Advisory: Be careful of what you read on social media. The algorithms used by these platforms have no regard for Biblical truth. They target your emotions to keep you engaged on their site so their advertisers can drop more ads. These platforms exist to enrich their stockholders. Consider God’s promise to Believers in James 1:5, “If any of you lacks wisdom, you should ask God, who gives generously to all without finding fault, and it will be given to you.”

Featured Story

A bank run occurs when a large number of people withdraw their money from a bank because they believe the bank may cease to function in the near future.

Paul, too, described the Tribulation as birth pains. First Thessalonians 5:3 says, “While people are saying, ‘Peace and safety,’ destruction will come on them suddenly, as labor pains on a pregnant woman, and they will not escape.” This event follows the Rapture and the removal of the Church, in 4:13-18. In 5:9, Paul reemphasizes the absence of the Church from this time period by saying, “For God has not destined us for wrath, but for obtaining salvation through our Lord Jesus Christ.” The wrath spoken of here is God’s judgment on the unbelieving world and His discipline of Israel during the Tribulation.

Matthew 24:6-8

There is a reason James Simons’ RenTec is the world’s best-performing hedge fund – it spots trends (even if they are glaringly obvious) well ahead of almost everyone else, and certainly long before the consensus.

That’s what happened with Deutsche Bank, when as we reported two weeks ago, the quant fund pulled its cash from Deutsche Bank as a result of soaring counterparty risk, just days before the full – and to many, devastating – extent of the German lender’s historic restructuring was disclosed, and would result in a bank that is radically different from what Deutsche Bank was previously (see “The Deutsche Bank As You Know It Is No More“).

In any case, now that RenTec is long gone, and questions about the viability of Deutsche Bank are swirling – yes, it won’t be insolvent overnight, but like the world’s biggest melting ice cube, there is simply no equity value there anymore – everyone else has decided to cut their counterparty risk with the bank with the €45 trillion in derivatives, and according to Bloomberg Deutsche Bank clients, mostly hedge funds, have started a “bank run” which has culminated with about $1 billion per day being pulled from the bank.

As a result of the modern version of this “bank run”, where it’s not depositors but counterparties that are pulling their liquid exposure from DB on fears another Lehman-style lock up could freeze their funds indefinitely, Deutsche Bank is considering how to transfer some €150 billion ($168 billion) of balances held in it prime-brokerage unit – along with technology and potentially hundreds of staff – to French banking giant BNP Paribas.

One problem, as Bloomberg notes, is that such a forced attempt to change prime-broker counterparties would be like herding cats, as the clients had already decided they have no intention of sticking with Deutsche Bank, and would certainly prefer to pick their own PB counterparty than being assigned one by the Frankfurt-based bank. Alas, the problem for DB is that with the bank run accelerating, pressure on the bank to complete a deal soon is soaring.

Here are the dynamics in a nutshell, (via Bloomberg): Deutsche Bank CEO Christian Sewing is pulling back from catering to risky hedge-fund clients, i.e. running a prime brokerage, as he attempts to radically overhaul the troubled German lender while BNP CEO Jean-Laurent Bonnafe wants to expand in the industry. A deal of this magnitude would be a stark example of the German firm’s retreat from global investment banking while potentially transforming its French rival from a small player in the so-called prime-brokerage industry to one of Europe’s biggest.

Of course, publicly telegraphing that DB is in dire liquidity straits and needs an in-kind transfer of its prime brokerage book would spark an outright panic, and so instead the story has been spun far more palatably, i.e., “BNP is providing “continuity of service” to Deutsche Bank’s prime-brokerage and electronic-equity clients as the two companies discuss transferring over technology and staff“, according to a July 7 statement. The ultimate goal of the talks is for BNP to take over the vast majority of client balances, which are slightly less than $200 billion currently.

There is just one problem: nothing is preventing those clients who would be forcibly moved from a German banking giant to a French banking giant from redeeming their funds. And that’s just what they are doing. Or rather, nothing is preventing them from moving their exposure for now, which is why they are suddenly scrambling to do it before they are suddenly gated.

Which is why the final shape of the deal remains, pardon the pun, fluid, and it is unclear how it will proceed, facing a multitude of complexities, including departing clients.

In an attempt to stop the bank run, BNP executives are meeting with U.S. hedge-fund clients this week to convince them to stay following similar sit-downs with European funds last week, Bloomberg sources said.

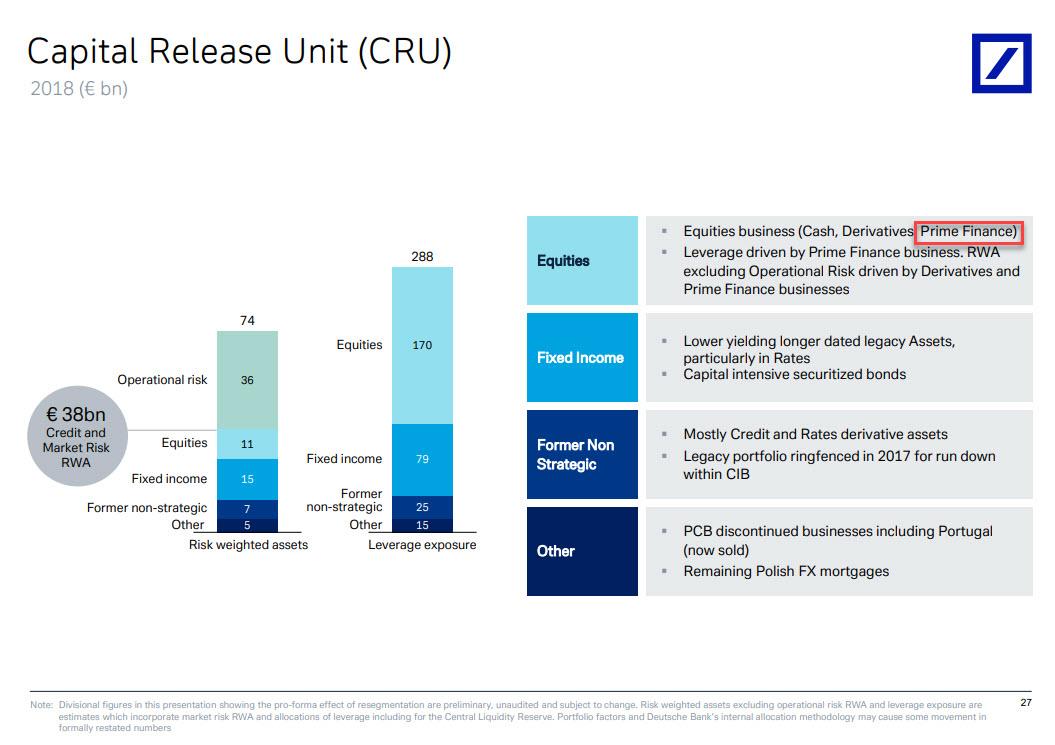

However, if this gambit fails, and hedge funds keep moving their business elsewhere, officials at the German bank may just relegate its assets tied to the prime finance division into the newly formed Capital Release Unit, i.e. the infamous “bad bank” which is winding down unwanted assets totaling 288 billion euros ($324 billion) of leverage exposure, and the prime brokerage is responsible for much of the 170 billion euros of leverage exposure that’s coming from the equities division into the division, also known as CRU a presentation shows.

It also means that countless hedge funds are suddenly at risk of being gated on whatever liquid exposure they have toward Deutsche Bank.

To be sure, Deutsche Bank’s hedge fund balances have been declining throughout the year as speculation swirled around Sewing’s intentions for the prime brokerage, but the rate of redemptions was far lower than $1 billion per day. Now that the bank jog has become a bank run, the next question is how much liquidity reserves does DB really have and what happen if hedge funds clients – suddenly spooked they will be the last bagholders standing – pull the remaining €150 billion all at once.

We are confident we will get the answer in a few days if not hours, until then please enjoy this chart which compares DB’s stock decline to that of another bank which was gripped by a historic liquidity run in its last days too… Source

Bank runs are contagious and hard to stop

Even worse, bank runs can be contagious, quickly spreading from truly broke banks to banks that are perfectly solvent. During panics like the Wall Street crash of 1929, healthy and shaky institutions alike were besieged by account holders demanding their money back.

“The problem with bank runs is it can cause a breakdown of the entire (banking) system, even though there’s no hard evidence of a bank being insolvent,” says Levine. “You can have a perfectly solvent situation, everything is going OK, and for some reason people get nervous, and all of a sudden the system can come crashing down.”

Once a bank run gets going, even a healthy bank can have a hard time stopping it because just giving everyone their money right then and there usually isn’t an option.

Banks don’t keep everyone’s money sitting in a giant vault somewhere ready to hand out when depositors ask for it. Instead, they’re taking consumers’ deposits and using them to make longer-term investments, such as loans to consumers and businesses, so they can make money — and pay depositors interest.

“Many depositors line up to take out their savings from a bank, but the bank, as it normally does, makes investments that cannot be turned into cash quickly enough to satisfy all of those savers immediately,” Levine says.

StevieRay Hansen

Editor, HNewsWire.com

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I, therefore, become your enemy by telling you the truth?”

Tagged In

Newsletter

Must Read

Other Sources

Latest News

Watchman: Daily Devotional,Selfishness and Self-Centeredness Are Prominent Characteristics of Ungodly People That Cannot Be Absent From Their Lives as a Result of Their Active Selfish Nature

Humans are naturally selfish and self-centered, and 2 Timothy 3:1 says that in the last days people will be lovers of themselves; the self referred…

Read MoreSelf Defense Warning Shots, In N.Y. You Will Go To Jail If You Defend Yourself Or Some-one Else

HNewsWire: by Tyler Durden A man with no criminal history who saved a woman from being attacked by a homeless man has been arrested and…

Read MoreWatchman: Jan. 6 Committee Tapes Have Disappeared, How Is This Possible? Simply Put, We Are Under the Control of Satan’s Soldiers AKA (The State of DC).

HNewsWire: The disappearance of videotapes of witness interviews conducted by the Democratic-led House Select Committee on the January 6 protesters has concerned the chairman of…

Read MoreWEF et al. Will Shut the Internet Down,Is This the Most Recent Predictive Programming, Akin to ‘Event 201’ for the COVID Pandemic? Satan Soldiers on the Move Against the People

HNewsWire: Could this be the latest predictive programming, similar to ‘Event 201’ was for the Covid pandemic? As we approach December 31, you will inevitably…

Read MoreWatchman: Attorney General Ken Paxton Is Pleading With the Supreme Court to Reject Special Prosecutor Jack Smith’s Politically Motivated Suit Against President Donald Trump

SRH: I’m Not a Supporter of Donald Trump, as the Majority of You Are Aware, but What They Are Doing to Him Is Terrible, Outrageous,…

Read More

We make every effort to acknowledge sources used in our news articles. In a few cases, the sources were lost due to a technological glitch. If you believe we have not given sufficient credit for your source material, please contact us, and we will be more than happy to link to your article.