Watchman Update: Governments Will Ban Bitcoin or Any Other Cryptocurrencies — Most Authorities Will Outlaw Them, Because They (Gov) Don’t Want to Lose Their Monopoly

HNewsWire Live Stream, 24/7 News

HNewsWire:

If COVID taught us anything it was that an emergency, real or faked, facilitates a lot of things that would never happen otherwise. The tyrants know this and are in the process of creating financial emergencies that will allow them to argue that there is no alternative but to implement CBDCs. The Biden Administration is implementing policy after policy that devalues the American dollar by limiting Americas ability to mine its own resources or produce its own goods while printing endless money. This will (or more likely is) facilitate an economic collapse. Meanwhile, WEF/CCP partner groups like Black Rock and Vanguard are leveraging their positions as major stakeholders in small and midsized banks to force the banks to accept terrible ESG and other risky investments that will, when combined with the inflation/devalued dollar and scarce resources, result in their collapse. This is an obvious thing to anyone that truly understands the inner-workings of banking (I ran a credit union for a number of years, was a compliance expert, and was involved in a number of national-level groups/projects).

Along with the effort to collapse the dollar and our banking system, the tyrants are also pushing legislation that can allow CBDCs to exist legally and without competition. This is being done in a VERY sneaky way because of the massive political opposition to anything CBDC-related. At this point, the major focus is on passing state-level legislation - particularly in a number of key RED states. Bills are being pushed that appear innocuous but are written to create a check-mate situation when CBDCs come into play. That way these red states won’t be able to oppose it.

When it comes to who is behind the push to sneak CBDC legislation on the state level we need look no further than the Uniform Law Commission (the “ULC”… stinking lawyers).

Here’s a link you can follow to see where this crew is pushing state law.

The response from many lawmakers when people are questioning these bills is that it is conspiracy theory to suggest these UCC bills will facilitate CBDC.

Here is a link to one of the authors of the bills telling you it is about CBDC (fast forward to about 46 or 47 minutes in); you should save a copy of this video quickly - I’m guessing it will disappear soon.

You can find additional information here from the South Dakota Freedom Caucus (they did great work shining light on the bill Kristi Noem just vetoed - saving South Dakota).

The ULC is promoting bills that would change the UCC (Uniform Commercial Code) to ensure that states have state law that is prepared to deal with CBDC.

These same bills would also ban any current forms of crypto like Bitcoin as a competitor for CBDC. These UCC changes reflect the state law changes to meet the goals laid out by the Fed (here’s an overview) and are fully laid out in this fun document.

Bills promoting these changes are pushing through hard red state such as Missouri (HB1165), Oklahoma (HB2776), Texas (SB2075), and Tennessee (SB479/HB640). They are also in a ton of other states and need to be stopped in all of them.

Let’s take an example from HB1165 in Missouri. I had the pleasure of reading this 103 page bill and can tell you it was physically painful to go through (which is why none of the elected officials will read it - they will just vote based on what the lobbyists or party leadership says). Understand that this is intentional. These CBDC bills are frequently being handed to Republican legislators who are told by leadership to file the bills. Because the bills are so complex and lengthy, most elected officials will not actually read them.

Within HB1165 (not to be confused with HB1169 which requires informed consent and which I support – despite RINO opposition), there are a quite a few changes to Missouri law. These important changes were quite expertly crafted to facilitate CBDC without actually talking about it so Republicans could be fooled into filing the bills even if they did read it. A great example is this new definition of “money” found on page 5:

“‘Money’ means a medium of exchange that is currently authorized or adopted by a domestic or foreign government. The term includes a monetary unit of account established by an intergovernmental organization or by agreement between two or more countries. The term does not include an electronic record that is a medium of exchange recorded and transferable in a system that existed and operated for the medium of exchange before the medium of exchange was authorized or adopted by the government.”

This language means that existing crypto currencies would not be eligible to be considered “money” by banks… a great way to make sure there will be no private competition for CBDC.

All this leads to the question, so what do we do?

The easiest solution is to get a large number of grassroots to promote an amendment that bans CBDC in your state. If you think this is a conspiracy theory or your elected officials tell you it is simply ask him/her to amend their bill to include the following language and see what kind of response they get from the lobbyists or you get from the official:

- Nothing in this bill shall be construed to legalize, authorize, or recognize any sort of digital currency as money in Missouri.

- All banking and financial institutions in Missouri shall be required to recognize at least one physical currency as “money”. This physical currency must be treated as the primary form of money in the state and valued to ensure it is the preferred form of trade within the state. No bank or financial institution shall penalize anyone for the use of physical money in Missouri nor shall they provide any incentives for the use of any digital currency. Physical and digital money must be taxed at equal rates.

- Missouri recognizes the importance of the Fourth Amendment of the Bill of Rights and prohibits any currency from being recognized as “money” that can be tracked without knowledge of that tracking and without being able to identify who is responsible for such tracking by the owner of the money. Digital currency may be recognized as money in the state of Missouri only if it can be verified as impossible to track without a warrant by a minimum of three an independent experts.

a. Independent Expert means, for purposes of this section, an individual with the requisite expertise to evaluate the proposed money to meet the requirements of this section. Courts should construe this clause strongly in favor of ensuring high levels of expertise and independence.

- No currency shall be recognized or accepted as money in Missouri if that currency could possibly be controlled in any way remotely. For purposes of this section, controlled includes who or how this currency can be shared with or spent in any way. This prohibition on the control of currency would preserve the Fourth Amendment and should be construed broadly.

- If any other statutes conflict with anything in this section this section controls. If any part of this section is determined to be unconstitutional or conflicting with any other controlling law the rest of this section shall continue to be in force.

While stronger language could be used (and this should be modified for any given state), none of this language would cause a problem unless the real reason for the bill is to promote CBDCs so no one pushing the Republicans to sponsor these bills should object. If they do, that should be all you need to know.

The war on freedom is expanding and we have to stop CBDC, call your state legislature and say hell no to these banking laws that they are pushing. I can’t stress enough how critical this issue is, CBDC means game over! Between that and the COVID vaccines, all they have to do is whip up a new pandemic (they already have them created), and we lose everything.

* * *

Now is the time to purchase gold, please go to BH-PM.com and get yourself set up with my good friend Andrew Sorchini (tell him Tom Renz sent you and you support our freedom fight). We’ve been warning about this for a long time, and the war is here folks, protect yourself and be prepared - https://bh-pm.com/

![]()

White House Targets Cryptocurrencies, Calls for Stronger Enforcement by Regulators...

HNewsWire: According to a White House blog published on January 27, some of the risks associated with the cryptocurrency industry include North Korea, fraud, and financial losses. It urged for broader oversight of cryptocurrencies, requesting assistance from financial regulatory authorities and Congressional politicians.

National security adviser Jake Sullivan, National Economic Council Director Brian Deese, Office of Science and Technology Policy Director Arati Prabhakar, and Council of Economic Advisors Chair Cecilia Rouse co-wrote the blog, which outlined the administration's strategy for mitigating the risks associated with cryptocurrencies.

Officials from the White House highlighted digital assets as a promising but fledgling industry that must be regulated for the protection of consumers. Sullivan has long been concerned about cryptocurrencies, which he put on the administration's radar in June 2021, following the well publicized ransomware incident on the Colonial Pipeline.

To underscore the need for additional legislation, the White House cited North Korea, claiming that a lack of security measures allowed North Korea to "steal over a billion dollars to fuel its aggressive missile development." This is in reference to claims made by South Korea's top spy agency that their northern neighbor used state-sponsored hackers to steal $1.2 billion from various digital asset initiatives.

Jake Sullivan talks at a White House news conference in Washington On December 12, 2022, White House national security adviser Jake Sullivan talks at a news briefing at the White House. (Reuters/Kevin Lamarque).

The Biden administration appears to be interested in "privacy coins," which are cryptocurrencies that algorithmically "wash" transactions to obscure their ownership history. The briefing linked to a 2022 study (pdf), which identified privacy coins under the report's "Malicious Acts" section, stating that such tokens are the preferred medium of exchange for criminals and bad actors.

One of the basic ideas driving the crypto movement, according to supporters of the popular privacy coin Monero, is the ability to transact anonymously. The White House encouraged Congress to enact new legislation to combat illicit activities in the digital asset industry. Stricter penalties for illegal financial linkages and increased transparency standards for crypto-related businesses were proposed.

The article also emphasized the importance of collaborating with international politicians. Many people have criticized foreign countries with lax legal structures for aiding much of the space fraud.

"These international exchanges have essentially no regulation," said Wealthion's macroeconomic strategist Jim Bianco. Bianco, on the other hand, acknowledged the potential that regulators could be co-opted by the corporations they are supposed to monitor, citing FTX founder Sam Bankman-Fried as an example.

"A lot of individuals in the industry were really uncomfortable with him because they didn't think he represented the industry's best interests," Bianco explained. "He was going to use his regulatory vision to build a moat around FTX."

The blog also emphasized the importance of regulatory vigilance. Laws promoting additional investment in cryptocurrency, according to White House officials, should be avoided. "Legislation should not allow mainstream organizations, such as pension funds, to rush into bitcoin markets," the blog stated. "Enacting legislation that reverses course and strengthens linkages between cryptocurrencies and the broader financial system would be a severe error."

According to the retirement planning website Equable, at least 15 state and local pension funds sustained losses in the FTX implosion in the fall of 2022. The Ontario Teachers Pension Plan lost $95 million in the failing cryptocurrency exchange. Another Canadian pension fund lost $150 million by investing in the now-defunct cryptocurrency network Celsius, which declared bankruptcy in July of last year.

However, some economists believe that legislation would do nothing to protect investors while imposing an unneeded expense on taxpayers. "We don't need additional government regulation," said Peter Schiff, chief economist at Euro Pacific Asset Management. "More free market regulation and personal responsibility are required."

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

Use the code HNEWS10 to receive 10% off your first purchase.

HNewsWire: Who Rose to the Top of America’s Foul-Smelling Stew of Corruption, a hard rain’s a-gonna fall…

It’s amazing how some of you people will not let go of the fantasy, Fox News turned on the conservative years ago, Hannity doesn’t get two craps about you, most of our elected have lied to the American people for so many years it’s an American sport with the politician, we are in biblical tribulation yet some of you believe life will go back to some type of normal lifestyle very soon, you’re going to be greatly disappointed the only one that will save you is Jesus Christ the Son of God….

Traditionally oriented VC companies placed large bets on the crypto ecosystem in 2021, and 2022 was expected to be the year of widespread adoption of cryptocurrencies. However, 2022 proved to be a disastrous year for the developing crypto ecosystem as tragedy after calamity struck. Some of the most prominent figures who were said to be driving the cryptocurrency ecosystem forward instead caused it to have its worst year in memory.

Nonetheless, there were several heroes who performed well under pressure. These victorious projects demonstrated that the cryptocurrency ecosystem is more than the sum of its parts and can weather even the most severe storms.

First, we'll look at a few of the 2022 crypto ecosystem's major success stories. The list includes both public and hidden organizations that are making strides in the business.

Successful ones

It's tough to choose winners in a year that witnessed the multibillion-dollar failures of the Terra ecosystem, FTX, and Three Arrows Capital. It's true that crypto has always had its detractors, and that year 2022 was no exception. Despite the fall of major centralized institutions, the year ended on a bright note.

And Trezor and Ledger

Part of Satoshi Nakamoto's motivation for developing Bitcoin was the desire to help individuals gain independence from middlemen in their financial transactions.

Most cryptocurrency investors choose to maintain their holdings on centralized exchanges due to the attractive interest rates offered on yield products and derivatives trading services. When millions of clients lose money as a result of a centralized exchange's failure, however, these promising products become a nightmare.

Investors in cryptocurrencies no longer have faith in centralized exchanges after the FTX hack. Companies making hardware wallets, like as Ledger and Trezor, have benefited from a trend of investors moving toward self-custody.

Self-custody services and hardware wallets gained popularity in December. After FTX's demise, sales and revenue for Trezor increased by 300%, and for Ledger, it was their best sales day ever.

Good hackers

Several applications, like decentralized finance (DeFi), are still in their formative stages because of the immaturity of the crypto ecosystem. In other words, it's vulnerable to flaws and hacks because of this. For almost $5.93 billion in 2022, DefiLlama claims that DeFi protocols were heavily mined.

The total USD value of hacks in 2022 that target DeFi technologies. Input: DefiLlama

In any case, if it weren't for the efforts of white hat hackers, those numbers would have been far higher. These good guys recovered millions in stolen money and reported vulnerabilities that may have been used in future attacks. Immune Fi, a security service company, says that its bug reward program for white hat hackers has stopped the theft of $20 billion worth of crypto assets.

When compared to the potential loss of billions of dollars due to exploits, the cost of paying out millions of dollars in bug bounties seems more than reasonable.

Tether

Tether, a stablecoin, has navigated its way through the turbulence of 2022, dodging the falling Terra and FTX currencies.

See the volume and price of USDT over the course of a year. CoinMarketCap is the original source.

Every time a centralized stablecoin has been introduced, it has been met with a barrage of criticism. Speculation surfaced that Tether was vulnerable to the collapse of the Terran economy when the native stablecoin depegged.

However, USDT overcame the fear and has greatly reduced its exposure to volatility during 2022. The company also promised to terminate any and all FUD by not making any further loans out of its reserves.

With 82% of its deposits in liquid assets, Tether has become more open to the public. At the conclusion of the third quarter, the company's total assets were $68.06 billion, which was more than the $67.8 billion in total liabilities.

Inferior ones

There were several losers in the crypto sector in 2022, with Sam Bankman-Fried being the most prominent. During the first several months of 2022, the former CEO of crypto exchange FTX had a net worth of $20 billion. In less than a year, Bankman-Fried reportedly stole clients' money and committed securities fraud, and he is currently free on bail. Do Kwon, co-founder of Terra, was last seen in Serbia and is also included.

Planet Earth Dollars

During the bull market, algorithmic stablecoins were a unique and promising notion. On the back of this publicity, the Terra ecosphere saw unprecedented growth. However, Terra USD (UST), now known as TerraClassicUSD (USTC), ultimately failed due to its poor design and Kwon's careless decisions. A number of governing bodies have issued warnings about algorithmic stablecoins after Terra's native stablecoin failed.

Forty billion dollars in investor funds were lost when UST went down, and the crisis spread to almost a half dozen additional crypto businesses that had dealt with Terra. The fall of Terra's UST set off even more turmoil in 2022, and although many businesses and people may be considered losers, it was the trigger that set off the implosion.

FTX, Alameda Research, and Centralized Exchanges

Alameda Research, FTX's sibling firm, was also worth several billion dollars by the beginning of 2022. On the other hand, FTX went insolvent after a bank run in November. New information revealed that FTX and Alameda Research were not as impartial as they had previously represented themselves to be. The so-called "sister company" FTX US, which operates within the jurisdiction of the United States, was also discovered to be involved in the drama.

The police claim that FTX and Alameda were engaged in embezzling consumer payments and were also sending money to each other. Alameda made billions in loans to other companies using FTX money. But FTX utilized fictitious internal projects with exaggerated prices as collateral to get large debts. In November, the whole Ponzi scheme collapsed.

The collapse of FTX and Alameda spread panic across the cryptocurrency industry and destroyed faith in controlled exchanges and the industry as a whole.

Capitalists in the Cryptocurrency Market

Investors in cryptocurrencies have lost the most money with the collapse of several cryptocurrency exchanges and prominent VC companies. Millions of crypto investors who held their money on FTX lost their life savings overnight, as if the pain of the bear market weren't enough.

A few decades ago, Terra supported an economy of $40 billion. One of the top five largest cryptocurrencies by market capitalization was its native token, LUNA, which is currently known as Terra Classic (LUNC). Millions of consumers had committed time and money into the ecosystem, and in just a few short hours, they had lost everything. Several centralized cryptocurrency exchanges and staking platforms, including Celsius, BlockFi, and Hodlnaut, went bankrupt after Terra, causing investors to lose millions of dollars. Also suffering heavy losses were crypto investors in the market for nonfungible tokens, where the value of certain widely held holdings dropped by as much as 70%. There are few people who have lost more money this year than those who put their money into cryptocurrencies.

To put it bluntly, 2022 will be known as the "year from hell" in the world of cryptography. Investors in cryptocurrencies would probably rather forget 2018 and start new. Investors and venture capital organizations alike are rethinking how they approach cryptocurrency ventures. With the crypto market having seen such turbulence in 2018, the next year is expected to see a quickening of rules pertaining to the sector. The public's faith in the sector might be bolstered as a result of this.

“Our courts oppose the righteous, and justice is nowhere to be found. Truth stumbles in the streets, and honesty has been outlawed” (Isa. 59:14, NLT)…We Turned Our Backs On GOD, Now We Have Been Left To Our Own Devices, Enjoy…

While Mainstream Media Continues to Push a False Narrative, Big Tech Has to Keep the Truth From Coming out by Shadow Banning Conservatives, Christians, and Like-Minded People, Those Death Attributed to the Coronavirus Is a Result of Those Mentioned, They Truly Are Evil…

The Founding Fathers were wary of institutional threats to liberty and the citizenry’s sovereignty, which included centralized concentrations of power (monarchy, central banks, federal agencies, etc.) and the tyranny of corruption unleashed by small-minded, self-interested, greedy grifters who saw all elected offices and positions of government influence as nothing more than a means to increase their own private wealth.

Under the Guise of Climate Change, an EU Central Banker Is Advocating for a Ban on Bitcoin

HNewsWire: The "excessive ecological footprint" of cryptocurrencies like Bitcoin and Ethereum has led a top official at the European Central Bank to argue that they should be banned.

A member of the ECB's Executive Board named Fabio Panetta has called for the European Union to ban cryptocurrencies like Bitcoin that use proof-of-work validation for transactions. This is a decentralized process that requires computers to solve complex equations in a race to the finish line in order to complete a transaction, but it is also very energy-intensive.

The Italian economist said that "crypto-assets perceived to have an excessive ecological impact should be outlawed" because of the EU's efforts to address climate change.

Nonetheless, it seems that the ECB's environmental reason is a smokescreen for the true intended goal, which is the creation of a Central Bank Digital Currency (CBDC) and the eradication of non-government-controlled alternatives like Bitcoin and Ethereum.

Only money issued by the central bank can guarantee stability. The answer is to bring the current arrangement of two currencies into the digital era. Panetta said that the system relies on the complementary functions of central bank money and commercial bank money.

"At the present time, cash is the only form in which central bank money can be used in the retail sector. However, as more and more transactions become digitalized, cash's prominence and effectiveness as a monetary anchor are dwindling.

Instead, digital currencies issued by central banks would ensure that taxpayer dollars continue to be used for online purchases. Private digital currencies would be easier to convert if they were pegged to a central bank's digital currency, which would provide a digital, risk-free common denominator. As a result, monetary independence and the integrity of a single currency would be safeguarded. In light of this need, the ECB is developing a digital version of the euro.

The European Commission has said that it plans to introduce legislation in early 2023 to provide the foundation for Europe's own CBDC.

It would guarantee that Euro currency continues to be used. In addition, ECB head Christine Lagarde announced last month that it will be built on a European infrastructure, allowing intermediaries to expand payments innovation throughout the Eurozone.

While UK Prime Minister Rishi Sunak has been a strong advocate for a CBDC to be issued by the Bank of England, no firm date for its adoption has been provided.

Even though Sunak, when working for Boris Johnson as finance chief last year, said that a CBDC will coexist with physical bank notes and coins, others worry that it may ultimately replace cash entirely, given the general trend of diminishing cash use.

The Bank of England set out the risks of a central bank digital currency last year when it conceded that such currencies might be "programmable" to allow governments to control how residents spend their money.

Bank of England official Tom Mutton said, "You might incorporate programmability - what happens if one of the parties in a transaction sets a limit on [future use of the money]?

For example, it could discourage behavior that is generally seen as damaging to society. "But it might also limit people's liberty."

What Went Wrong And How Much More Will Bitcoin Drop

HNewsWire: You're going to lose if you invested substantially in Bitcoin believing it to be a currency. Neither the United States nor any other large nation will allow the people to manage their own currency.

The purpose of this issue will be twofold:

- The first will be an in-depth look at the Celsius platform, and breakdown the design of the business/ecosystem to understand what went wrong.

- The second is to detail the events that have transpired over the recent weeks with Celsius “yield generation” strategies, and update subscribers on the state of the market, with potentially big ramifications on the horizon.

The following is written by Bitcoin Magazine’s Namcios, detailing Celsius’s core business operations.

Celsius: Design And Assumptions

This section takes a deep look at the inner workings of the project itself, as per its white paper, including some red flags in its design and backboning assumptions that could’ve served as a warning to investors – and can hopefully be applied to other projects to prevent similar losses in the future.

“As more people join the Celsius ecosystem, the more everyone benefits,” per the white paper.

Throughout its white paper, Celsius conflates terms and assumptions, pushing forward design decisions that don’t necessarily play along. One example of this is naming itself Celsius “network” while having an entire section dedicated to showing an “executive team.” It can be argued that networks don’t have executive teams, though Celsius has a few founders, a CEO, a COO and a CTO, as well as marketing and development departments. It also repeatedly refers to a “community” it seeks to create with its network, though the user can be certain that the executive team will almost always preserve its own self-interests instead of the community’s – which is what happened on Sunday as withdrawals were halted in the platform. (The withdrawal issue will be explored in length in a subsequent section.)

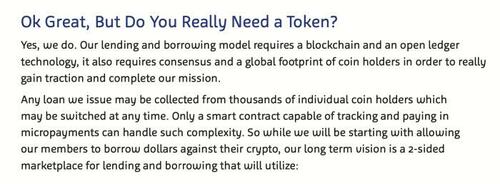

Celsius fails to provide a proper explanation for why its project needs a token, as seen in the image above. The white paper simply states that its “lending and borrowing model requires a blockchain and an open ledger technology,” citing that such needs come “in order [for the project] to really gain traction.”

Both can hardly be seen as factual responses to that question. In fact, the white paper in its entirety is more akin to a marketing deck or a pitch to investors than what a white paper should really be: a technical document explaining the engineering decisions behind the project’s design.

Moreover, complex trading platforms exist in the world that handle very complex structures and settlement orders, meaning that a smart contract is also not a strong enough reason for a blockchain.

Indeed, the real reason as to why Celsius needs a blockchain and an open ledger technology is to issue its CEL tokens – for which it built an ecosystem around to generate enough “traction.” Moreover, the CEL tokens also allowed the team to raise money from investors to build out the platform and wallet. Still, the issuance of credit could’ve been done without a blockchain, but in that case the team would’ve lacked an important motto for generating hype nowadays – “crypto,” “decentralized” and “blockchain.”

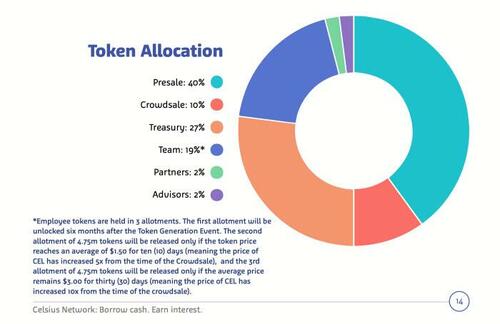

The white paper demonstrates that Celsius performed a presale of CEL tokens (amounting to 40% of the total number of CEL tokens) at $0.20 per token and later did a crowdsale (amounting to 10% of the total number of CEL tokens) at $0.30 per token. While the presale occurred in Q4 2017, the crowdsale began in March 2018.

Celsius details in its white paper how big of a role CEL plays in the project. In fact, all of the platform’s functionality – borrowing and lending – would only come into effect after the tokens were issued.

CEL is an ERC-20 token, meaning that it is a fungible token deployed with a smart contract on Ethereum, that seeks to “create a value-driven lending and borrowing platform for all our members,” as per the white paper.

Ownership of the token allowed users to join the Celsius platform, deposit cryptocurrency into the Celsius wallet, apply for dollar loans and pay interest on those loans at a discounted rate at launch. The document also outlined that after launch, the token would eventually enable users to lend cryptocurrency to gain interest, get rewards on cryptocurrency lent out and achieve “seniority” in the platform. Seniority sought to reward those opting to use CEL with better rates – a self-enforcing feedback loop of incentives that seek to generate more demand for CEL.

This feedback loop extends beyond this dynamic to play a key role in the user acquisition and retention strategies for Celsius. In short, Celsius’ token dynamics assume that borrowers bring fees, which are converted into CEL tokens that get paid out to lenders after a fee cut, attracting more retail investors who are willing to put up their cryptocurrency as collateral to gain some of those fees, hence increasing the demand for CEL – driving up the price and allowing Celsius to spend more money on marketing and advertising to attract more users.

“The system also creates a supply and demand cycle of the Celsius token (CEL),” the white paper states, referring to the platform composed of borrowers, lenders and the orchestrating Celsius service.

All in all, Celsius’ design involves a mix of traditional and burgeoning technologies to market yields much higher than those available in traditional financial systems. The complex web of different moving parts was tentatively glued together with confluent incentives derived from the CEL token – which based itself on a reinforcing economy of issuance and distribution for the acquisition and retention of users.

Play-by-Play Of Celsius Missteps

Late Sunday evening, crypto exchange Celsius announced they were halting all withdrawals, transfers, and asset swaps on the platform. The platform, which offers users yield on their crypto assets, as well as the ability to borrow against, had been the subject of much scrutiny in recent weeks/months over their apparent yield-generation strategies.

Throughout 2021, there were multiple arbitrage strategies that offered traders “risk-free return.” These strategies were the GBTC arbitrage, and the futures market contango. These strategies, which took advantage of pricing dynamics between spot market bitcoin and select derivatives (in this case the Grayscale Bitcoin Trust and bitcoin futures contracts) allowed for market neutral arbitrage, and for many individuals, funds and companies to capitalize on the massive “yield.”

Many companies capitalized on this dynamic by offering native yield products, where they put on these trades with customer funds, and profited on the difference that was harvested against what was paid to customers. When the music was playing, this sort of strategy could be maintained, but as demand for yield products grew and the arbitrage in both the futures market and with GBTC disappeared, the ability to generate yield did also.

In 2021 crypto yield services had the GBTC arbitrage and the massive contango (futures price above spot price) to arbitrage and secure *risk free* yield.

That all was gone in late fall, and the largest emergent “yield product” in crypto became…

UST on the Anchor product.

— Dylan LeClair 🟠 (@DylanLeClair_) May 11, 2022

This dynamic caused Celsius to turn to increasingly exotic and risky instruments to generate “yield” for depositors. On May 3, before the LUNA/UST collapse, on-chain analysts documented Celsius sending funds into the anchor protocol.

🚨#CelsiusNetwork sent 99,780 Ether ($275 million) to #Anchor protocol in the last two weeks- *half of it in the last 24 hours.*

Is #Celsius so desperate for yield they are turning to the Anchor Ponzi? 🤨 (1/3)@Bitfinexed @DoombergT @ben_mckenzie @SilvermanJacob @concodanomics pic.twitter.com/GU1y9O0RvT

— Dirty Bubble Media: 🌡⏰💣 (@MikeBurgersburg) May 3, 2022

Following the LUNA/UST collapse, rumors began to fly as to which companies/counterparties had been hit, and whether insolvencies were a worry, with Celsius being a key focus.

Crypto contagion.

A whole lot of funds/companies/products blew up their treasuries with UST yield on Anchor. Billions of $$ of promises - gone.

I wouldn’t want to have any value in in a crypto yield product. I suspect we have some yet to be announced insolvencies here.

— Dylan LeClair 🟠 (@DylanLeClair_) May 11, 2022

Given the opaque nature of the company’s operations, there wasn’t any way to know for certain whether the company was insolvent from an asset/liability standpoint, but merely the potential for such a situation made the risk/reward of using the platform’s yield products a bad trade-off.

Not your keys, not your coins.

Get your coins away from counter-parties. ESPECIALLY if you are lending it for a yield.

Not a drill.

Certain yield offering products were 110% using UST and anchor… and now there have likely been some blow ups.

— Dylan LeClair 🟠 (@DylanLeClair_) May 11, 2022

The yield users receive for keeping assets on the Celsius platform is NOT sufficient enough to compensate for the tail risk of insolvency/collapse. Withdraw!

I spread a similar message during the collapse of LUNA and was ridiculed for fear mongering. https://t.co/JSY2PklUCo

— Dylan LeClair 🟠 (@DylanLeClair_) June 10, 2022

Aside from depositing user funds on the Anchor protocol for yield, it was uncovered that Celsius also had a large stake in stETH. stETH, a liquid derivative, allows users to stake their ETH in anticipation of the merge to proof-of-stake, while still having liquid access to their capital in the form of stETH. Similar to the GBTC redemption mechanism, once ETH is staked for stETH, it cannot be unstaked until “the merge” is successful.

While this issue won't delve deep into the weeds of Ethereum’s proof-of-stake system and the exotic derivatives complex that has been built around it, the purpose of mentioning stETH is to highlight another yield-generation strategy that went wrong for Celsius, as the stETH<>ETH exchange rate began to break from 1.0.

stETH is depegged, trading at .95

Liq is drying up & smart money is pulling capital. Coupled w/ the rumoured risk of Celsius' functional insolvency, there could be significant selling

Me & @Riley_gmi & have been researching this for the past week

Here is what we found pic.twitter.com/wtgFA779Np

— CryptoJoe (@Crypto_Joe10) June 10, 2022

Celsius is a massive holder of stETH (Liquid staked ETH using Lido) to earn yield on their ETH waiting on the merge to PoS.

However staked ETH cannot be unstaked, so there are secondary markets to trade stETH<>ETH.

The peg is currently breaking. https://t.co/36Gri5OkXL pic.twitter.com/eUrcDT2lry

— Dylan LeClair 🟠 (@DylanLeClair_) June 10, 2022

With Celsius holding a large amount of stETH that was falling from its alleged peg, illiquidity worries increased further, with the market to buy ETH for stETH not nearly liquid enough for Celsius’ massive position to exit without sustaining massive losses. With an increasing number of users withdrawing their funds from the platform, and with cryptocurrency markets already selling off meaningfully over the weekend, Celsius announced they were pausing all withdrawals, swaps, and asset transfers on the platform.

We are taking this necessary action for the benefit of our entire community in order to stabilize liquidity and operations while we take steps to preserve and protect assets. Furthermore, customers will continue to accrue rewards during the pause in line with our commitment to our customers.

We understand that this news is difficult, but we believe that our decision to pause withdrawals, Swap, and transfers between accounts is the most responsible action we can take to protect our community. We are working with a singular focus: to protect and preserve assets to meet our obligations to customers. Our ultimate objective is stabilizing liquidity and restoring withdrawals, Swap, and transfers between accounts as quickly as possible. There is a lot of work ahead as we consider various options, this process will take time, and there may be delays.

The biggest problem with Celsius’ operations was that it was increasingly obvious that the firm was taking extreme risk with user funds that were often not able to be properly quantified. Thus, when thinking of native “yield” on crypto assets, specifically with bitcoin which is absolutely scarce, it is important to understand that it’s not yield, but rather shorting extreme tail risk.

Now, with the price of bitcoin trading at $23,100 at the time of writing, Celsius is on the verge of a margin call on 17,900 wBTC (wrapped bitcoin on Ethereum).

17k wBTC owned by Celsius to be liquidated at 20.27k.

Disastrous leverage unwind underway. https://t.co/4IDL0PoF03

— Dylan LeClair 🟠 (@DylanLeClair_) June 13, 2022

The liquidation price level was at $20,272 before Celsius topped off the vault with additional collateral, pushing the liquidation price to $18,300. The main concern is that this liquidation level is completely transparent, and opportunistic speculators are currently indiscriminately selling to force Celsius to sell (either willingly covering or through forced liquidation).

You can check the status of the vault here with live updates to liquidation levels.

Market Implications

Either way, the market is in a precarious position over the short term, with a likely partially-insolvent exchange doubling down on a margin position. If the history of bitcoin (and financial markets) have shown anything, it is that doubling down on a leverage position likely never ends well, with the worst part being that user funds are what’s being put at risk.

With this in mind, the probability of a volatile wick to the downside looks likely. Short-term traders/speculators should be watching the status of the Celsius loan vault closely, as a liquidation would bring a couple hundred million dollars of selling pressure in short order.

Lessons Learned

As of late, novel narratives have been employed to drive retail customers to believe in the power of “blockchain technology” and “cryptocurrency” as drivers for a revamped financial system. However, as argued before, blockchain serves a very specific purpose – solve the double spending problem to port cash (peer-to-peer money) into the digital realm. This was achieved by Satoshi Nakamoto, who, after decades of research by many scientists and mathematicians, arrived at the design of Bitcoin – published in a proper white paper in 2008.

From the point of view of users, three lessons can be learned.

First, beware of self-reinforcing ecosystems. This was true for Terra’s UST project and is also true for Celsius. Terra and the Luna Guard Foundation have repeatedly said things along the lines of “generate enough demand” for the survival of UST, while Celsius’ white paper repeatedly makes the case that the more people join, the better it is for everyone. Notably, in the case of Celsius, the case that a lending and borrowing platform needs its own token is a hard one to make. (Hodl Hodl, for instance, allows truly peer-to-peer bitcoin-backed loans without the usage of a token – it only leverages an escrow system.)

Second, if something seems too good to be true, it probably is. Celsius ported itself as an impossible-to-fail system that was secure and cared for its users while offering one of the highest yields and lowest rates on the cryptocurrency lending market. Celsius CEO Alex Mashinsky made the case that users could always withdraw funds from his platform, though on Sunday announced nobody was able to withdraw funds. The platform cited this decision had users’ best interests in mind, but that is hardly the case.

Lastly, and this one is getting old – hold your own keys. If you don’t have full control over your bitcoin, meaning you can’t transact with whoever you want, whenever you want, you don’t own your bitcoin – someone else does. Depositing bitcoin into Celsius for some “risk-free” yields seemed like a good idea, until it wasn’t. If in doubt, always custody your own coins. Withdraw your bitcoin from exchanges and walk yourself through a self-custody solution that only you know the key to. Moreover, be extra careful when keeping a significant amount of your net worth in credit of a newly-founded company such as Celsius (CEL token). They can go under – just like Terra. As always, do you own research.

Post Script from ZH

For those wondering what key price support/threshold levels are, the following thread lays it out: the crypto community is now set on forcing the liquidation of Celsius by depressing the price of bitcoin to the "liquidation" level of $18,388, which absent some miraculous bailout of Celsius, one should "assume it happens any time."

Maker, Maker's prop desk frens, Jump, Alameda, compound/aave mafia, mev squad, absolutely everyone-- we need all hands on deck to help ensure this liquidation is successful. Assume it happens any time

— ryanb.eth🐼 (@ryanberckmans) June 13, 2022

Source: ZeroHedge

HNewsWire:

Update: 5/16/22 Governments Will Ban Bitcoin or Any Other Cryptocurrencies — Most Authorities Will Outlaw Them, Because They (Gov) Don’t Want to Lose Their Monopoly According to the non-profit organization, Terra's UST stablecoin has just 313 BTC remaining in its bitcoin holdings...

A non-profit company that holds Terra's bitcoin reserves, Luna Foundation Guard (LFG), has revealed that it has sold over 80,000 BTC in the last week to purchase TerraUSD (UST) in an effort to protect its collapsing US dollar peg.

On May 8, as the price of $UST started to fall significantly below $1, LFG began converting this reserve to $UST in accordance with its non-profit goal and focus on the health of the Terra ecosystem," LFG announced in a Twitter thread.

LFG, located in Singapore, aims to increase demand for Terra's stablecoins and "buttress the integrity of the UST peg and support the expansion of the Terra ecosystem". In responsibility of collecting and keeping bitcoins to develop the UST's reserves, it was responsible for this task.

Bitcoin money have been transferred to a counterparty "to allow them to initiate transactions with the Foundation in huge scale and on short notice," according to the foundation's statement.

50,000 BTC were exchanged for over 1.5 billion UST by this counterparty.

LFG alleged that Terraform Labs, which developed Terra, sold 33,206 BTC for 1.16 billion UST on May 10 "in a last ditch attempt to maintain the peg" as the UST value continued to fall.

LFG has 313 bitcoin in reserve as of May 16 compared to 80,394 BTC on May 7. Another asset held by the charity is UST and LUNA. In order to guard against a potential governance assault, the bulk of its LUNA is staked (locked up) "across a variety of validators" as the token's price continued plunging towards zero and the quantity of LUNA in circulation increased.

A last tweet from LFG said that the Foundation intends to utilize its remaining assets "to reimburse remaining users of $UST, smallest holders first," LFG claimed. In the meanwhile, we're considering the best way to distribute our content, so stay tuned for more information.

HNewsWire:

The market value of the world's cryptocurrencies fell by more than $200 billion overnight, falling below $1.5 trillion for the first time since July 2021 and falling by over half from its $3 trillion highs in November 2021...

CoinMarketCap is the source.

The majors, such as bitcoin, are responsible for the majority of the losses...

...as well as ethereum...

...and, as DeFi worries grow, ETH is significantly underperforming BTC today...

Today's volatility, however, is centered on the fact that Tether, crypto's first and biggest dollar-pegged stablecoin, has lost its peg due to rising redemption demand.

Tether (USDT), the world's biggest stablecoin, temporarily fell 5 percent on Thursday, going as low as $0.95, as Decrypt's Sujith Somraaj reports below.

According to CoinMarketCap statistics, the stablecoin has rebounded somewhat but is still trading at $0.98. Its market capitalization exceeds $81 billion. Tether and Bitfinex CTO Paolo Ardoino told Decrypt through email that the volatility was due to "pure market forces."

"Tether is [more than] $1 on Bitfinex and little lower than $1 on Kraken. As a consequence, arbitragers are purchasing USDT cheap on Kraken and profitably dumping it on Bitfinex "He said. "Other market makers have purchased USDT [for less than] $1 on Kraken and redeemed it for $1, still profiting. All of this, however, is due to market dynamics and has nothing to do with the value of Tether, which remains fixed."

Tether's wild price movement comes after a turbulent week for the sector, which saw the collapse of Terra's stablecoin UST and a 10% decline in market leader Bitcoin.

UST, formerly the third-largest stablecoin, de-pegged for the first time last weekend by just a few cents.

However, its demise has been massive since then. On May 11, 2022, it momentarily plummeted to $0.2998, a 71 percent drop from its dollar peg.

According to CoinMarketCap, the currency is presently worth $0.62.

USDT and UST are two kinds of stablecoins. UST is a smart contract-controlled algorithmic stablecoin, and USDT is backed by Tether's reserves.

Understanding the USDT Tether

One USDT is issued in exchange for one dollar in an equivalent asset placed into Tether, and vice versa. These assets include cash, corporate bonds, commercial paper, and other assets, according to Tether's transparency report.

Tether's reserves supporting USDT are made up of 83.74 percent cash and cash equivalents, 4.61 percent corporate bonds and precious metals, 5.27 percent secured loans, and 6.38 percent other assets, including digital tokens.

The business claims that just 6.36 percent of total 83.74 percent cash and cash equivalent amount is in cash and bank deposits.

Tether's cash equivalents are broken out. Tether is the source.

Redeeming these digital currencies has allegedly become quite popular recently.

According to Tether's CTO Paolo Ardoino, more than $300 million in USDT has been redeemed in the last 24 hours, which is the process of converting USDT to cash dollars.

During redemptions, the user receives a dollar from the reserves, and USDT is deducted from the token's supply.

"Honoring USDT redemptions at $1," Ardoino tweeted. "Over $300 million has been redeemed in the past 24 hours without breaking a sweat."

Other stablecoins tethered to the dollar, such as Circle's USDC and Binance's BUSD, are trading at a modest premium over USDT.

"There may be some stablecoin contagion after UST," said Fadi Aboualfa, director of research at crypto custodian Copper, in an email.

"Anyone who was present between 2017 and 2019 and witnessed big declines in Tether, and it was really a chance to purchase at a bargain."

Cointelegraph contacted Ardoino to find out whether there is reason to be concerned about USDT's ability to keep its $1.00 peg in light of recent occurrences. Ardoino emphasized that the USDT has remained stable through many black swan occurrences and very unpredictable market circumstances, and that it has never denied redemptions:

"Tether continues to process redemptions routinely in the face of some anticipated market panic after yesterday's market." Despite this, Tether has not and will not reject redemptions to any of its clients, as it has always done."

With FUD levels reminiscent of the 2018 Bitcoin market meltdown, Ardoino provided perspective based on the technological distinctions between USDT and algorithmic stablecoins:

"In contrast to these algorithmic stablecoins, Tether maintains a solid, conservative, and liquid portfolio of cash and cash equivalents, such as short-term treasury bills, money market funds, and commercial paper holdings from A-2 and above rated issuers."

The recent Terra (LUNA)/UST problem may have harmed trust in stablecoins and their respective platforms' capacity to fulfill token swaps for its $1.00 peg. Despite this, Ardoino thinks stablecoins will remain an important component in the cryptocurrency industry. "I do not think that confidence for centralized stablecoin users was ever lost," he said, adding that "there will always be a market for stablecoins as they give an option for traders to connect with the greater crypto ecosystem."

TME's daily newsletter email is provided below. Sign up for ZH premium here to get the 24/7 market information feed and themed trading emails.

TME now provides a dedicated crypto feed that is now FREE.

On themarketear, go to the crypto tab. Enjoy it on your computer or download our progressive app (install via Chrome or Safari on your phone, by tapping Add to Home screen from the browser menu). Please keep in mind that this trial will only be available for free for a short period.

Bitcoin's waterfall movement

Bitcoin is plummeting again today, down roughly 8% as of writing, trading around the $26,000 mark. BTC has been in free decline after breaching the critical 40k and 38k levels we've been pointing out as line in the sand levels. There is virtually no genuine support below 30k till the 20k level. Take note that the 50th day has passed the 100th day. The second graphic depicts the weekly view. The 200 weekly moving average is slightly below the 22k mark. The volatility is enormous, and the losses are much greater...

Refinitiv is the source.

Refinitiv is the source.

Bitcoin's influx issue

For years, people have been talking about the institutional bid in BTC, but it has yet to appear. Prop bets on MSTR and El Salvador are plainly insufficient. Given the recent volatility increase in cryptos, we believe institutional purchasers will be slow to arrive. They are preoccupied with managing stock volatility...and are not anticipating further volatility.

JPMorgan Chase & Co.

ETH - extreme chart

We just mentioned the recent ETH breakdown on Sunday (here), as we wrote: "ETH is slipping below a massive trend line that has been in place since February 2021. Things might grow considerably worse if you go too near..." That was around 30% ago. The volatility is severe, and everything is incredibly "fluid." 1700 is a significant support level and the day's low so far. The 2k and 2300 levels are the first major resistance levels. Take note of how high the 100 and 200 day moving averages are...

Refinitiv is the source.

Oversooold cryptos

BTC and ETH's RSI are both very oversold. Do you want to catch some falling knives?

Refinitiv is the source.

Do you need more oversold cryptocurrency charts?

We'll let you decide if we're in a crypto winter or not, although the current backwardation shows more oversold levels than May 2021. Since 2018, the second chart depicts the longer term BTC perspective of the futures spread. JPM tells us that: "...when demand is exceptionally weak and price expectations become negative, the futures curve reverses. This was the situation during the 2018 crypto winter "(They do not believe we are on the verge of a crypto winter.)

JPMorgan Chase & Co.

JPMorgan Chase & Co.

Volatility is the true cause of the crypto surge.

The rise in crypto vols has been incredible. BTC short term maturities have risen from approximately 55 to presently trading around 140 in only a few days. As of this writing, the ETH 1 week maturities ranged from 65 to 160. We explained our crypto long volatility argument on April 29 (here), writing: "It seems strange, but BTC volatility might be a reasonably inexpensive worldwide "just in case" hedge..." Chasing crypto volatility is a really late trade... If you haven't yet booked your worldwide hedge earnings, do so as soon as possible.

Genesisvolatility is the source.

Genesisvolatility is the source.

Bitcoin's fixation with risk on/off

Remember that Bitcoin is a risk-on/risk-off asset. Short-term and long-term term correlation perfection...

Refinitiv is the source.

Refinitiv is the source.

What about the inflation protection?

BTC is still referred to as an inflation hedge. It did not follow the recent rise in US 10-year breakevens, but it seems to be "noticing" the decline in breakevens...

Refinitiv is the source.

Cryptocurrencies are biased

The skew in BTC and ETH has reached high "terror" levels. The crowd is paying up for puts, pushing skew to new highs. This is how contagious fear emerges...

Refinitiv is the source.

Refinitiv is the source.

Bitcoin and the Fed's BS delta

Fed BS raises all boats, even crypto. The Fed BS "delta" versus BTC graphic is well known to TME readers. Bitcoin has been "discounting" the Fed's balance sheet delta for some time. The second graphic depicts BTC on a log scale.

Refinitiv is the source.

Refinitiv is the source.

A blockchain unicorn army...

In Q1'22, a record 14 blockchain unicorns debuted, raising the sector's total to 62...

(From CB Insights)

In the long term, cryptocurrency always rises.

In case you didn't notice. 2031 coinbase bond

Refinitiv is the source.

Brian's fortune

"Brian Armstrong, the creator of Coinbase Global Inc., had a personal worth of $13.7 billion in November and around $8 billion at the end of March. According to the Bloomberg Billionaires Index, that's now down to $2.2 billion after a selloff in digital currencies ranging from Bitcoin to Ether caused a steep drop in the market value of Coinbase, the biggest US cryptocurrency exchange." (Bloomberg)

More and more individuals were expected to invest in cryptocurrency.

Coinbase and Binance are two US-based exchanges. Volume decreases in the United States were greater this year.

Bloomberg is the source.

The -80% club: where BTC is a winner

% lower than high for chosen cryptos...

Bilello is the source.

This one has to be extended by the crypto guys.

There are many folks who will never recover from the most recent devastation in this place. Perhaps it will contribute to lower inflation since there will be fewer readily acquired millions to spend this summer... Never forget to keep an eye out for the negative.

ZeroHedge,TME is the source.

![]()

Bitcoin Falls in Value Ahead of an EU Vote That May “Practically” Ban Key Digital Currencies

Update: 3/13/22

HNewsWire- Cryptocurrencies fell on Sunday evening after trading rangebound for the previous two days, as a result of a delayed market realization and reaction that on Monday, a European parliamentary committee will vote on a new regulatory framework for crypto assets, which, according to Bloomberg, could speed up passage of a measure that industry executives say could "practically ban key digital currencies including Bitcoin and Ethereum in Europe."

According to the final draft of the Markets in Crypto Assets (MiCA) law, which was seen by Bloomberg News, crypto-assets issued and/or traded in the EU "shall be subject to minimum environmental sustainability standards and set up and maintain a phased rollout plan to ensure compliance" with those requirements. The measure will be voted on by the Economic and Monetary Affairs Committee on Monday, and in an unexpected twist, the draft legislation includes a late amendment that seeks to restrict the usage of cryptocurrencies powered by an energy-intensive computational technique known as proof-of-work.

Before the vote, Jake Chervinsky, director of policy at the Blockchain Association, said that "the MiCA scenario is worse for crypto than anything in the United States." The European Parliament votes tomorrow on "environmental sustainability requirements," which seem to be a pretext for a Bitcoin prohibition."

According to Bloomberg, the references to minimum sustainability and rollout standards seem to be last-minute adjustments intended to limit or prohibit the use of digital currencies based on a so-called "proof-of-work" consensus process, such as Bitcoin and Ethereum (at least until the rollout of Ethereum 2.0 which is proof of stake). An previous draft did not include the notion of a proof-of-work system, according to EU parliamentarian and crypto-expert Stefan Berger of Germany's Christian Democratic Party in a Tweet early last week.

According to CoinDesk, the section in question requires all crypto assets to meet the EU's "minimum environmental sustainability requirements with regard to its consensus method used for verifying transactions, prior to being issued, sold, or admitted to trade in the Union."

The regulation recommends a phase-out plan for cryptocurrencies like bitcoin and ether, which are already traded in the EU, to transition their consensus mechanism from proof-of-work to alternative techniques that consume less energy, such as proof-of-stake. Although there are plans to transition Ethereum to a proof-of-stake consensus mechanism, i.e., Ethereum 2.0, bitcoin does not have this choice.

One of the primary consensus mechanisms regulating the Bitcoin blockchain is proof of work. Bitcoin miners donate computer power to the network, which protects and processes the blockchain, and are compensated in Bitcoin for their efforts.

An earlier version of the regulation advocated outlawing proof-of-work crypto in the EU beginning in January 2025. Following complaints from crypto enthusiasts, the provision was eventually withdrawn before the amended version was reintroduced into the newest edition.

Stefan Berger, the EU legislator in charge of supervising the MiCA framework's content and development, has been attempting to strike a compromise on proof-of-work restrictions. Berger also said at the time that he does not believe MiCA is the appropriate venue for establishing technology or energy-related laws since the framework's objective is to regulate cryptocurrency as assets. Once the proposal is approved by the parliament, it will go to a trilogue, which is a formal round of talks involving the European Commission, the Council, and the Parliament.

"As you might guess, the Greens and Socialists are condemning the proof-of-work idea and criticizing energy usage, claiming that bitcoin requires more energy than the Netherlands," Berger said in a February interview with CoinDesk, referring to the political groups pushing the energy issue.

On Saturday, industry leaders flocked to Twitter to express their worries about whether the new, stronger draft regulation would constitute a de facto ban on Bitcoin.

"Ledger will always defend freedom and self-custody, especially in our own backyard." "We are calling on you all to contact your Member of European Parliament and let them know that you oppose a Bitcoin ban in Europe," stated Pascal Gaulthier, Chief Executive Officer of Ledger, one of the world's leading crypto wallet providers, on Twitter.

According to Microstrategy CEO Michael Saylor, "the only established technique to generate digital property is through Proof-of-Work." Until proved otherwise, non-energy-based crypto methods like Proof-of-Stake must be considered securities. A trillion-dollar blunder would be to outlaw digital property."

"Since there is no way #bitcoin can & will execute a rollout plan out of POW, it would damage #BTC as well," tweeted Patrick Hansen, head of strategy at crypto wallet startup Unstoppable Finance.

"A vote with very high stakes in the EU." "The fact that such a concept has progressed this far is really alarming, and it is unlikely to hold up to actual reality," remarked Jeremy Allaire, creator of Circle Pay, on Twitter.

The good news for crypto bulls is that, according to CoinDesk, which sources individuals familiar with the subject, a slim majority of committee members may vote against the plan. If this is the case, the selloff on Sunday night is just the latest successful effort to shake out the weak holds. ZeroHedge

Update: 2/28/22 Major Central Banks Will Follow the Russians and Chinese in Banning Bitcoin and Its Imitators.

![]()

As the development of national CBDCs progresses, increasing restrictions on bitcoin and other rivals will be introduced.

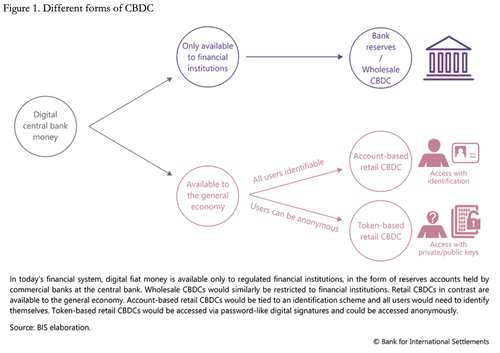

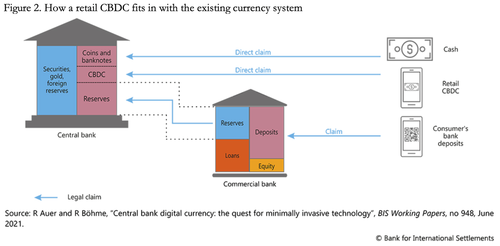

A CBDC is a digital form of central bank money that is different from balances in traditional reserve or settlement accounts. It is a digital payment instrument, denominated in the national unit of account and is a direct liability of the central bank.

Two separate functions have been identified. There is a general purpose, or retail function, whereby a CBDC is an alternative to currency cash and commercial bank deposit money. And there is a wholesale function for use between financial intermediaries, incorporating cross-border settlements. Figure 1 above illustrates the flows of these two different functions.

The adoption of a CBDC requires a central bank to upgrade their banking systems to deal with tens or even hundreds of millions of depositors and businesses — a task whose sheer scale and technological challenges should not be underestimated.

Figure 2 illustrates the relationship between a retail CBDC and existing currency liabilities.

CBDCs are intended to be an addition to current settlement systems and currency quantities. Declining use of banknotes and coins, which are a bearer form of central bank liability and a direct claim on it, is being claimed as a justification for a new electronic settlement medium with the same currency standing in the form of a retail CBDC.

The widespread use of debit cards has blurred the distinction between the cash notes and coins issued by a central bank, and deposit money which is a liability of commercial banks. Users of currency in retail transactions are generally unaware of the distinction, and bank regulators believe that their oversight provides justification for the seamless operation between these different risk categories. Source: ZeroHedge

![]()

Bitcoin does not yield any income, unlike stocks and real estate that typically generate dividends or rental yields. It is therefore impossible to calculate the intrinsic value of Bitcoin with any degree of accuracy. Advocates of Bitcoin object to this argument, pointing out that this is a characteristic Bitcoin shares with gold, which also does not yield any income. This is true, but the comparison is flawed: Bitcoin has been around for twelve years, while the first evidence of gold being used as a means of payment is found on the tablets containing the Babylonian king Hammurabi’s code of laws, 1,870 years before the birth of Christ. In China, gold was being used as money 1,100 years before the birth of Christ, in the form of small cubes.

![]()

New Proposed Bill -Lobbied By The Banks- Would Give Yellen Unilateral Power To Ban Crypto In The U.S.

I know a lot people are suspicious of cryptocurrencies, and with fair reason — the market is volatile and heavily manipulated. But when you have governments and central banks publicly demonizing the technology, labeling it ‘a threat to the global financial system’ (while at the same time privately profiting from it), you have to at least query what’s going on here…

Crypto, for all of its flaws and potential future privacy issues etc., gives the little guys –the yous and mes– a fighting chance. It levels the playing field. And they hate that. They, being the big banks and big governments, are doing everything in their power to prevent the mass adoption of the technology, and now they’re even attempting to slip in new powers via the backdoor to forward this intention.

The below video, released by Cardano founder Charles Hoskinson, passionately are articulately lays out the big banks intentions here. And you can think whatever you want about Cardano (and its native token ADA), but this proposed legislation, when passed, spells terrible news for ALL cryptocurrencies and would also be another nail in the coffin of freedom and democracy:

As if we didn’t have enough on our plate already, this is yet another battle to add to the war. But I do see a positive here, particularly given our limited resources — each of today’s problems appear to stem from the same center of evil, meaning beheading just the one top dog, the one ‘beast’, should simultaneously bring down all of its grubby little offshoots and slimeball tentacles–whether that be CAGW, vaccine mandates, banning financial independence, or Jim Himes.

Correct me in the comments if you think I’m off base here, but if the big banks are sneaking in legislation through the backdoor that could rob citizens of the ability to trade a legal asset, then that asset must be bad for business and ‘the system’ at large, and so, conversely, good for the citizens. The issue then becomes correctly Identifying the one ‘beast’ to behead…

![]()

Satan Soldiers At The Biden Admin To Regulate Bitcoin 'As A Matter Of National Security Report — In Other Words Any Other Digital Currency Will Be Shut Down

The White House wants to bring order to the ‘haphazard approach’ that is currently being employed by regulators to Bitcoin and cryptocurrency.

The White House wants to set out a cohesive set of policies to regulate Bitcoin and cryptocurrencies as currently legislation and its enforcement are scattered across sectors and agencies, according to multiple reports.

The Biden administration will release an executive order in the coming weeks to task federal agencies with assessing the risks and opportunities that Bitcoin and cryptocurrencies pose, Bloomberg first reported.

The order is set to come under the umbrella of national security efforts as the administration seeks to analyze cryptocurrencies and employ a cohesive regulatory framework that would cover Bitcoin, cryptocurrencies, stablecoins, and NFTs, Barron’s reported Thursday.

“This is designed to look holistically at digital assets and develop a set of policies that give coherency to what the government is trying to do in this space,” a person familiar with the White House’s plan told Barron’s.

“Because digital assets don’t stay in one country, it’s necessary to work with other countries on synchronization.”

The regulatory efforts would reportedly involve the State Department, Treasury Department, National Economic Council, and Council of Economic Advisers, as well as the White House National Security Council as the administration gauges that cryptocurrencies have “economic implications for national security,” per the Barron’s report.

The White House’s plan is to “bring order to the haphazard approach that the government is now using to regulate crypto,” the person told Barron’s. Currently, different aspects of the cryptocurrency market are dealt with by different agencies, including the Securities and Exchange Commission and the Commodity Futures Trading Commission, but there’s little coordination and consensus when it comes to the classification of the many different assets in the market.

According to the Bloomberg report, senior officials at the administration had held multiple meetings on the plan, and the directive is expected to be presented to President Joe Biden in the coming weeks.

[ZH: So let's just remind ourselves of how perceptions of bitcoin have changed over the years...]

[ZH: May we dare to suggest crypto has only become a 'matter of national security' for the US since the idea of Putin using it to get around US sanctions and the nuclear-threat of SWIFT-deactivation started to circulate.] Source: ZeroHedge

![]()

The government can and will ban bitcoin and other cryptocurrencies.

“Every government in the world is working on computer money now, including the U.S. The Chinese are there already. I cannot imagine that governments are going to say ‘ok, this is our crypto money, or you can use their crypto money.’ That’s not the way governments work, historically. Money is going to be on the computer. It already is in China. In China, you can’t take a taxi with money. You have to have the money on your phone, you can’t even buy ice cream. So it’s happening, but I doubt if it’s going to be someone else’s money. History shows it will be government money

CBDCs are not cryptocurrencies. The CBDCs are digital in form, are recorded on a ledger (maintained by a central bank or Finance Ministry), and the message traffic is encrypted. Still, the resemblance to cryptos ends there.

The CBDC ledgers do not use blockchain, and CBDCs definitely do not embrace the decentralized issuance model hailed by the crypto crowd. CBDCs will be highly centralized and tightly controlled by central banks.

CBDCs are not new currencies. They are the same currencies you already know (dollars, yuan, euros, yen, sterling) in a new form, using new payment channels. They are a technological advance, but they do not replace existing reserve currencies.

CBDCs are currently being introduced by major central banks around the world. Countries are at different stages of deployment. China is the furthest along. They have a working prototype of a digital yuan that will be showcased at the Beijing Winter Olympics in February 2022.

If you’re there and want to buy tickets, meals, souvenirs or pay for hotel rooms, you’ll be expected to pay with the new digital yuan using a mobile phone app or other digital payment channel.

The European Central Bank has also moved quickly on a CBDC version of the euro. They are not yet at the prototype stage, but they have made material advances and are getting close to that stage. Japan and the U.S. are at the back of the line.

The Fed has a research and development project underway with MIT to study how a digital dollar might intersect with or even replace the existing dollar payments system (which is already digitized, albeit without a centralized ledger).

The U.S. is probably several years away from its own CBDC at best.

So, yes, the move toward central bank digital currencies is real. How does this relate to what is sometimes called The Great Reset? This would be the movement toward a single global reserve currency.

This movement would be nominally led by the International Monetary Fund acting as a kind of world central bank. Still, the IMF cannot make decisions of this magnitude without U.S. approval. (The U.S. has just enough voting power in the IMF to veto any material decisions it does not like).

In turn, U.S. approval would require a global consensus among major economies including China, the UK, Germany, France, Italy, and other members of the G7 and G20.

This desire to create true world money would involve the creation of a digital special drawing right (SDR). SDRs are issued by the IMF to member nations and may be issued to other multilateral institutions such as the United Nations.

In effect, the IMF has a printing press as powerful as the Fed and ECB printing presses and can flood the world with their world money. Displacing the dollar would involve a meeting and agreement similar to the original Bretton Woods agreement of 1944. The agreement could take many forms. Still, the process would conform to what many call The Great Reset.

This process has been underway since 1969 when the SDR was created. Several issues of SDRs were distributed between 1970 and 1981, then none were issued until 2009 in the aftermath of the Global Financial Crisis of 2008. A new issue was distributed earlier this year.

The U.S. Government Is Targeting Cryptocurrency to Expand the Reach of Its Financial Surveillance

One of the most important aspects of cryptocurrencies from a civil liberties perspective is that they can provide privacy protections for their users. But EFF is concerned that the U.S. government has been increasingly taking steps to undermine the anonymity of cryptocurrency transactions and importing the widespread financial surveillance of the traditional banking system to cryptocurrencies.

On Friday, the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) announced a proposed regulation that would require money service businesses (which includes, for example, cryptocurrency exchanges) to collect identity data about people who transact with their customers using self-hosted cryptocurrency wallets or foreign exchanges. The proposed regulation would require them to keep that data and turn it over to the government in some circumstances (such as when the dollar amount of transactions in a day exceeds a certain threshold).

The proposal appears designed to be a midnight regulation pushed through before the end of the current presidential administration, as its 15-day comment period is unusually short and coincides with the winter holiday. The regulation’s authors write that this abbreviated comment period is required to deal with the “threats to United States national interests” posed by these technologies

The crypto-hating Treasury Secretary Janet Yellen was about to go on a holy war against digital currency, causing a flash crash last weekend. And late this past week, on top of reports that President Biden is looking to hike capital gains taxes for the rich, there were rumors that Yellen wants a jaw-dropping 80 percent tax rate for crypto. That helped send bitcoin tumbling near the $49,000 mark on Friday.

If you believe market history often repeats, and there’s lots of evidence it does, consider what came out of the dot-com bubble of the 1990s. When the bubble burst, the losses were staggering.

Here's What Going To Happen “Digital Currencies” CBDC Will Remove Any and All Remaining Privacy, Granting Total Control Over Every Transaction — Bitcoin Will Die Hard — “Central Bank Digital Will Be the Only Currencies” — (CBDCs) Are Exactly What’s Coming…

It’s Here People — You Would Have to Be Blind Not to See Where This Is Going, “Yoked”… Central Bank Digital Currencies One of the most potentially far-reaching trends in the financial landscape right now is the imminent roll-out of Central Bank Digital Currencies (CBDCs), and the parallel attacks which central bankers are waging on private…

Update: 9/23/21 The Groundwork is Being Laid By Satan Soldiers For The Fed’s NWO

Digital Currency and Direct Deposits To Households via FedNow accounts…

Introducing the Central Bank Digital Dollar

After looking at what the FED is and isn’t allowed to do, we can look at how their authority is to be expanded. According to the Digital Asset Bill, section 11 of the Federal Reserve Act is to be amended to provide the Federal Reserve Board with new powers:

“(d) To supervise and regulate through the Secretary of the Treasury the issue and retirement of Federal Reserve notes (both physical and digital), except for the cancellation and destruction, and accounting with respect to such cancellation and destruction, of notes unfit for circulation, and to prescribe rules and regulations (including appropriate technology) under which such notes may be delivered by the Secretary of the Treasury to the Federal Reserve agents applying therefor.”

So far so good. But the next section, contains the real story. According to the Digital Asset bill, Federal Reserve notes will in the future also be issued digitally:

“Federal reserve notes, to be issued at the discretion of the Board of Governors of the Federal Reserve System for the purpose of making advances to Federal reserve banks through the Federal reserve agents as hereinafter set forth and for no other purpose, are authorized. Notwithstanding any other provision of law, the Board of Governors of the Federal Reserve System is authorized to issue digital versions of Federal reserve notes in addition to current physical Federal reserve notes. Further, the Board of Governors of the Federal Reserve System, after consultation with the Secretary of the Treasury, is authorized to use distributed ledger technology for the creation, distribution and recordation of all transactions involving digital Federal reserve notes. The said notes shall be obligations of the United States and shall be considered legal tender and shall be receivable by all national and member banks and Federal reserve banks and for all taxes, customs, and other public dues. They shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, District of Columbia, or at any Federal Reserve bank.” 7)

Creation, Distribution and Redecoration