HNewsWire:

By Tyler Durden

Just one day after JPMorgan CEO Jamie Dimon said private credit could spark turmoil if when the opaque sector of financial markets weakens, warning that “there could be hell to pay,” and adding that he has “seen a couple of these deals that were rated by a rating agency and, I have to confess, it shocked me what they got rated. So, it reminds me a little bit of mortgages”, Satan has just sent his first invoice to the banking industry.

After scaring his fellow bankers, perhaps in hopes of sparking another mini bank run and getting the FDIC to gift him with yet another bank, it turns out that perhaps Jamie Dimon was correct that “not all the people doing [private credit] are good,” and earlier today Bloomberg brought us the first notable example of a “bad” doer when it reported that Canadian investment manager Ninepoint Partners is “temporarily” suspending cash distributions in three of its private credit funds, making it the latest, and certainly largest, lender to put a squeeze on investors to cope with a private credit liquidity crunch.

Unitholders of funds with about C$2 billion ($1.5 billion) of assets won’t be able to receive cash payouts, the Toronto-based Ninepoint confirmed to Bloomberg News, adding that the firm will revisit its decision in the third quarter although with the credit crunch only likely to deteriorate dramatically by then, the only question is how many more funds will Ninepoint be gating.

“After reviewing our various liquidity options, Ninepoint Partners and our subadvisors have determined that the best path forward to preserve liquidity and balance the long-term goals of these three affected funds is to redirect future distribution into additional units rather than cash distributions starting July 1,” a spokesperson for the firm said in an emailed statement.

Ninepoint is the latest lender in the $1.7 trillion private credit industry to take urgent measures to preserve cash and pre-empt a flood of redemption requests, by effectively freezing their money. And with consumer credit deteriorating sharply in recent months amid record credit card debt coupled with a record surge in installment loans (most of which can’t even be tracked by credit raters), executives at large banks have been sounding the alarm for weeks, with some worrying that private credit markets may be getting too inflated.

“We’re all aware of the risks,” Bill Winters, CEO of Standard Chartered Plc, said at an event last month. “Like always, good things go too far and then correct. And the job of us as banks and the job of you as supervisors is to make sure we don’t get carried out when the tide goes away.”

Of course, it is some banks’ job to make sure you do get carried away, because when you fail, those same banks – like JPMorgan for example – will end up absorbing all your deposits while the taxpayers, thanks to the FDIC, will be stuck with all the private credit that “went too far.”

The private credit market – a corner of finance dominated by non-bank lenders who originate loans to private businesses – has grown rapidly in recent years, as it is far less regulated and banks are hoping they can offload all exposure before the next crash while pocketing the upside. Although returns on these assets have increasingly outpaced the S&P 500 since the early 2000s, risks in the industry are not well known, the IMF noted in April. Of course, for those who have been around for longer than a few years, will recall that hedge funds issuing 2nd and 3rd liens was also all the rage… right before the financial system collapsed in 2008.

So is Ninepoint the proverbial dead canary in the coalmine?

The Canadian private lender, which oversees about C$7 billion, is among those firms offering “flexible terms” to some borrowers, but with higher risks. It is those risks that have now prompted the firm to freeze cash distributions. Other firms, such as Oaktree Capital Management, have had to cut management fees on private credit funds, following increases in problem loans and disappointing earnings, Bloomberg reported.

The largest of Ninepoint’s three funds is Ninepoint-TEC, which reported C$1.2 billion on assets at the end of 2023. It makes asset-backed loans to companies that “may have difficulty obtaining financing from other sources” — and certain borrowers have the option of using a PIK, or pay-in-kind, structure rather than cash interest payments. In other words, it is literally a loan shark that will lend you money – at a much higher rate than otherwise – when nobody else will. So yes, shockingly, things will collapse since the creditors didn’t get funds for a reason.

The Ninepoint Alternative Income Fund, which is around C$600 million, has the bulk of its loans to middle-market companies in the US and Canada. It normally targets payouts to investors of 10% to 12% of the average net asset value in a calendar year, according to documents on Ninepoint’s website.

To avoid panic from escalating further, the firm said it is not winding down these funds, according to its statement. “Investors will continue to have access to the ongoing benefits of being invested in private credit as we remain focused on ensuring the sustained performance and stability of our current portfolio.”

Private credit is not alone in gating investors: some real estate funds, including the $10 billion Starwood Real Estate Income Trust, have also taken steps to limit the ability of investors to pull cash out.

While we find the recent hype over “private credit” extremely overblown, having lived through the 2nd/3rd/4th lien bubble during the peak of the housing bubble, for those readers who are unfamiliar, we will republish an article we wrote back in March using Morgan Stanley data discussing “What’s Behind The Recent Explosion In Private Credit.”

The evolution of private credit is reshaping the landscape of leveraged finance. Investors of all stripes and around the globe are taking notice. The rapid expansion of the private credit market in the last few years has come against a much different backdrop in public credit markets – a contraction in high yield (HY) bonds and lackluster growth in broadly syndicated loans (BSL). What the emergence of private credit means for public credit markets is a topic of active debate.

While private credit is an umbrella term encompassing a wide variety of strategies, direct lending is the relevant strategy for an apples-to-apples comparison with the public markets in leveraged finance. In this context, we define private credit as debt extended to corporate borrowers on a bilateral basis or involving a small number of lenders, typically non-banks. Lenders originate and negotiate terms directly with borrowers without the syndication process that is the norm in public markets for both bonds and loans. Typically, private credit loans are not publicly rated, not traded in secondary markets, have stronger lender protections and offer a spread premium to public markets.

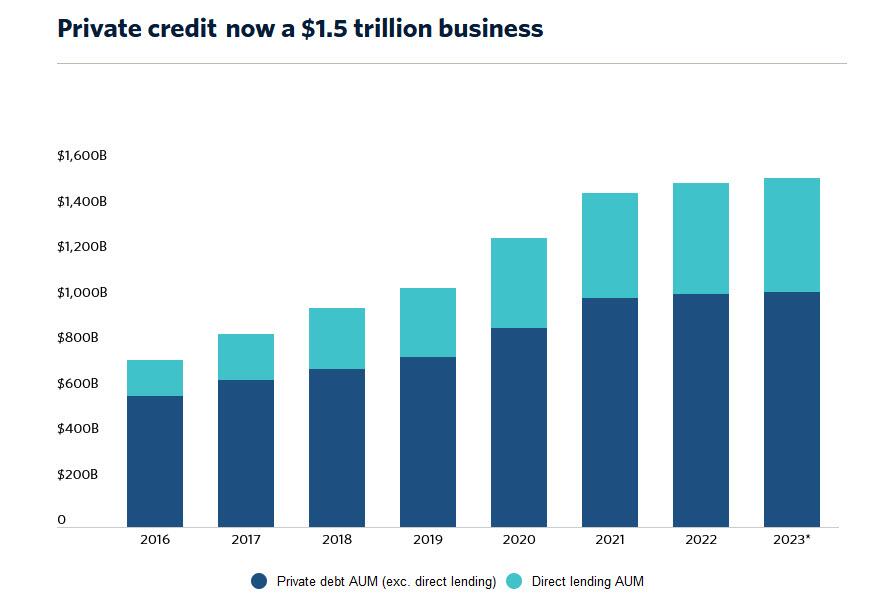

Lenders in the private markets range from funds deploying direct lending strategies to investment vehicles such as business development companies (BDCs) and collateralized loan obligations (CLOs) as well as insurers and pension funds, among others. According to PitchBook data, the assets under management (AUM) of global direct lending funds alone have quintupled, surpassing US$550 billion by 2023, up from US$95 billion ten years ago; the total private universe AUM is now $1.5 trillion.

Beef in Bulk: Half, Quarter, or Eighth Cow Shipped to Your Door Anywhere within Texas Only

We do not mRNA vaccinate our cattle, nor will we ever!

Grass Fed, Grass Finished Beef!

From Our Ranch to Your Table Order Today

| Level | Price | |

|---|---|---|

| Monthly | $5.00 per Month. | Select |

| Annual | $50.00 per Year. | Select |

| Trial Membership | $0.00 now and then $5.00 per Month. | Select |

![]()