Watchman’s Update: Gog and Magog Have Taken Shape, Saudi Arabia Seeks to Join the Russia/China-Led BRICS Coalition, and America Will Cease to Exist Once This Event Occurs, Tribulation Warp Speed!

HNewsWire: Take A Hard look At This Pic!

It's hard to overstate the potential impact of a move underway that - thanks to Biden's catastrophic diplomacy - could result in China replacing the U.S. as a security guarantor with the petro-monarchies that control so much of the world's oil reserves.

Notice The Left Hand

Notice The Left Hand

Notice The Left Hand

Notice The Left HandBloomberg reports:

Oil-rich Gulf monarchies are using their wealth to strengthen ties with China as they worry about the future of their long-standing security partnership with the United States.

Seven months after President Xi Jinping attended the first China-Gulf summit in Riyadh, economic exchanges between the world's second-largest economy and countries such as Saudi Arabia and the United Arab Emirates have increased, expanding far beyond crude purchases, where Beijing has long held sway.

Syngenta Group's planned $9 billion Shanghai IPO is one of the deals that could benefit from closer ties in the coming months. According to people familiar with the situation, the state-backed company's advisers have been in talks with Middle Eastern sovereign funds, including the Abu Dhabi Investment Authority and Saudi Arabia's Public Investment Fund, about becoming cornerstone investors.

According to Bloomberg data, the value of Gulf companies' acquisitions and investments in China has increased by more than 1,000% year on year to $5.3 billion.

For decades, the Middle East's oil-rich states have looked to the United States as their primary economic partner and security guarantee. Their holdings of dollar-denominated US debt, as well as the settlement of sales contracts in dollars, ensure that the US dollar remains the world's reserve currency. This status allows the United States to run massive deficits, print money to cover them, and avoid a foreign exchange crisis or severe devaluation.

China is currently in an economic slump, most likely a recession, with high youth unemployment and a loss of markets and manufacturing investment as the United States and Europe decouple from the Chinese economy. However, with their vast resources and significant markets, petro-monarchies could at least partially replace Western powers, relieving domestic political pressure on Xi Jinping to behave better on the global stage.

Make no mistake: economic factors have a direct impact on strategic military relations. China would make every effort to leverage its strengthened economic and financial ties into deeper military ties, including the establishment of military bases and a more robust diplomatic, cultural, educational, and media relationship. The ultimate goal would be to dethrone the US as the strategic guarantor for the monarchies that control the oil export market.

This decline in US influence was precipitated by Biden's virtue-signaling demonization of Crown Prince Mohammed bin Salman over the Khashoggi assassination. It had no advantages. Of course, killing and dismembering opponents in a diplomatic enclave is abhorrent, but great nations that aspire to be hegemonic learn to tolerate allies with less-than-perfect records. When we were fighting Hitler, we allied with the Soviet Union.

With our military readiness declining, conventional ammunition stocks depleting, and military leadership focused on diversity, abortion access, and transsexual rights, the United States appears to be a declining force. Who would want to stake his own regime's future on an alliance with such a decaying and decadent power?

The Saudis will not change their ways and will be ruthless in defending their regime. Many other countries, rightly or wrongly, regard the United States as equally ruthless. When the US went after MbS over Khashoggi, it received nothing but positive domestic commentary. Relationships are now spiraling downward, and the logic behind the spiral extending and amplifying is significant. The strengths and needs of China and the Gulf monarchies are complementary.

If China continues to be the dominant power in the Middle East, the world's power structure will be very different, and China will call the shots that a poorer and weaker United States will have no choice but to accept.

HNewsWire Update 7/9/23

Since a new gold standard may be implemented globally, the gold market may experience renewed bullish momentum.

The Russian government confirmed on Friday, as reported by state-run RT, that the BRICS nations (Brazil, Russia, India, China, and South Africa) will launch a new trading currency backed by gold. The BRICS summit in August in South Africa is expected to be the venue for the official announcement.

The latest developments are providing fresh impetus to the global de-dollarization trend. In an effort to diversify their reserves away from the U.S. dollar, central banks around the world have been buying gold at a record pace since the middle of 2022.

Many experts believe the next step will be the introduction of a currency backed by gold. Recent gold purchases by China have been interpreted by many as an effort to legitimize the yuan on the global stage.

However, some countries that are allies of Russia are nervous because the U.S. government has weaponized the U.S. dollar against Russia for invading Ukraine.

Gold will receive substantial support from the possibility of a gold-backed BRICS currency, but some market watchers believe it will be a while before the effect is felt.

Degussa's chief economist, Thorsten Polleit, characterized the news as "a step in the right direction," but he cautioned that "there is still a long way to go" before the plan can be implemented.

In an exclusive interview with Kitco News, he said, "At first glance, a new transaction unit backed by gold sounds like good money, and it could be, first and foremost, a major challenge to the US dollar's hegemony."

But, as Polleit pointed out, the details are where it gets tricky.

For the new currency to be on par with gold and a truly sound currency, it must be easily exchanged back into gold at any time. Not sure if this is what countries like Brazil, Russia, India, China, and South Africa had in mind, he said. There's no denying that if gold were used as money, the unit of account, it would completely alter the economic landscape. Goods priced in fiat currencies could skyrocket if this occurs, as could the value of many fiat currencies relative to gold (including the BRICS fiat currencies). The international fiat money system might be shaken up. I have my doubts that this is what the BRICS hope to accomplish.

According to Polleit, the BRICS nations could also form a new bank to finance international trade, but this time the bank's capital would have to be in the form of gold.

"Against this gold stock, the new bank could, say, grant financing loans to exporters and issue the "new currency"; or BRICS exports will be sold against the "new currency" and/or gold," he explained. It's too soon to draw any firm conclusions about where this is leading us; we need more information.

While this may help gold in the long run, short-term problems persist, according to Naeem Aslam, chief investment officer at Zaye Capital Markets. He continued, saying that a global gold-backed currency was unlikely even after the announcement.

"But this doesn't mean this can't be achieved at all," he emphasized. "Right now, any more upbeat reports on this could help the gold price, but more importantly, traders are now going to be focused on the US CPI data, which is due next week."

Some experts still have serious doubts about the statement.

Gold-backed currencies among the BRICS nations sound like an empty echo. Bannockburn Global Forex CEO Marc Chandler stated, "They do not have the gold to meaningfully back a currency." Has nothing been learned from the EMU's experiment with monetary union without fiscal union? Consider me extremely dubious.

To compete with the U.S. dollar as the world's reserve currency, many experts have been discussing the possibility of a new global currency. Former Goldman Sachs chief economist Jim O'Neill argued in a paper published in the Global Policy Journal at the end of March that the dominance of the U.S. dollar is unsettling regional and international monetary systems. He also said that the world economy would benefit from having a BRICS currency that challenged the U.S. dollar's dominance.

The value of the dollar and the ripple effects were "dramatic" whenever the Federal Reserve Board "entered into periods of monetary tightening" or "loosening," he said.

HNewsWire: Ezekiel 33:9 But if you do warn the wicked person to turn from their ways and they do not do so, they will die for their sin, though you yourself will be saved.

The increasing number of nations seeking to join BRICS brings geopolitics into the spotlight. At the time of writing, existing members, those who have applied to join and those expressing an interest total 36 nations, with over 60% of the world’s population and one-third of global GDP.

Plans for a new trade currency backed by gold appear to be on the agenda for the BRICS meeting in Johannesburg in August. In this article, the geopolitical aspects of its introduction are considered, and the indications that how it will involve gold are discussed. The mechanics of this project are then suggested.

But first, we look at the situation in Ukraine, attempting to put the recent Wagner rebellion into context. Furthermore, Russia’s deteriorating trade surplus, weakness of the rouble and rising bond yields suggest that it is time for President Putin to put an end to Ukraine’s misery. He is likely to do this by attacking Kiev, which is only 60 miles from Belarus, while the bulk of Ukraine’s army is distracted by operations over 400 miles to the south and east.

Introduction

Given the hysteria in the Western press over the Wagner group’s alleged coup attempt, it is time for an update on the battle between the hegemons. But I shall commence with an attempt to put the leader of the Wagner mercenary group’s supposed coup attempt to bed.

It emerges that Western intelligence knew something was up, as much as ten days before the dispute between Wagner and the Russian defence ministry became evident. This was The Daily Telegraph yesterday:

“Before Wagner troops began their advance on Rostov and then on to Moscow last weekend, British officials had ‘an extremely detailed and accurate picture of the mutiny plans’, it was revealed yesterday. The details were shared by US intelligence ahead of the mutiny and contained information of where and how Wagner mercenaries planned to move.”

This immediately puts up a red flag. Did Britain’s MI6 or the CIA have a part in it? If not, how is it that they knew so much about it? Is it likely that the Wagner leadership or elements in it had been bribed by western intelligence into staging an attempted coup of the Russian government? But we must leave this speculation hanging, in the certainty that black ops are being widely deployed by western intelligence in Ukraine, Russia, and Belarus and that anything is possible.

Western commentary, always informed by government briefing and censorship, seems to take Putin for a fool. We are routinely told in op-eds that his regime hangs by a thread, the Russian economy is in a state of collapse, and similar episodes to the Wagner farce have always been the straw about to break Putin’s back. It has been going on like this since the launch of his special military operation in February 2022. If he smoked, like Castro doubtless the CIA would offer him a box of exploding cigars.

But clearly, Putin is no fool. He will realise the limitations of mercenary troops. He has used Wagner specifically to spread fear in Eastern Ukraine. Like the French Foreign Legion of Beau Geste yore, Wagner’s recruiting ground appears to have been among jailbirds, criminals on the run, social misfits, and is a haven for psychopaths.

It seems that Prigozhin’s complaint (who leads the Wagner force) was not with Putin but his senior military advisers. There is a long history of commanders in the field being frustrated with ministerial ineptitude. To Prigozhin, it is likely that Wagner’s role in Eastern Ukraine had evolved from clear military objectives to a feeling of being hung out to dry, while Russian divisions led by inept generals dithered. Putin would have understood why Prigozhin threw his toys out of the pram and sought to calm him down. Furthermore, Putin’s special military operation is probably entering a new phase where mercenary forces might complicate battlefield planning, as I shall explore further in this article.

Undoubtedly, Wagner’s role will continue to be countering American and British undercover activities in foreign theatres such as Kurdistan, Chad, and Sudan. And the majority of his forces in the Ukraine theatre will probably be absorbed into the Russian army as Putin’s special military operation enters a new phase. And if Prigozhin managed to get a backhander out of the Americans to “stage a coup d’état” as conspiracy theorists suggest, I suspect that this comic opera will end up with both Prigozhin and Putin enjoying the joke at the western alliance’s expense.

Russia’s situation

We were originally told that sanctions would rapidly bring Russia to her knees and force the Russian people to overthrow Putin. Neither have materialised, and the evidence is that the Russian economy is stronger today than it was a year ago and Putin’s public backing remains high. Since early-2022, Russia’s economy had officially been in a mild recession, but in April economic activity was recorded as rising sharply due to buoyant industrial production and retail sales.

Sanctions never work, and a sanctioned nation rapidly adapts. Furthermore, while sanctions have focused on hitting Russian oligarchs, a low flat 13% income tax and corporation tax of 20% on company profits means that Russian SMEs, artisans, and shopkeepers are doing well. It also explains Putin’s continually high approval ratings, but Russia’s economy has far greater potential under sound money and lower interest rates. Furthermore, with consumer price inflation running at about 2.5%, domestic economic conditions are remarkably stable.

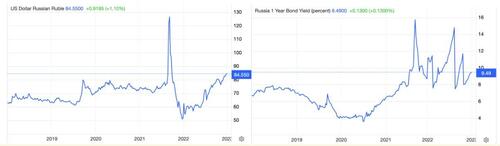

Russia’s balance of payments has been declining sharply. According to the central bank, the current account surplus between January and May was $22.8bn equivalent, compared with $123.8bn for the same period last year. This decline was due to lower oil and commodity prices, as well as marginally lower export and higher import volumes. The rouble has declined, and interest rates have recently risen as the charts below illustrate.

To have such volatility in the exchange rate and interest rates is the greatest weakness in Russia’s economic condition. The way to fix it is for the rouble to adopt a proper gold standard. And between the Bank of Russia’s official gold reserves, Russia’s National Wealth Fund, and the Gokhran precious metals fund there are ample bullion resources to establish it. The merits of such a move for the domestic economy would be interest rate stability at far lower rates. Bank credit could then respond to economic demand for credit, which would undoubtedly expand, without undermining the rouble’s domestic purchasing power.

Putin and his economic adviser, Sergey Glazyev, have shown that they understand these benefits, and that a gold standard for the rouble is likely to be Russia’s end game in the financial war against the western alliance. Furthermore, unless energy and commodity prices begin to increase, the fiat rouble and Russian interest rates could come under renewed pressure. The other way to look at rising energy and commodity prices is to attribute them to a decline in the dollar’s purchasing power for them, artificially suppressing their values.

This brings us to the reasons for Russia to step up the attack on Ukraine, which can be expected to give a new impetus to higher energy and commodity prices.

Besides the need to drive commodity prices higher for the benefit of the rouble and the balance of payments, the timing appears propitious. The redeployment of battle-hardened Wagner troops in Belorussia across the border from Kiev could form part of Putin’s plan for a new attack, now that Ukraine’s summer campaign to recover territory in the East and South is absorbing most of Ukraine’s military forces.

Before we were distracted by the Wagner episode, there were putative signs that the US deep state was changing its view from the conflict being easily winnable with covert support and Putin vulnerable to being toppled. And therefore, the true objective, the dismemberment of Russia, is no more than a dream and the proxy war is becoming a long drawn out operation. There is now little doubt that as a front man Zelensky is unable to deliver the goods, and his supporters in the western alliance are faced with being committed to the long haul.

The stakes for America are extremely high. Increasingly, neutral countries around the world are shifting their foreign policies on the evidence that America and her dollar are losing their hegemonic power. If America and NATO fail in Ukraine, it won’t just be thirty nations lining up to join BRICS: it will be the moment America’s political grip on the world is certainly lost. And then President Biden can kiss goodbye to his re-election chances next year.

Equally, Putin will strive to make sure his counteroffensive succeeds, and that must be the short-term priority. The financial benefits for Russia, principally the consequences for energy and oil prices will flow from it.

Russia is unlikely to immediately adopt a gold standard for the rouble when Ukraine falls because of the geopolitical consequences, not least for its partnership with China. It would undoubtedly hasten the fiat dollar’s destruction as a reserve currency, making financing of the US trade and budget deficits virtually impossible at current interest rates. While these outcomes would undoubtedly be helpful to Putin, it would amount to a major escalation of the financial war between Russia and the western alliance with unpredictable consequences. And it would be a change from Putin’s proven strategy of letting the western alliance make all the strategic errors without his intervention.

Furthermore, Russia is in partnership with China in a joint grand strategic plan for Asia and allied nations. And there is no doubt that the economic consequences of a collapsed dollar would rebound badly on China’s manufacturing base.

Far better to commence the move towards gold backing by other means, and this train of events has already been put in place under the command of Sergey Glazyev, a close confident of Putin, a moving light in the expansion of the Moscow Gold Exchange, and Minister in charge of Integration and Macroeconomics for the Eurasian Economic Commission. Glazyev was given the brief to come up with a new trade settlement currency for the Eurasian Economic Union (EAEU), which appears to be a Trojan horse for a wider BRICS and Shanghai Cooperation Organisation deployment.

If that plan is successful, then both the rouble and China’s renminbi could also adopt gold standards in due course, having the underlying financial conditions to sustain them.

The BRICS summit in Jo’burg

There is evidence that plans for a new trade settlement currency will be announced at the upcoming BRICS meeting in Johannesburg on 22—24 August[i]. If so, it will be a major development for global markets and a threat to the dollar’s future. And a new supranational trade currency for BRICS, the Shanghai Cooperation Organisation, and the Eurasian Economic Union has the merit of not having to address the vested trade and domestic currency interests of each member state. It would be designed to ensure its reserve status does not give overriding power to one nation, unlike the dollar.

It is probable that an announcement concerning the new currency will come out of the summit, but it is likely to be preliminary in nature, and gold might not even be mentioned at this stage. And it would make more sense for Glazev’s brief designing such a currency to be officially expanded from that of the EAEU committee, involving China more directly. That being the case, the only practical means of tying the new trade currency to multiple commodities and national interests is to use gold.

It increasingly suits Russia to see this move announced, and the timing could well coincide with or shortly follow Putin’s next push in Ukraine. But we should not expect this new currency to arrive shortly, only that it is being planned.

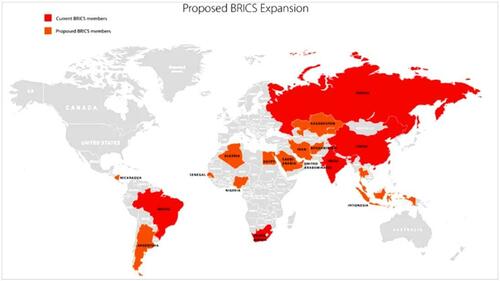

Another aspect of the Johannesburg summit is the increasing queue for BRICS membership. It will need the agreement of existing BRICS members. But given that the existing five members have diverse political interests, if is not easily forthcoming either China and Russia will have to strong-arm them into acceptance, or form a different membership category, such as associates. Either way, formal applications have been submitted from Algeria, Argentina, Bahrain, Bangladesh, Egypt, Indonesia, Iran, Saudi Arabia, and the United Arab Emirates. In addition, Afghanistan, Belarus, Comoros, Cuba, Congo, France, Gabon, Guinea-Bissau, Honduras, Kazakhstan, Nicaragua, Nigeria, Pakistan, Senegal, Sudan, Syria, Thailand, Tunisia, Turkey, Uruguay, Venezuela, and Zimbabwe have expressed an interest. Including the existing five members, that is 36 nations in total

The most interesting expression of interest comes from France, with President Macron reported to have applied to attend the Johannesburg summit. Only yesterday, it was reported that he was denied the opportunity to attend. But it is visible evidence of an EU member not toeing the American line. And recently, TotalEnergies the French conglomerate sold LNG to China for yuan, not dollars, signalling France’s independence from petrodollars.

Discounting France from actually applying for membership because Macron has his hands firmly tied by the EU, if membership was granted to all other applicants and those interested in joining an expanded BRICS, it would encompass 64% of the world population, and 33% of world GDP in 2017 (the latest year for which all individual national GDPs is available). For reference, the US’s population is 4.25% of global population and 24% of 2017 global GDP.

It seems to have escaped wider notice, but the only full members of the Shanghai Cooperation Organisation not members of BRICS, applying for membership, or expressing an interest are the four central Asian states — Kazakhstan, Kyrgyz, Tajikistan, and Uzbekistan, already in the EAEU. Furthermore, nine of the SCO’s Observer States and Dialog Partners are among the BRICS applicants. This is almost certainly centrally organised, with the possible objective for BRICS to be merged with the SCO, or to become indistinguishable from it.

For China and Russia, the advantages of integrating the SCO with BRICS are obvious. They are assembling an organisation based on free trade which dwarfs the US and EU and extends beyond Asia. Macron appears to be aware of the implications, and so are Germany’s industrial leaders, opening the way for an EU schism and an extension of Asian hegemony. It builds a trade bloc which makes the western alliance’s sanctions meaningless and will have complete independence from the dollar and its allied fiat currencies. Alternatives to the SWIFT international payments system now exist and can be easily extended.

It will allow for military and intelligence cooperation against terrorism (for which read Five Eyes’ black ops). In this, the experience of the Middle East has been instructive. Since Saudi Arabia sided with China and gave the US its marching orders, peace has been restored to the region.

The thinking behind a new trade currency

While any announcement about a new trade settlement medium at the BRICS summit in Johannesburg is likely to be preliminary, we can be sure that the legwork has already been done by Sergei Glazyev. Furthermore, various statements by nations prepared to accept settlement in national currencies other than the dollar must be seeing this as a temporary solution, pending more satisfactory payment arrangements. The Saudis accepting Kenyan shillings, or Russia accepting Iranian reals makes no sense on any other basis. Because the current position is temporary, it is time limited.

In an article entitled “Golden rouble 3.0: How Russia can change foreign trade infrastructure”[ii] written for Vedomosti, a Moscow-based Russian business newspaper published on 27 December2022, Glazyev laid out his latest thoughts. Furthermore, it was co-authored by Dmitry Mityaev, who is Assistant Member of the Board for Integration and Macroeconomics of the Eurasian Economic Commission — so this article was not just Glazyev’s musings, and we can assume that it carried official weight in Russia, at least. The article focused on the potential for a gold-backed rouble rather than the new trade settlement medium, but the same logic applies.

From this article, the EAEU currency commission now appears to have dropped the original indicated proposal for a new currency based on a weighted index of participating currencies and commodities entirely, using gold and credit based upon it instead as the principal means of settling trade imbalances. Presumably, the requirement to make payments in the new trade currency could be circumvented if one or more national currencies such as the rouble or renminbi went onto credible gold standards. The implication is that the rouble will readopt a gold standard sometime after a gold-backed trade currency is announced, reviving the gold backing (though not the relationship) that the Soviets operated between 1944 and 1961.

To reinforce the importance of a return to a gold standard, both Russia and the Saudis heading up OPEC+ will be aware of the consequences of the fiat petrodollar regime for their primary export product — crude oil.

In August 1971, when the Bretton Woods agreement was abandoned, crude oil was priced at $3.56 a barrel and the market price for gold was $42.85. Converting this into ounces of gold per barrel gives us a value of 0.0831 ounces. Today, the gold price of oil is 0.036 ounces per barrel, down 57%. In other words, using gold Glazyev can demonstrate that the true cost to OPEC+ of dollarisation has been to more than halve the value of their export revenues since the Bretton Woods agreement was suspended. By accepting a new trade settlement medium tied to gold, this US enforced erosion of oil values will cease. And to compensate for the loss of oil’s value from the ending of Bretton Woods, the gold price in dollars would have to be more than double that of today at over $4,400.

The evidence mounts therefore, that gold provides a framework within which Glazyev intends to operate. That he must be thinking this way has become fundamental to his approach, confirmed by his many references to gold in his article for Vedomosti, to the rouble’s history tied to gold, and to the US’s debasement of petrodollars. In the UK at least, Russia’s media appears to be censored, so Glazyev’s Vedomosti article (referenced in endnote ii) may not be available to many readers in the west. Therefore, for ease of reference the salient points in the English translation of his detailed article are summarised as follows [with additional commentary in square brackets]:

- In the nine months to September 2022, Russia’s trade surplus with members of the EAEU, plus China, India, Iran, Turkey, The United Arab Emirates etc. was $198.4bn equivalent, against $123.1bn for the same period last year. In other words, the western alliance’s sanctions failed to suppress Russia’s oil revenues, merely redirecting their sources. [Since then, this surplus has declined materially due lower oil and other commodity prices. Time for another special military operation?]

- The trade surplus with SCO members has allowed Russian companies to pay off external debts, replacing them with borrowing in roubles. [Glazyev doesn’t make this point, but a return to the gold standard would reduce borrowing costs in roubles substantially]

- Russia became the third largest country using renminbi for international settlements, accounting for up to 26% of foreign exchange transactions in the Russian Federation. The share of settlements in soft currencies is growing for SCO members, dialog partners and associates, replacing dollars, and is expected to increase further. [This is almost certainly a temporary fix, ahead of a new trade settlement currency being established]

- Since these currencies are subject to exchange rate risks and possible sanctions, the best way to offset them is to take payment in non-sanctioned gold from China, the UAE, Turkey, possibly Iran, and other countries instead of their local currencies. [A BRICS/SCO trade settlement currency tied to gold would eliminate this problem]

- Gold purchased by the Russian Central Bank can be stored in central banks of friendly countries for liquidity purposes and the rest repatriated to Russia.

- Gold can be a unique tool to combat western sanctions if used to price all major international goods (oil, gas, food, fertilisers, metals, and solid minerals). This would be “an adequate response to the west’s price ceilings”. And “India and China can take the place of global commodity traders instead of Glencore or Trafigura”.

- Gold (along with silver) for millennia was the core of the global financial system, an honest measure of the value of paper money and assets… It was cancelled half a century ago, tying oil to the dollar. But the era of the petrodollar is ending. Russia, together with its eastern and southern partners has a unique chance to jump ship from a dollar-centred debt economy.

- By signing the Bretton Woods agreement but not ratifying it, for the USSR “Golden Rouble 2.0” played an important role in post-war Soviet industrialisation. Now the conditions for “Golden Rouble 3.0” have objectively developed.

- Sanctions against Russia have boomeranged against the west. It now faces geopolitical instability and rising prices for energy and other resources [i.e., yet more price inflation].

- In 2023, [there will be a shift from] risky investments in complex financial instruments to invest in traditional assets, primarily gold. Gold’s increasing prices towards Saxo Bank’s forecast of $3,000 per ounce will lead to a substantial increase in the values and quantities of gold reserves. Large gold reserves will allow Russia “to pursue a sovereign financial policy and minimise dependency on external lenders”. [Note that in addition to official reserves it is believed that Russia has at least a further 10,000 tonnes — more than the officially declared total for the US Treasury.]

- Central banks are adding to their gold reserves. China has an export ban on all mined gold. According to the Shanghai Gold Exchange, customers have withdrawn 23,000 tonnes of gold. India is considered the world champion in gold accumulation…. Gold has been flowing from West to East… Is the West’s central bank gold safely earmarked, or is it all “de-done” through swaps and leasing? The West will never say, and Fort Knox’s audit will not either.

- Over the last 20 years, gold mining in Russia has almost doubled. Gold production may well grow from 1% of GDP to two or three per cent… Already, Russia’s annual gold production is set to rise from 300 tonnes to 500 tonnes… giving Russia a strong rouble, strong budget, and a strong economy. [Note that in this statement Glazyev reveals that he expects most of the increase of mine output is to be in its value measured in dollars.]

Glazyev is all but saying for definite that Russia plans to enact Golden Rouble 3.0. And we should be in no doubt that Russia is backing away from the west’s fiat monetary system and sees far higher gold prices expressed in falling dollars. The only question is the speed with which it is moving in this direction.

What Glazyev did not mention in his Vedomosti article, other than his reference to western central banks not necessarily having possession of their gold reserves, would be the consequences for the dollar and other western fiat currencies of gold becoming the trade settlement medium throughout Asia, or of the rouble returning to a gold standard. Inevitably, holders of dollars and financial assets, totalling some $30 trillion, would make comparative value judgements not just for the dollar but also for their exposure to other fiat currencies. Not only would this cause private sector actors engaged in cross-border trade to re-evaluate their exposure to fiat currencies as well, but the whole system of fiat currency reserves held by central banks could become threatened.

The strong indications are that Putin supports Glazyev’s thesis. But he has a wider remit, including military strategy over Ukraine. NATO is now committed to the Ukrainian proxy war for as long as it takes. It will require a swift victory by Putin to end this misery, and increasingly the rest of the world knows it. But almost certainly, the forthcoming military escalation by Putin will destabilise financial markets in the western alliance.

A renewed panic in energy and commodity markets seems certain, which will lead to fears in the western alliance’s financial markets of higher price inflation for longer, driving bond yields up and equities lower. Neo-Keynesian investors might initially expect the uncertainty arising from renewed military action to drive global liquidity into the dollar, which is their traditional safe haven, rather than gold. But US-centric markets fail to appreciate that at $30 trillion the currency and financial assets are already over-owned by foreigners, while physical gold is not. And they fail to appreciate that Putin can exploit this weakness.

It would be a good time for Putin to encourage financial conditions to deliver a major blow to the dollar’s hegemony. Under cover of the battlefield, Russia could let markets drive up prices of nearly all her exported commodities. It would then be seen by neutral nations as a market response to the western alliances’ political imperatives. But soaring energy and commodity prices will reflect a sharp decline in the purchasing power of the dollar and its fiat currency cohort of euros, yen, and sterling.

Yet again, by pursuing its military and political objectives in Ukraine, the western alliance would be seen by the wider world to be entirely responsible for collateral financial damage. And that surely, must suit Putin.

Constructing a trade medium of exchange

We now turn to the mechanics of constructing a new trans-national gold-backed currency. One condition which will need to be in place is for a value for gold measured in goods to back inter-Asian trade. Despite the accumulation of gold by the central banks of the Shanghai Cooperation Organisation membership, some of them may not have sufficient official gold reserves to cover their balance of payments deficits except for limited times, requiring a higher gold value in order to do so. And other members, such as Russia, could see continual accumulation of physical gold because of her balance of payments surplus. Ideally therefore, instead of trade settlements being entirely in physical gold, they should be facilitated by a banking system whose credit values are securely based on gold to ensure flexibility.

The task therefore is to design an entirely new non-national currency backed by gold, specifically created for cross-border trade and commodity transactions. Presumably, this is what Glazyev is trying to achieve instead of the more cumbersome EAEU project originally announced. It is a relatively simple task and does not require blockchains and the paraphernalia of a CBDC. The mantra should be to keep it simple, and therefore have no mystery.

The bulleted list that follows is a brief outline of how a new trade settlement currency based on gold can be established to replace the fiat dollar in all transactions between SCO/BRICS member nations. By being completely independent of national currencies, it should be politically acceptable to all involved, as well as a long-term practical solution to facilitate the Russian-Chinese axis’s ambitions for an Asian industrial revolution, free from interference by America and her allies.

The essential elements are as follows:

- The announcement of the creation of a new central bank (NCB) and a new gold-based currency on the lines below will be made in advance of implementation to allow bullion markets to adjust to the new regime before it comes into existence.

- A new central bank is then established, whose function is to issue a new book-entry currency backed by physical gold, issued and available only to participating central banks. It will be designed to be a fully trusted gold substitute, independent from fiat currency values.

- The new currency will only be redeemable for physical gold by participating central banks. They will also be free to add to their NCB currency reserves by submitting additional gold to the NCB at any time.

- The NCB’s eligible participants will only be the central banks of participating nations, limited to member nations of the SCO, EAEU, and BRICS. The NCB’s currency is issued to the national central banks against their assigning a minimum 40% gold backing for it. For example, currency representing one million gold grammes secures an allocation of 2,500,000 currency units denominated in gold grammes. The gold does not have to be delivered to a central storage point but can be earmarked[iii] from within a participating central bank’s gold reserves, on condition that they are securely stored in vaults on a list approved by the NCB.

- Commercial banks trading in member nations and elsewhere will be free to create and deal in credit denominated in the NCB’s new currency. Issuers and users of this credit are always free to acquire physical gold in the markets, should they wish to back credit created in the new currency with gold itself.

- All taxes and restrictions on gold ownership must be fully removed by participating nations. Gold’s legal status as money must be reaffirmed, if necessary.

- An efficient central clearing system for commercial banks dealing in credit based on the new currency will need to be established.

- Accompanied by the major energy producers setting price benchmarks, commodity exchanges in member nations will be required to price all products in the new NCB currency, replacing pricing in US dollars completely for trade between participating member nations. They can still quote prices in dollars for others should they so wish.

The purpose of the new currency is to provide the basis for trade finance and other cross border financial settlements on a sound money basis. It is also likely to lead to participating nations placing a greater emphasis on their own currencies’ stability while providing a safe haven from a fiat currency systemic collapse.

All empirical evidence informs us that when gold becomes the means by which credit is valued, credit’s own value is not dependent on stability in the quantity of credit, taking its value from gold. This stability imparts pricing certainty to trade and investment, necessary conditions for maximising economic progress particularly in the context of wider industrial development throughout Asia.

Constructed on the lines above, remarkably little physical gold would be required to underwrite cross-border payment values for trade in Asia and beyond. This trade settlement currency should be simple and quick to establish. It must be free from interference from members of the western alliance trying to preserve their own fiat currency systems. And the 40% gold backing rhymes with the basic requirement for a metallic monetary standard set by Sir Isaac Newton, when he was Master of the Royal Mint.

For participating central banks, the replacement of gold in their reserves for allocations of the new currency would represent a significant increase in their reserves. As confidence in the scheme builds, it could be argued that only minimal gold reserves need to be retained by participating central banks, with the balance swapped for the new currency. For example, the Reserve Bank of India officially possesses 795 tonnes of gold. Converted into the new gold currency, its value in reserves is uplifted to 1,988 tonnes equivalent.

Things To Come: It has been 7 years on 17th/1/2023 since 'the little horn[son]' -the Bibi[baby] son whose name /number adds to 666 renewed the Mosaic Covenant with Pope Francis in the Synagogue in Rome. ...7 year Biblical cycle....I believe we now might enter the Last Week- watch for his 'covenant with the many' acceptance speech?[42 month authority left]. ....building the New Temple...then the Last Two Prophets come a measuring ?...Merry Christmas & New Year,,,,Maranatha Shalom....old Messianic Jew. A Friend Of HNW.

HNewsWire Update 6/30/23

More and more countries have aspired to belong to BRICS since 2009, but none from the West.

The BRICS countries represent 40% of the world population and 25% of the global GDP.

Thanks to BRICS, China can impose its vision of international cooperation and Russia can show that it will not be isolated on the stage of global players.

The group is a thorn in the side of the Americans all the more so that a dozen other developing countries (marked in orange on the map below) want to join the current five countries of the alliance (red).

Source: Silkroadbriefing

What America certainly doesn’t like is the fact that French President Macron communicated the other day his interest in attending meetings of the alliance. France in BRICS would be a trigger for profound changes in the geopolitical landscape. We bet that Turkey can also join soon, which, like the case of France, will weaken the importance of the UN as a purely Anglo-Saxon project and that of NATO. Indeed, the BRICS countries are against the UN’s attempts to link the issues of climate with the issues of security, and France in BRICS can return to the de Gaullean concepts of foreign policy outside NATO.

A challenge to cohesion in BRICS is the large disparity in countries’ capacities (in favor of China) and the members’ focus on cooperation with the PRC, which results in a smaller number of relationships among the other partners. However, the main factor that has weakened the BRICS in recent years is the deterioration of relations between the largest member states, China and India, since 2017. Border and trade disputes culminated in the clashes on the Ladakh border in June 2020, which almost led to the cancellation of the BRICS summit in the same year and prompted India to deepen cooperation with the United States and the EU.

Now, the West’s involvement in the war in Ukraine is reviving anti-Western sentiments, not only in the BRICS countries.

Indeed, it is clear to more and more countries that the war was provoked by NATO’s excessive expansion.

The BRICS politicians also want to fight inflation whose cause they perceive not in the Russian attack but in the Western sanctions.

Whether you are pro-Western, pro-Russian, or in favor of the New Silk Road, it is better for all of us to live in a multi-polar world rather than to have all the strings pulled on the Potomac.

HNewsWire:

In recent years, at least a few of high-ranking US military commanders have issued warnings about a "coming conflict with China," with the most recent warning being the most unusual, given in the form of a memo by an active four-star general and circulated with an official order.

This instance is especially notable since he took the unusual step of communicating it down via military command and to the main commanders he supervises, emphasizing the importance of the warning:

A four-star Air Force general delivered a memo to his officers on Friday predicting that the United States will be at war with China in two years and instructing them to prepare by firing "a clip" at a target and "aiming for the head."

"I hope I am incorrect," said Gen. Mike Minihan, director of Air Mobility Command, in a memo obtained by NBC News on Friday. "My instincts tell me I'll fight in 2025."

The letter was sent on Friday by General Mike Minihan, a four-star commander. Image courtesy of Getty Images

According to various accounts, Gen. Minihan commands over 50,000 service troops and nearly 500 planes.

The memo is especially concerning because it tells commanders under him to "examine their personal affairs and whether a meeting with their service base legal office should be arranged to ensure they are legally ready and prepared."

He explained that he believes Beijing intends to move against the self-ruled island of Taiwan within that time frame, which would elicit a significant US military reaction.

The general also recommended "a fortified, ready, integrated, and nimble Joint Force Maneuver Team ready to fight and win within the first island chain." In the message, Gen. Minihan issued an order demanding all major efforts in preparation for a forthcoming China battle to be reported directly to him by Feb. 28.

NBC explained why he believes China would invade Taiwan within the next two years:

According to Minihan's document, because both Taiwan and the United States will hold presidential elections in 2024, the United States will be "distracted," and Chinese President Xi Jinping will have an opportunity to move on Taiwan.

Beijing, for its part, has long asserted that it is solely interested in achieving peaceful reunification with Taiwan through political methods. China has also blamed Washington for militarizing the island, causing current tensions, and for fanning independence forces through high-level trips, including as Nancy Pelosi's very provocative visit to Taipei in August.

Gen. Minihan has a reputation for being one of the Pentagon's most outspoken and hawkish top generals. In his most recent memo, he instructed all Air Mobility Command personnel to "fire a clip into a 7-meter target with the full understanding that unrepentant lethality is most important." Take aim at the head.

HNewsWire: Several former military officials said that the United States could face significant shortfalls if there is ever a conflict with the Chinese regime over Taiwan, coming as U.S. military jets shot down a Chinese spy balloon that drifted across the United States.

“Unfortunately, talking broadly and in overall terms, the Chinese have dramatically increased their air, sea, space, cyber, and missile capabilities in the last couple of decades,” James Anderson, acting undersecretary of defense for policy under President Donald Trump, told Fox News.

“In some of the scenarios that could happen, we might well be at a competitive disadvantage initially because they have home-field advantage in terms of their capacity to quickly mobilize local forces,” he said, “and that’s really important to the [Chinese military].”

Last week, Rep. Michael McCaul (R-Texas), the new chairman of the Foreign Affairs Committee in the House of Representatives, said the odds of conflict with China over Taiwan “are very high” after a U.S. general released a memo about a potential conflict with the regime in 2025.

Gen. Mike Minihan, who heads the Air Mobility Command, wrote to the leadership of its roughly 110,000 members, saying, “My gut tells me we will fight in 2025.”

“I hope he is wrong … I think he is right, though,” McCaul said in an interview last week.

Although the general’s views do not represent the Pentagon, it shows concern at the highest levels of the U.S. military over a possible attempt by China to exert control over Taiwan, which Beijing claims as a wayward province. “We’re preparing for it and we should,” Sen. Dick Durbin (D-Ill.), a member of the Senate leadership, told news outlets last week in response to a question about a possible U.S.-China conflict. “There are four countries around the world that we watch very carefully in terms of our own security. China is number one.”

But those fears were exacerbated after a Chinese spy balloon floated over much of the United States over the past several days before it was shot down off the South Carolina coast by a U.S. F-22 fighter jet. The balloon’s presence over the United States, first detected in Montana, prompted Secretary of State Antony Blinken to announce that he’s canceling his scheduled trip to China this year.

Meanwhile, the United States hasn’t been involved in such a conflict in decades since World War II, it has been noted. A possible conflict would require a large number of warships and aircraft carriers to exert control over the Pacific Ocean.

“The United States hasn’t been in such a conflict since 1945 and the casualties would come in a very short period of time. The war game covered three or four weeks,” Mark Cancian, a senior adviser at the Center for Strategic and International Studies, told WJAR-TV last week. Such a conflict “really requires a cultural change in the U.S. military,” he said.

One issue, Cancian noted, is U.S. industrial production has slipped in recent decades. A large number of U.S.- and Western-based countries have outsourced manufacturing to China and other countries in recent years, according to economists, namely after China entered the World Trade Organization in 2001.

“It certainly is a realistic concern,” he told the outlet. “Our inventories are not large and our ability to replace them, the surge capability of our defense industry is not great so that in a long conflict we will risk running out of key munitions and weapons.” Source: ET

Heino Klinck, a senior adviser to the National Bureau of Asian Research, told Fox News on Sunday that it’s difficult to predict what could happen. Source: ET

“There are areas in which they have dominance, and there are also areas in which we have dominance, so it’s not exactly an apples and oranges type of comparison,” Klinck, who previously served as deputy assistant secretary of defense for East Asia before leaving in 2021, told the outlet. “China certainly has geographic advantages just based on the fact that it’s only 100 miles from Taiwan, so that’s something that requires advanced logistical planning,” he added.

Anderson noted that China hasn’t conducted a significant military operation in decades. Beijing last fought a conflict with Vietnam in 1979 along the two countries’ borders, while the United States has partaken in many conflicts since the end of World War II.

“The fact is they have no experience conducting a major amphibious assault on the scale that would be required to take the island of Taiwan,” Anderson told Fox. “Yes, they did attack various outlying islands of Taiwan during multiple crises in the 1950s, but those were very small-scale operations.”

He added: “There are no good parallels, and … from our perspective, the fact that the Chinese don’t have a good parallel is good news because this is a competitive disadvantage for them.”

![]()

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

Use the code HNEWS10 to receive 10% off your first purchase.

A Dollar Collapse Is Now In Motion, Saudi Arabia Signals The End Of 'Petro' Status

Authored by Brandon Smith via Alt-Market.us,

HNewsWire: The decline of a currency’s world reserve status is often a long process rife with denials. There are numerous economic “experts” out there that have been dismissing any and all warnings of dollar collapse for years. They just don’t get it, or they don’t want to get it. The idea that the US currency could ever be dethroned as the defacto global trade mechanism is impossible in their minds.

One of the key pillars keeping the dollar in place as the world reserve is its petro-status, and this factor is often held up as the reason why the Greenback cannot fail. The other argument is that the dollar is backed by the full force of the US military, and the US military is backed by the US Treasury and the Federal Reserve – In other words, the dollar is backed by…the dollar; it’s a very circular and naive position.

These sentiments are not only pervasive among mainstream economists, they are also all over the place within the alternative media. I suspect the main hang-up for liberty movement analysts is the notion that the globalist establishment would ever allow the dollar or the US economy to fail. Isn’t the dollar system their “golden goose”?

The answer is no, it is NOT their golden goose. The dollar is just another stepping stone towards their goal of a one-world economy and a one-world currency. They have killed the world reserve status of other currencies in the past, why wouldn’t they do the same to the dollar?

Globalist white papers and essays specifically outline the need for a diminished role for the US currency as well as a decline in the American economy in order to make way for Central Bank Digital Currencies (CBDCs) and a new global currency system controlled by the IMF. I warned about this years go, and my position has always been that the derailment of the dollar would likely start with the end of its petro status.

In 2017 I published an article titled ‘Saudi Coup Signals War And The New World Order Reset’. I noted at the time that the sudden power shift over to crown prince Mohammed Bin Salman indicated a change in Saudi Arabia’s relationship to the US. I stated that:

“To understand how drastic this coup has been, consider this — for decades Saudi Kings maintained political balance by doling out vital power positions to separate, carefully chosen successors. Positions such as Defense Minister, the Interior Ministry and the head of the National Guard. Today, Mohammed Bin Salman controls all three positions. Foreign policy, defense matters, oil and economic decisions and social changes are now all in the hands of one man.”

The rise of MBS was backed by the Public Investment Fund (PIF), a fund comprised of trillions of dollars supplied by globalists within Carlyle Group (Bush family, etc.), Goldman Sachs, Blackstone and Blackrock. MBS garnered the favor of the globalists for one specific reason – He openly supported their “Vision For 2030”, a plan for the dismantling of “fossil fuel” based energy and the implementation of carbon controls. Yes, that’s right, the head of Saudi Arabia is backing the eventual end of oil based energy, and part of that includes the end of the dollar as the petro currency.

In exchange for their cooperation, the Saudis are being given access to ESG-like funding as well as access to AI advancements and the so-called “digital economy.” It sounds crazy, but there is much talk of AI developments to cure numerous health problems and extend lifespan. With those kinds of promises, it’s not surprising that Saudi elites would be willing to dump the dollar and even oil.

In 2017 I noted that:

“I believe the next phase of the global economic reset will begin in part with the breaking of petrodollar dominance. An important element of my analysis on the strategic shift away from the petrodollar has been the symbiosis between the U.S. and Saudi Arabia. Saudi Arabia has been the single most important key to the dollar remaining as the petrocurrency from the very beginning.”

I believed that the threat to petro status would ultimately be spurred on by a proxy war between East and West:

“World economic war is the real name of the game here, as the globalists play puppeteers to East and West. It is a geopolitical crisis they will have created to engineer public support for a solution they predetermined.”

Back then I thought that such a proxy war would be initiated in the Middle East, possibly in Iran. However, it’s clear that Ukraine is the powderkeg the globalists have chosen, at least for now, with Taiwan being the next shoe to drop.

In the years since I made these predictions the relationship between Saudi Arabia, Russia and China has grown very close. Arms deals and energy deals are becoming a mainstay of trade and this has led to a quiet but steady distancing of the Saudis from the dollar. This past week, the dominoes were set in motion for dollar collapse when Saudi Arabia announced at Davos that they are now willing to trade oil in alternative currencies.

In response, Xi Jinping pledged to ramp up efforts to promote the use of the Chinese yuan in energy deals. This falls in line with another article I wrote in 2017 titled ‘The Economic End Game Continues,’ in which I described how conflict with Eastern nations (China and Russia) would be exploited to create a catalyst for the end of the dollar’s petro status.

The importance of the Saudi announcement cannot be overstated; this is the beginning of the end of the dollar. The dollar’s world reserve status is largely dependent on its petro-status. Without one, you cannot have the other. This is almost the exact same dynamic that led to the implosion of the British Sterling decades ago as the global petro currency which resulted in the rise of the dollar to take its place.

This time, though, it will not be a single foreign currency that takes on the role of world reserve, it will be a basket currency system controlled by the IMF called Special Drawing Rights, along with a single global digital currency that is yet to be named but is now under development.

The consequences of the loss of reserve status will be devastating to the US economy. It is the only glue holding our system together – The ability to defer inflation by exporting it overseas is a superpower only the US enjoys. The Fed can print money perpetually if it wants to in order to fund the government or prop up US markets, as long as foreign central banks and corporate banks are willing to absorb dollars as a tool for global trade. If the dollar is no longer the primary international trade mechanism, the trillions upon trillions of dollars the Fed has created from thin air over the years will all come flooding back to the US through various avenues, and hyperinflation (or hyper stagflation) will be the result.

This dynamic is already in play, as foreign holders of US debt and dollars have been dumping them at record pace since 2017. The process continues at a time when the Federal Reserve is cutting it’s balance sheet and raising interest rates, which means there is no longer a buyer of last resort.

This may be why multiple foreign central banks have renewed their purchases of gold reserves and are once again stockpiling precious metals. They seem to be well aware of what is about to happen to the dollar, while the American public is kept in the dark.

The effects of the decline of the dollar may not be immediately felt, or become obvious for another year or two. What will happen is consistent inflation on top of the high prices we are already dealing with. Meaning, the Federal Reserve will continue to hold interest rates higher and prices will barely budge or they may climb in spite of monetary tightening. Even in the face of a major recessionary contraction, which I predict will be triggered starting in April, prices will STILL remain higher.

All the while the mainstream media and government economists will say they have “no idea” why inflation is so persistent, and that “nobody could have seen this coming.” Some of us saw it coming, but only because we accept the reality that the dollar’s days are numbered.

![]()

Satan still has influence in the world, and our own human hearts still turn against God. Second Corinthians 4:4 explains, “The god of this age has blinded the minds of unbelievers, so that they cannot see the light of the gospel that displays the glory of Christ, who is the image of God.” Paul explains how people willingly reject the truth of God and that, “just as they did not think it worthwhile to retain the knowledge of God, so God gave them over to a depraved mind, so that they do what ought not to be done” (Romans 1:28). He also warns, “There will be terrible times in the last days. People will be lovers of themselves, lovers of money, boastful, proud, abusive, disobedient to their parents, ungrateful, unholy, without love, unforgiving, slanderous, without self-control, brutal, not lovers of the good, treacherous, rash, conceited, lovers of pleasure rather than lovers of God—having a form of godliness but denying its power. Have nothing to do with such people” (2 Timothy 3:1–5).

Even those who have put their faith in Jesus Christ and been rescued from the penalty of sin still struggle against the sinful nature (Romans 7—8). We still go against God and, as a result, contribute to the problem of evil in the world. God has graciously forgiven us in Jesus Christ and continues to cleanse us from sin (1 John 1:9). Through the work of the Holy Spirit, God also enables us to put our evil deeds to death and live in His ways (Philippians 2:12–13; Ephesians 4:17–32; Colossians 3:1–14; Romans 12:1–2; Hebrews 12:1–2).

Evil will persist until Christ returns, but we can rest assured that God allows no more evil than will ultimately play into His good and perfect purposes. He restrains evil (Job 1—2; 2 Thessalonians 2:6–12). Though God never authors or applauds evil, He is able to use it to His good ends (Romans 8:28–30; James 1:2–4; 1 Peter 1:6–9).

Though the evil in our world can seem overwhelming, it has by no means overcome the goodness of God. God’s children—those who have put their faith in Jesus Christ (John 1:12)—live in this world as ambassadors and lights (2 Corinthians 5:20–21: Matthew 5:13–16). We are tasked with sharing the good news about Jesus with the world (Matthew 28:18–20; Acts 1:8) and demonstrating His character through actively loving others (John 13:34–35; Galatians 6:9–10; 1 John 4:7–12). The Holy Spirit resides in us (Ephesians 1:13–14; 1 John 4:13). Nothing will separate us from God’s love, not even the darkest evil (Romans 8:28–39).

Saudi Arabia Is Moving Closer to China While Moving Away From the United States

HNewsWire: Don't worry about the millions of illegal immigrants flooding into the country as you leave costly military equipment in Afghanistan and deplete your weapon stocks in Ukraine and then pretend there's no issue. When China is ready to infiltrate outside, as it has done domestically, there is a serious danger that the United States may be unable to defend itself.

According to Gregory Copley, president of the International Strategic Studies Association, the United States' relationship with Saudi Arabia is deteriorating as a result of China's increasing closeness to the Gulf Kingdom.

"It is the most severe setback that the US and the West has faced since arguably the middle of the Cold War era," Copley said on NTD TV' "China in Focus" program.

He cited the interaction between the West and the Middle East during President Richard Nixon's presidency.

"What we observed in the early 1970s was that the United Governments and the West acquired a tremendous relationship with all of the Middle Eastern states, including Israel, the Arab States, and Iran," he remarked.

"There was no serious fear of mutual hostility, and the area was seeing much more positive development and stability," he noted.

The Nixon administration was successful in establishing a cease-fire between Israel, Egypt, and Syria in 1973.

"And fundamentally, what we saw under President [Joe] Biden was the total, what we saw under President [Barack] Obama early in his time, the collapse of that equilibrium in the Middle East," Copley said.

He singled out Chinese President Xi Jinping's visit to Saudi Arabia in early December.

"The People's Republic of China's goal was to step in and say, 'We are a friend to everybody, and we will ensure peace in the area,' something only the United States had been able to achieve in the previous several decades," he said.

Mao Ning, a spokeswoman for China's foreign ministry, described Xi's visit as the "biggest and highest-level diplomatic event between China and the Arab world since the formation of the People's Republic of China."

"So we have President Xi doing something that had not been accomplished since President Nixon's successes in the early 1970s, up until 1974," Copley observed.

Various Reactions

According to Copley, there was a huge contrast between Chinese President Xi Jinping's opulent greeting in Saudi Arabia and Biden's frigid reception in Riyadh during his July visit.

"There were no ministers waiting for him at the airport. "His welcome was nothing remarkable, and the conversations were on very, very tiny and continuing details," he said of Biden's visit.

"However, when... Xi Jinping came in Riyadh recently, he was met with all of the trappings of a complete state visit, with flypasts, Royal Saudi Air Force fighter and trainer jet aircraft, all in the colors of the People's Republic of China flag, and the like," he continued.

Copley ascribed the deterioration in US-Saudi ties to Biden's criticism of Saudi Crown Prince Mohammed bin Salman, who was suspected of masterminding the murder of Washington Post journalist Jamal Khashoggi in 2018 when he entered a Saudi consulate in Turkey.

"You have a situation where much of the Middle East, including Saudi Arabia, was becoming alienated toward the US. Biden administration, because of the basically disruption of the [Abraham] Peace Accords, which had been achieved with so much difficulty and hard work," he added, referring to the 2020 peace agreement reached by Israel, Bahrain, and the United Arab Emirates through the Trump administration's mediation.

China and Saudi Arabia Progress

Copley also emphasized Beijing's improvement in its economic connection with the Gulf country, as seen by Xi's recent visit to Saudi Arabia. "The People's Republic of China was making tremendous success in negotiating Middle Eastern oil sales in currencies other than the US currency, the petrodollar," he claimed.

"Saudi Arabia has been experimenting with selling oil and gas to the PRC with yuan as well." During his visit, Xi reportedly focused on China's ongoing attempts to replace the dollar as the currency denomination for Chinese-Saudi oil trading by using the Shanghai Petroleum and National Gas Exchange as a payment mechanism.

"So what we've seen is a significant crack in the dominance of the US dollar in the Middle East, but it's far from complete," Copley said. Xi's visit featured Saudi-Chinese talks, a China-Arab conference, and a summit between China and the Gulf Cooperation Council (GCC).

"The accords that Xi Jinping has done in the Middle East are highly significant geopolitically because they also connect the Beijing-dominated Eurasian bloc of states—a strategic alliance involving Saudi Arabia, Russia, and Iran," he added.

"It provides them, in particular, a conduit now down via Saudi Arabia, down to Africa," he continued.

According to the expert, this connection would allow Beijing to avoid sailing cargo "across the Indian Ocean in the South China Sea up to Chinese ports," which he claims are "susceptible to interdiction by Western countries, whether it's the US or the Europeans, or the Japanese and Australians."

There is no long-term solution. Copley believes that if China's economy continues to deteriorate, the arrangements reached with the Middle East will not provide a long-term solution to the regime.

China's economy is being harmed by poor consumer demand as a result of Beijing's zero-COVID policy, notably in the real estate industry. The slow real estate market has resulted in a considerable decrease in fiscal income and a significant rise in expenditures, resulting in a severe fiscal imbalance.

"It's a tremendously dramatic moment of transition for Beijing," he remarked. They will either make a tremendous breakthrough, causing the West to collapse, or they will fail and fall within the next decade."

George Bush was dead right about one thing.

Please do not inquire. Don't tell anybody. Most eastern countries will eventually abandon the United States.

‘I’ve Done It’: Netanyahu Announces His 6th Government, Israel’s Most Hardline Ever

HNewsWire: Benjamin Netanyahu informed President Isaac Herzog late Wednesday that he had reached an agreement with his coalition partners to form Israel's 37th government, promising right-wing and religious-led political stability seven weeks after the country's fifth election since 2019 and minutes before his mandate to form the next government expired.

In accordance with Israeli law, Netanyahu was also scheduled to notify Knesset Speaker Yariv Levin, who would make the announcement during Monday's parliamentary session. Following that, Netanyahu will have seven days to swear in his cabinet, but party officials believe it will happen before the January 2 deadline.

The talks between Netanyahu and his far-right and ultra-Orthodox allies came down to the wire, with the Otzma Yehudit party announcing an hour before the deadline that it was still in talks with Netanyahu's Likud and that it "wasn't apparent" whether the two sides would reach an agreement.

Over a month after getting the authority to form a government, Netanyahu eventually contacted Herzog to announce his coalition roughly 20 minutes before the deadline.

Immediately thereafter, just before midnight, Netanyahu announced his administration, simply tweeting, "I've done it."

HNewsWire: The BRICS coalition, which includes Brazil, Russia, India, China, and South Africa, focuses mostly on trade discussions, while it has also reached agreements on security issues such as counterterrorism. Despite increased tensions between members over the last decade, particularly between India and China, whose military fought in conflict over their shared border in 2020, the coalition has held.

The BRICS alliance also held despite the election of a self-proclaimed conservative president, Jair Bolsonaro, who radically shifted the focus of domestic politics from what it was when far-left socialist President Luiz Inácio Lula da Silva helped create the coalition in 2009. Despite campaigning on anti-communism in 2018, Bolsonaro has generally maintained close connections with China and has remained neutral in Russia's invasion of Ukraine, strongly opposing sanctions against Moscow.

On November 13, 2019, Chinese President Xi Jinping (L) and Brazilian President Jair Bolsonaro shake hands during a press conference following their bilateral meeting at Itamaraty Palace in Brasilia, Brazil. - On the eve of a summit with their BRICS counterparts from Russia, India, and South Africa, Brazil's President Jair Bolsonaro walked a diplomatic tightrope, seeking to strengthen ties with Beijing while not upsetting major friend Donald Trump.

On November 13, 2019, Chinese President Xi Jinping (L) and Brazilian President Jair Bolsonaro shake hands during a press conference following their bilateral meeting at Itamaraty Palace in Brasilia, Brazil.

Saudi Arabia's interest in joining BRICS is not surprising; reports in July suggested that Saudi officials were considering the possibility; however, Riyadh actively seeking closer ties with nations such as Russia and China will likely worry the White House, given the OPEC+ oil cartel's announcement to cut production by two million barrels per day.

The government of leftist American President Joe Biden instantly condemned Saudi Arabia, the cartel's leader, for boosting oil prices to facilitate Russia's invasion of Ukraine, a claim Saudi Arabia adamantly disputed, backed up by Ukrainian President Volodymyr Zelensky.

Ramaphosa spent the weekend in Riyadh, where he signed 17 memorandums of agreement on trade and diplomacy worth an estimated $15 billion.

"The Crown Prince (Prime Minister Mohammad bin Salman bin Abdulaziz al Saud) did stress Saudi Arabia's wish to be a part of Brics, and they are not the only country," Ramaphosa said after meeting with the crown prince, according to the South African newspaper the Times.

Ramaphosa would to say if he would support Saudi Arabia joining the diplomatic coalition, emphasizing that the decision would have to be made by all five parties.

Chinese President Xi Jinping makes a keynote speech in virtual format at the BRICS Business Forum opening ceremony on June 22, 2022.

"The BRICS nations will gather in a summit next year under the chairmanship of South Africa." And the matter will be taken into account," Ramaphosa stated. "And already, a number of countries or nations have approached the other member countries, and we've given them the same response, which is that it will be discussed by the BRICS partners themselves, five of them, and then a decision will be made."

MOSCOW, RUSSIA – SEPTEMBER 30 (RUSSIA OUT) – Russian President Vladimir Putin talks at a signing ceremony with separatist leaders in the Grand Kremlin Palace on September 30, 2022 in Moscow, Russia. Separatist leaders from Ukraine's occupied regions of Donetsk, Lugansk, Kherson, and Zaporizhzhya have come in Moscow to sign cooperation contracts.

South Africa was added to the BRICS (formerly BRIC) coalition only once. Following the last BRICS conference, there was speculation that the participants were interested in expanding the organization, whose principal mission is to act as a counterweight to American interests on a global scale. The Russian Foreign Ministry revealed in June that the Islamist dictatorship of Iran and Argentina's socialist administration of President Alberto Fernández had sought for membership.

Iranian President Ebrahim Raisi inspects an honor guard as he departs Tehran's Mehrabad airport for New York to attend the annual UN General Assembly meeting on Monday, September 19, 2022. Raisi's remark that "there are some indicators" that the Holocaust occurred but that further investigation was needed drew an outrage from Israeli officials on Monday, who condemned the remarks as antisemitic Holocaust denial. Raisi made the remark during an interview with CBS' "60 Minutes" on the eve of his trip to New York for the United Nations General Assembly.

"While the White House was thinking about what else to switch off in the world, ban or spoil, Argentina and Iran sought to join the BRICS," Russian Foreign Ministry spokeswoman Maria Zakharova said at the time, referring to US-led sanctions imposed in response to Ukraine's eight-year-long incursion.

Fernández and Iranian President Ibrahim Raisi both attended the most recent BRICS summit in China in June.

Argentina's President Alberto Fernandez will take office on Monday, June 27, 2022.

The inclusion of Iran in the coalition may hinder Saudi Arabia's participation. The two countries, which have the world's most prominent Sunni and Shiite Muslim regimes, have long been geopolitical enemies and are currently engaged in a proxy war in Yemen.

Iranians frequently dispute the Saudi government's management of Islam's two holiest places, Mecca and Medina, whereas Saudi Arabia regards Iran as a regional threat and frequently lobbies for sanctions on the Iranian regime in order to limit its impact.

Purnima Anand, the president of the BRICS International Forum, said a month after the BRICS meeting this year that Saudi Arabia, along with Turkey and Egypt, had approached the group to request membership.

"All of these countries have expressed an interest in joining and are planning to apply for membership," Anand told Russian media. "I feel this is a good step because expansion is always viewed positively; it will undoubtedly strengthen BRICS' worldwide power."

Saudi Arabia's ambition in forming a coalition that actively challenges the United States' financial influence comes after a difficult week for Washington-Riyadh relations. The Biden administration reacted angrily to OPEC+'s decision to restrict oil production by 2 million barrels per day, stating that Saudi Arabia, which leads the oil cartel, was "aligning with Russia."

In response to the output cut, White House spokesman John Kirby stated Biden would immediately "reevaluate" ties with Saudi Arabia; however, Biden later said he would not discuss the issue until after the American midterm elections in November.

The Saudi Ministry of Foreign Affairs responded to the criticism with an unusually long missive expressing "complete rejection" of the Biden administration's position.

"The Government of the Kingdom of Saudi Arabia would like to emphasize its unequivocal rejection of these assertions that are not founded on facts and that misrepresent the OPEC+ decision outside of its solely economic context," the statement said.

Any attempts to distort the facts about the Kingdom's position on the Ukraine issue are regrettable and will not influence the Kingdom's principled position, including its vote to support UN resolutions on the Russian-Ukrainian situation."

On Friday, Zelensky said that he had spoken with Crown Prince Mohammed bin Salman over the phone and praised Saudi Arabia for its assistance, thus contradicting the White House's attempt to portray Riyadh as a Russian ally in the fight.

"I spoke with Saudi Crown Prince Mohammed bin Salman. "Thank you for your support of Ukraine's territorial integrity and resolution in the UN General Assembly," Zelensky tweeted.

Russia has warned Israel about persistent claims that the Israeli government is planning to offer Ukraine with lethal military aid. So far, its assistance has been limited to humanitarian and non-lethal items, with Israeli officials repeatedly refusing Kiev's pleas for armaments, notably the famous Iron Dome anti-air system.

There is currently no indication that the Knesset has sanctioned or authorized defensive help, but some Israeli officials are becoming more vocal about the idea in response to widespread claims of Iran delivering Moscow 'kamikaze' drones allegedly used in the last stepped-up attacks.