Watchman: It Would Be Quite Foolish Not to Believe That the FedNow Program Is a Stepping Stone Towards CBCDs at This Stage–the Beast Has Been Roll Out

HNewsWire:

by Brian Shilhavy

Editor, Health Impact News

Note: While I am writing and publishing this article on March 31, 2023, most of you will be reading this on April 1, 2023, or later.

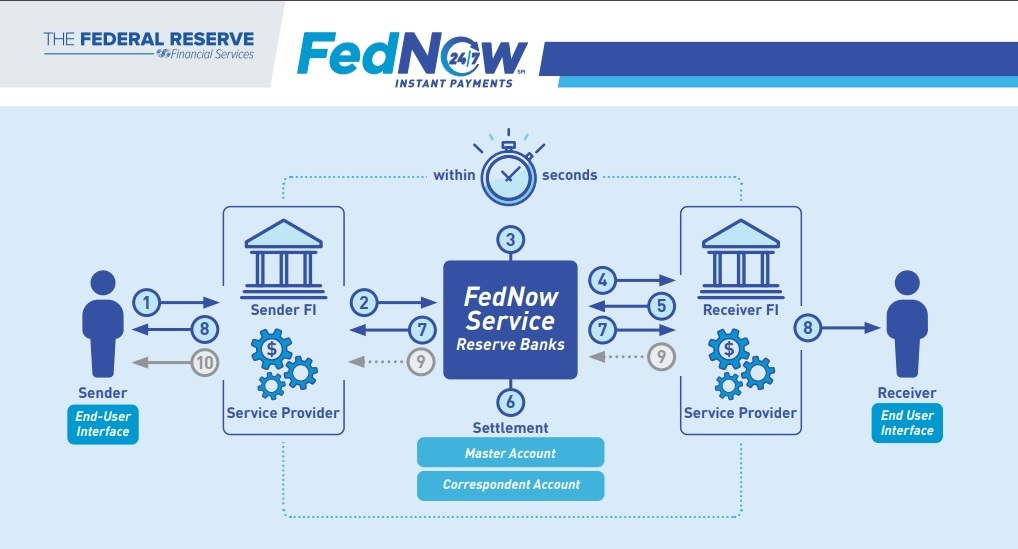

The first week of April, 2023 marks the beginning of the enrollment and certification process for financial institutions to start participating in the Federal Reserve’s new FedNow “Instant Payments” services, which is scheduled to launch in July, 2023. (Source.)

What is FedNow?

The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the U.S. to provide safe and efficient instant payment services.

Through financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real time, around the clock, every day of the year. Financial institutions and their service providers can use the service to provide innovative instant payment services to customers, and recipients will have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.

The FedNow Service will be deployed in phases, with the initial launch taking place July 2023.

The video below follows a payment over the FedNow Service from start to finish, highlighting what financial institutions need to know about their role in the process.

While many in the alternative media (myself included) have linked the FedNow program to Central Bank Digital Currencies (CBDCs), technically speaking, FedNow is NOT part of the development of CBDCs.

Michelle Bateman, Director of Product Management, Payments at Finastra, is a member of FedNow’s pilot program, and she has stated that the project to develop CBDCs is completely separate from the FedNow Instant Payment service.

And what about central bank digital currency (CBDC)? As has been widely reported, the Fed, like most other central banks in developed nations, is investigating the potential of a digital currency or digital dollar.

Bateman noted that it is still being reviewed, and the two projects are completely separate. (Source.)

The main difference is that once CBDCs are rolled out, consumers will have accounts with a Federal Reserve Bank, while the FedNow program does not. The FedNow program will be offering “Master Accounts” at the Federal Reserve for financial institutions only.

However, as I have previously stated, rolling out CBDCs is a mammoth project, and cannot be done overnight. It would be foolish to believe that the FedNow program is not a stepping stone towards CBDCs.

As you can see from the flow chart at the top of this article, with the implementation of the FedNow Instant Transfer program, all the data involving a financial transaction between two “End-Users” will flow through the Federal Reserve banks.

So while they are advertising the FedNow program as a new system that will make payments and wire transfers much quicker and much more convenient, it is also a mass data collection system for the Fed to begin storing private bank information.

Will this include all the personal details of account holders in private banks?

Yes, apparently it does, based on “Operating Circular 1 (OC 1)“, a document on the Federal Reserve website under “Rules and Regulations Resources.”

In that document, Section 6.0 deals with “FEDERAL RESERVE BANK RESPONSE PROGRAM FOR UNAUTHORIZED ACCESS TO SENSITIVE CONSUMER INFORMATION OBTAINED IN THE COURSE OF PROVIDING FINANCIAL SERVICES.”

Section 6.1, “THE RESERVE BANK’S POSSESSION AND USE OF CONSUMER INFORMATION” states:

The Reserve Banks do not hold accounts for individuals and do not provide Reserve Bank services to individuals. In the course of providing Financial Services to Depository Institutions and other authorized users of Reserve Bank services, the Reserve Banks obtain, store, and transmit information that includes Sensitive Consumer Information.

Under the general supervision of the Board of Governors, the Reserve Banks have implemented information security measures designed to protect the security and confidentiality of nonpublic personal information obtained by them, to protect against any anticipated threats or hazards to the security or integrity of such information, and to protect against unauthorized access to or use or reuse of such information that could result in substantial harm or inconvenience to a Depository Institution’s customer.

In other words, the Fed needs all of your “Sensitive” information to protect you from hackers.

What is that “Sensitive Consumer Information”?

Section 6.2 defines that:

Sensitive Consumer Information means a consumer’s name, address or telephone number, in conjunction with the consumer’s social security number, driver’s license number, account number, credit or debit card number, or a personal identification number or password that would permit access to the consumer’s account, if the Reserve Bank or any other party that holds Sensitive Consumer Information as an agent of the Reserve Bank obtains such information in the course of providing Financial Services. (Source.)

How convenient. So when they are ready to roll out CBDCs and establish an account for you, they will already know everything about you and be able to open an account for you at the Federal Reserve, even if you choose not to participate, if your bank was already participating in the FedNow program.

This will save months, if not years, in trying to collect this data in order to implement CBDCs.

It still remains to be seen how many financial institutions decide to participate in FedNow, since it is voluntary. The U.S. Treasury is already part of the program, so if someone wants their tax returns instantaneously, the FedNow service will be very attractive.

Visa and Mastercard are also already part of FedNow. Banks will undoubtedly be pressured to participate for fear of being left out of the advantages of “Instant Payments.”

This appears to be the beginning of the end for “private banking” in the U.S., no fooling.

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

Use the code HNEWS10 to receive 10% off your first purchase.

Source: medicalkidnap HNewsWire HNewsWire

Newsletter

Support Orphans

Editor's Bio

A Thrilling Ride

Every once in awhile, a book comes across your path that is impossible to put down. A Long Journey Home is not a casual book that you read in a week or earmark to complete at a later date. Once you begin, cancel your schedule, put your phone on silent, find a quiet place where you cannot be disturbed, and complete the journey. Click Here to Purchase on Amazon.com!

Recent News

Watchman: Rumble Defies Global Censorship Trends, Takes Stand Against New Zealand’s Free Speech Crackdown

By StevieRay Hansen |

Twitter Is Suppressing Free Speech Under the Direct Orders of the Government. So What Else Is the Government Hiding?

By StevieRay Hansen |

Watchman: Once Satan’s Soldiers Eliminate Free Speech, Life Becomes a Cheap Ruse—Brazil Imprisons a Conservative Congressman for Eight Years Over a YouTube Video, America Is Next, Google Is Evil and Tribulation On Steroids

By StevieRay Hansen |

Watchman: At Some Point, You’re Going to Realize That Twitter Is Just Like Fox News, Which Has Turned On Its Conservative and Christian Audience. Mr. Musk Is a Globalist and Satan Worshiper, and He Has Misled You Into Thinking That Twitter Belongs to the Free Speech Audience. Not True…

By StevieRay Hansen |

Watchman’s Daily Devotional, A Lie Is Offered to Those Who Will Not Love the Truth. Truth-Seekers Face Constant Opposition Until They Choose to Reject the Last Lies

By StevieRay Hansen |

Watchman: They Killed With Immunity, Bill Gates,Google and Our Own Government

By StevieRay Hansen |

Reach People