Watchman: Another US Bank Quietly Shutters, As Bank Runs Persist And Deposits Decrease

HNewsWire:

The Federal Deposit Insurance Corporation (FDIC) seized the banks assets on November 3rd. In a press release the FDIC wrote:

Citizens Bank, Sac City, Iowa, was closed today by the Iowa Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC entered into a Purchase and Assumption Agreement with Iowa Trust & Savings Bank, Emmetsburg, Iowa, to assume all of the deposits of Citizens Bank.

The two branches of Citizens Bank will reopen as branches of Iowa Trust & Savings Bank on Monday during normal business hours. This evening and over the weekend, depositors of Citizens Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

Depositors of Citizens Bank will become depositors of Iowa Trust & Savings Bank, so customers do not need to change their banking relationship in order to retain their deposit insurance coverage. Customers of Citizens Bank should continue to use their existing branch until they receive notice from Iowa Trust & Savings Bank that it has completed systems changes to allow its branch offices to process their accounts as well.

As of September 30, 2023, Citizens Bank had approximately $66 million in total assets and $59 million in total deposits. In addition to assuming all of the deposits, Iowa Trust & Savings Bank agreed to purchase essentially all of the failed bank’s assets.

Customers with questions about the transaction should call the FDIC toll-free at 1-866-314-1744. The phone number will be operational this evening until 9:00 p.m. Central Time (CT); on Saturday from 9:00 a.m. to 6:00 p.m. CT; on Sunday from noon to 6:00 p.m. CT; on Monday from 8:00 a.m. to 8:00 p.m. CT; and thereafter from 9:00 a.m. to 5:00 p.m. CT. Interested parties can also visit the FDIC’s website.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $14.8 million. Compared to other alternatives, Iowa Trust & Savings Bank’s acquisition was the least costly resolution for the DIF, an insurance fund created by Congress in 1933 and managed by the FDIC to protect the deposits at the nation’s banks. Citizens Bank is the fifth bank to fail in the nation this year. The last failure in Iowa was Polk County Bank, Johnston, Iowa, on November 18, 2011.

This regional bank closure adds to the growing list of financial institutions falling this year, with speculation that a large number more are potentially at risk. SEE: Collapse: Accredited Weiss Research Warns 5,274 US Banks Have The Potential To Fail, As More Bank’s Ratings Are Downgraded

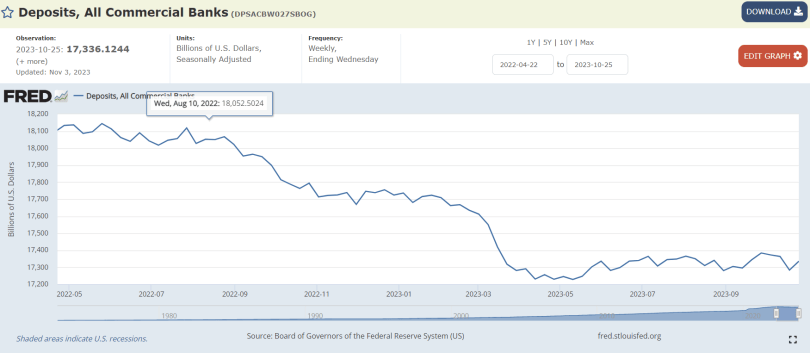

Largely unreported by the media, deposits from large and smaller institutions continue to dwindle. Within the last three weeks plus, the Federal Reserve reports that a whopping $100 billion reduction in deposits were recorded. Particularly deposits dropped from $17.38 trillion on September 27th to $17.28 trillion by October 18th.

This coincided with a survey from the Fed that revealed Americans are still concerned about a looming banking bust.

Although survey respondents noted the banking sector has stabilized since the period of acute stress earlier this year, many highlighted risks of renewed deposit outflows given that large portions of deposits remain uninsured.

Survey respondents viewed small and regional domestic banks as particularly vulnerable due to their higher concentration of CRE exposures, which could lead to tighter bank lending conditions.

The paper reported

SEE: De-Banking: Americans Are Withdrawing Massive Amounts Of Money From Banks As Collapse Crisis Looms

Even though the public is largely in the dark about the true scope of the financial landscape transpiring, some bellwethers are being reported in the mainstream that do provide some insights into what’s going on.

Jamie Dimon, CEO of JP Morgan-Chase, the largest bank by assets in the United States, dumped 1 million shares of his own stock last week, CNBC reported, though this was attributed to his possible retirement and not to instability in the economy.

But the week before that CNBC also reported that “Big banks are quietly cutting thousands of employees, and more layoffs are coming,” read the headline.

Pressured by the impact of higher interest rates on the mortgage business, Wall Street deal-making and funding costs, the next five largest U.S. banks have cut a combined 20,000 positions so far this year, according to company filings.

CNBC wrote

Banks are cutting costs where they can because things are really uncertain next year.

They need to find levers to keep earnings from falling further and to free up money for provisions as more loans go bad. By the time we roll into January, you’ll hear a lot of companies talking about this.

Chris Marinac, research director at Janney Montgomery Scott, said in a phone interview.

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

Use the code HNEWS10 to receive 10% off your first purchase.

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio

A Thrilling Ride

Every once in awhile, a book comes across your path that is impossible to put down. A Long Journey Home is not a casual book that you read in a week or earmark to complete at a later date. Once you begin, cancel your schedule, put your phone on silent, find a quiet place where you cannot be disturbed, and complete the journey. Click Here to Purchase on Amazon.com!

Recent News

Reach People