction in such a truncated amount of time in our history,” Benfer said when asked about how the current homeless crisis compares to the 2008 housing crisis.

She continued: “We can expect this to increase dramatically in the coming weeks and months, especially as the limited support and intervention measures that are in place start to expire. About 10 million people, over a period of years, were displaced from their homes following the foreclosure crisis in 2008. We’re looking at 20 million to 28 million people in this moment, between now and September, facing eviction.”

She also noted that evictions could have a negative effect on people’s health, stating that evictions cause more respiratory distress and increased mortality. Since the main way to combat the virus has been to shelter-in-place, evictions could lead to a quicker spread of the virus, Benfer says.

With regard to individual state moratoriums on evictions, Benfer says that as soon as they run out, Sheriff’s are just waiting to execute evictions: “The moment the moratoriums lift, all of those families will be immediately put out. And right now, 29 states lack any state level moratorium against evictions. “

She continued: “Some of the moratoriums are limited to different segments of the population, and in their duration. They were also not coupled with financial assistance to ensure that renters don’t accrue this backed-up debt and are stabilized enough to stay in their unit.”

As a result, she is calling for an immediate nationwide moratorium on evictions, coupled with more financial assistance: “As an immediate measure, we need a nationwide uniform moratorium on eviction, and it has to be coupled with financial assistance to ensure that the renter can stay housed without shifting the debt burden onto the property owner.”

Benfer also talked about the problems with holding eviction hearings via video streaming, instead of in a courtroom. “When you consider that people are now choosing between rent and food for their families, they’re also unlikely to be able to pay for minutes on their phone, or Wi-Fi, to log into a remote hearing,” she said.

“So appearance itself may be very challenging. And if they fail to appear, if they weren’t able to dial in or if they don’t have the right link to the Zoom, that’s considered a failure to appear, which results in a default judgment for the property owner.”

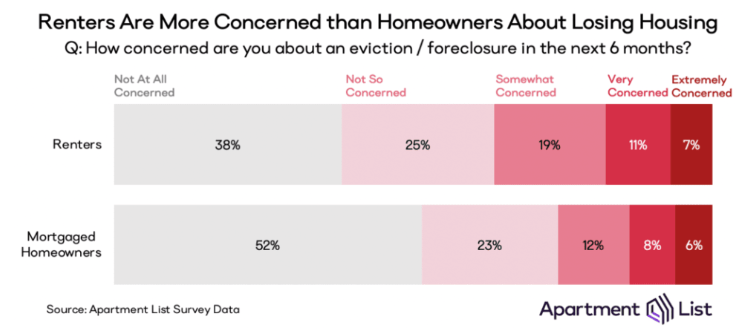

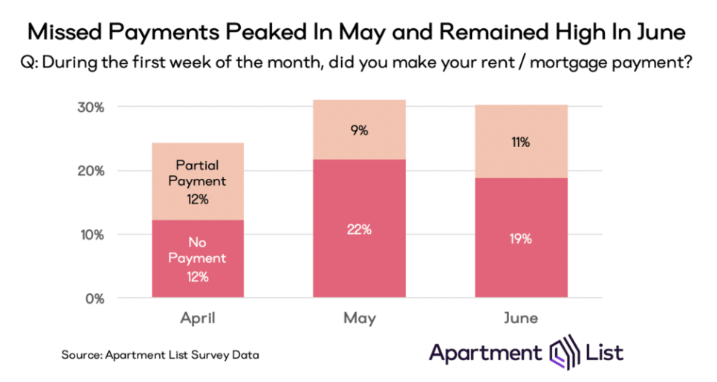

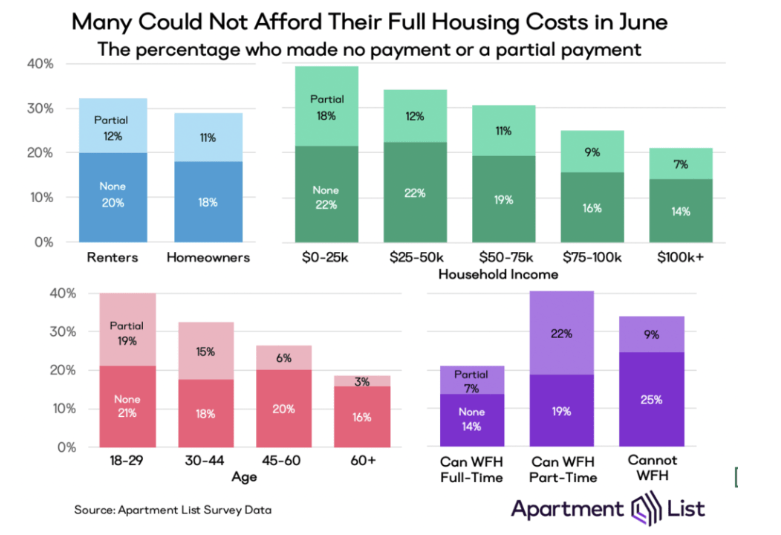

Recall, we just wrote days ago about how hard it was to get evicted in individual states. We also noted that 30% of owners didn’t make their housing payment in June.

That figure stood at 24% in April and 31% in May, before falling slightly to 30% in June. One third of the 30% in June made a partial payment, while two thirds made no payment at all.

“Missed payment rates are highest for renters (32 percent), households earning less than $25,000 per year (40 percent), adults under the age of 30 (40 percent), and those living in high-density urban areas (35 percent). While the missed payment rate for mortgaged homeowners is just 3 percentage points lower than renters,” the survey showed.

Several places in the Bible there are references to worthless persons (Deut. 13:13; Judg. 19:22; 20:13; 1 Sam. 25:17; 1 Ki. 21:9-13; Prov. 6:12-14; 16:27; 19:28; Nah. 1:11). The term worthless translates the Hebrew בְּלִיָּעַל belial, which occurs 27 times in Scripture. The word means “Uselessness, wickedness…good for nothing.” These are people whom God designates as worthless because they continually resist His will and disrupt the activities of His people. Over time, the term Belial became a name for Satan (2 Cor. 6:15), who embodies wickedness, worthlessness and trouble, always resisting God and seeking to harm those who walk with Him (1 Pet. 5:8).

I Want Everyone to Know, Never Take Anyone’s Word for the Gospel, Especially Revelations, Here’s How It Works. When You’re in the Word God Will Speak to You Through His Holy Spirit He Will Move You in the Direction He Wants You to Go. Please Stop Looking For That Individual Here on Earth That Has All the Answers, They’re Not Here, and That is Confusing You… That Includes Anything I Say, Always Test Every Spirit. Every Word, Uttered Out of Any Man’s Mouth Must Be Verified Through the Holy Spirit. StevieRay Hansen

Ask The Blind Man ,He Saw it All

Source: HNewsWire ZeroHedge HNewsWire HNewsWire HNewsWire HNewsWire

StevieRay Hansen

Editor, HNewsWire.com

Speak up for those who cannot speak for themselves

for the rights of all who are destitute

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

Tagged In

Newsletter

Must Read

Other Sources

Latest News

What the Bible Has to Say about the Destruction of Our Society, Pt 1

A wise man once said, “A Bible that’s falling apart usually belongs to someone who’s not.” Do you get the feeling that people are falling…

Read MoreNew ‘Detention Camp In America: Quarantine Camps

& Forced Vaccinations… Evil people are waxing worse and worse and there is nothing Christians can do about that other than to PRAY and take…

Read MoreHow Satan Soldiers Is Using Unseen Enemies

To Panic The World… False flag terror is an intentional and mortal trick whereby blame is projected and made to fall upon an innocent third…

Read MoreHOW CAN THE TRUTH SET YOU FREE…

IF YOU WON’T BELIEVE HIM? WHAT if you discovered that everything you have been taught about God, Jesus, and the atonement is a lie? What if what you…

Read More

We make every effort to acknowledge sources used in our news articles. In a few cases, the sources were lost due to a technological glitch. If you believe we have not given sufficient credit for your source material, please contact us, and we will be more than happy to link to your article.