It’s Dangerous in China, All Hell Is About to Break Loose—Stock Market Mayhem—Chinese Stocks are Crashing

![]()

HNewsWire:With war raging across the world's bread basket, risk of World War 3 the highest it has been since the Cuban missile crisis, commodities hitting new all time highs every single day, inflation (even the watered down CPI version) set to hit 10% in a few months, and the Fed rushing to hike rates so high it slams the US into a pre-scripted recession (as it somehow hopes to make a "soft landing" even as fed funds futures signal a hard landing and at least 50 bps of rate cuts after the burst of hiking is over later this year), it is easy to forget that China is still around.

So here is a vivid remind that not only has nothing been fixed in the country that single-handedly pulled the world out of depression during the GFC, but that things are going from bad to much worse.

1. China on brink of biggest Covid-19 crisis since Wuhan as cases surge

China is scrambling to address its most severe Covid-19 outbreak in two years, reporting soaring cases in a fresh wave that has seen the country tweak its zero-Covid policy by allowing rapid antigen tests for public use. After topping 1,000 for two days in a row, new locally transmitted cases surged to more than 3,100, this time driven by a spike in symptomatic infections, the National Health Commission reported on Sunday. It came as 16 provinces reported new coronavirus infections, as did the four megacities of Beijing, Tianjin, Shanghai and Chongqing.

As a result of the latest covid breakout, China’s government has shut down the city of Shenzhen, a city of 17.5 million people known as China's Silicon Valley, and is restricting access to Shanghai by suspending bus services. All businesses except those that supply food, fuel and other necessities were ordered to close or work from home. That includes Foxconn, Apple's Chinese slaves:

- FOXCONN SUSPENDS OUTPUT AT CHINA HQ, IPHONE SITE IN SHENZHEN

And since the port of Shenzhen - one of the world's busiest container post is now also locked down, expect a fresh round of cascading chaos in Transpacific supply chains, just in time to join the snarled Transatlantic supply chains as the Ukraine war cripples all global seaborne traffic.

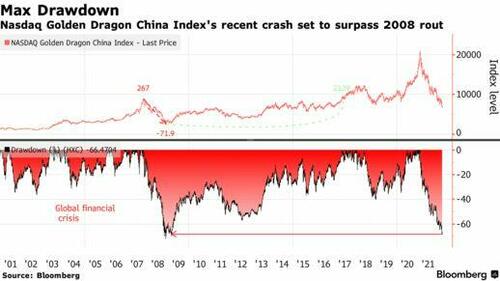

2. Chinese stocks are crashing

The Hang Seng tech index has plunged 61% from its peak last year. The Nasdaq Golden Dragon China Index of U.S.-traded stocks has fared even worse, down 68%, and with another bad day or two, the peak-to-trough decline could surpass its 72% crash in the 2008 global financial crisis. Meanwhile, in the US, Chinese ADRs collapsed 10% in a single day on Friday, the worst selloff since 2008, after the SEC listed 5 Chinese companies at risk of delisting should they refuse to show their books to American auditors, stoking panic every ADR will eventually be booted out. “The market is very panicky,” Paul Pang at Pegasus Fund Managers Ltd., who has sold almost all his stake in Alibaba Group, told Bloomberg. “Sanctions against China are not impossible, if China refuses to take sides on the war in Ukraine. Tech shares are among those risky names exposed in the crossfires in the rising Sino-U.S. tensions.”

Fear of a fresh regulatory crackdown by Beijing has escalated lately as policy makers proposed more curbs on online games. Earnings results so far have been unable to ease any worry about the growth outlook amid weakening consumer demand in China. The Hang Seng Tech Index is the one of the world’s worst-performing tech gauges since the war in Ukraine broke out and has dropped 17% in March, on course for its biggest monthly drop ever.

“We can’t see any rebound signals at the present,” said Yan Kaiwen, analyst at China Fortune Securities. The market is concerned about inflation because of the higher prices for oil and other commodities, which will have a negative impact on the global economy, he said.

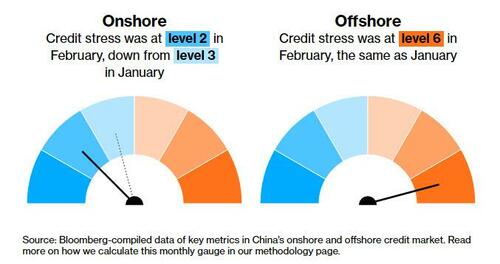

3. Chinese bonds are crashing

While nothing new to those who have been following the collapse in the Chinese junk bond market - closely linked to China's property sector - China credit stress reached new extremes in the offshore, USD market, where average junk yields rose above 25% meaning the primary market won't function properly anytime soon. Contagion has transformed stronger property developers into risky bets. Luxury property developer Shimao Group, which was once considered a bellwether for China’s safer builders, has been slashed deep into junk from investment grade in a matter of months. The firm has been cut to triple C territory by Moody’s Investors Service and Fitch Ratings. Logan Group has also been downgraded on undisclosed debt and governance worries. Cracks are also showing up in China’s government bond market. Yields on the 10-year sovereign note rose to 2.86%, the highest this year, as investors pointed to capital outflows.

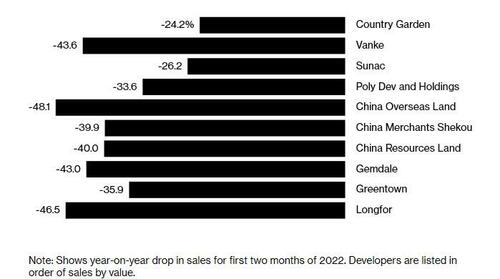

4. China's property sector is (still) crashing

China’s property industry has been rocked by at least 14 defaults by developers since authorities began cracking down on excessive borrowing and speculation in the housing market in 2020 which led to a historic default by China Evergrande. While policy makers are now signaling greater tolerance for selective relief by encouraging home buying in lower-tier cities, cutting mortgage rates and allowing more bank loans for developers, there are few signs this is helping boost sales. Unfortunately, these new measures have yet to bear fruit, as China's biggest developers are seeing home sales crater this year amid a market that is effectively frozen.

Home sales tumbled during the first two months of this year. China Vanke, the nation’s second-biggest developer by sales, saw a decline of 44%. At Country Garden Holdings Co., whose dollar bonds are at close to record lows, sales fell 24%. Even state-run China Overseas Land & Investment Ltd. saw them slump 48%.

While more adjustments are expected after the National People’s Congress taking place through this week, there are concerns of an “unstoppable downward spiral” according to Nomura International HK analysts. “We become increasingly worried whether the policy changes will be effective and timely enough to prevent property sales from a further correction” in the first half of this year, analysts Jizhou Dong and Stella Guo wrote in a note late February.

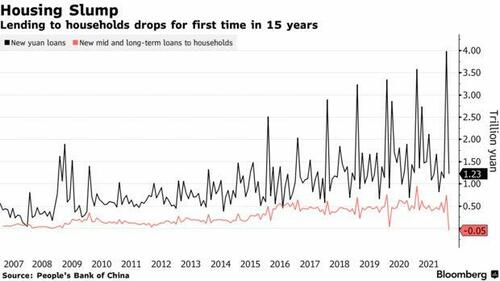

5. China Credit Collapses

February credit data was weaker thank expected after mortgage lending fell for the first time in 15 years. After a record January, China’s credit expansion slowed in February as a long holiday and the slumping housing market meant people and companies borrowed less. Banks lent 1.2 trillion yuan ($194 billion) in the month, down from 4 trillion yuan in January and less than in February last year. A key indicator of home mortgages declined for the first time in at least 15 years despite efforts by the central bank and other financial institutions to boost borrowing by cutting rates and lowering down payments.

Newly increased medium and long-term loans to non-financial companies fell to 505 billion from 1.1 trillion yuan a year ago, indicating companies were also reluctant to borrow and invest. The weak data came despite provinces selling special bonds, a key source of infrastructure funding, at a faster pace in February than in previous years.

“It’s a pretty bad set of data,” said Zhou Hao, senior emerging markets economist at Commerzbank AG. “There’s a lack of growth driver, and the real economy’s demand is weak,” he said, arguing that “the PBOC will have to cut rates early if it wants to do so” as inflation and capital outflow pressures will start to limit its space later in the year, he said.

6. Didi crashes

Didi halts plans for a HK IPO. Chinese regulators aren't yet satisfied with the security of its sensitive user data. The stock plunged 44% in US trading on Friday, its biggest one-day drop ever.

7. ESG blues

Norway's $1.3 Trillion sovereign wealth fund, the world's biggest, snubs Chinese sportswear stock Li Ning due to concerns over its ties to Xinjiang. Will other "green" funds follow in ditching their Chinese investments? “Norway sovereign fund’s offloading Li Ning is triggering some worries about the attitude over Chinese and Hong Kong stocks in the future,” said Castor Pang, head of research at Core Pacific Yamaichi. The news on Wednesday sent China's CSI 300 Index tumbling for its sixth day of declines -- the longest losing run since March 2020, and the Hang Seng Index finished at its lowest since July 2016 - and only a late day intervention by the National Team avoided an even worse rout.

The CSI 300 has lost 27% from a peak about a year ago, fueled by a slump in China’s property market and Covid-zero policy. Sentiment soured further on Wednesday as Norway’s $1.3 trillion sovereign wealth fund announced its exclusion of Li Ning Co. due to the risk that the sportswear maker contributes to serious human rights violations in Xinjiang. The move stoked worries about a potential retreat of other long-term investors. Li Ning plunged 9%.

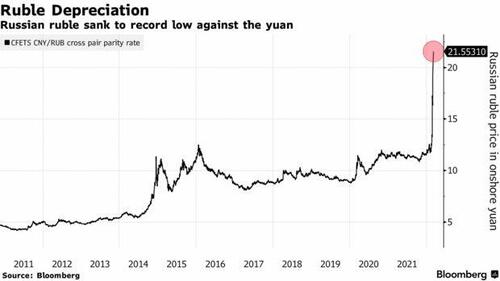

8. China Doubles Yuan Trading Band for Ruble

The PBOC will double the yuan trading band for the ruble amid signs of distressed liquidity as banks back away from making markets. According to Bloomberg, the currency pair will be allowed to trade 10% around the fixing rate to meet demand for market development from March 11, the China Foreign Exchange Trade System said in a statement. That compares with a previous limit of 5%. The change shows how global financial institutions are attempting to cope with the ruble’s volatility, as Russia is increasingly cut off from markets after it invaded Ukraine. The yuan hit a record high against the ruble last week, with some Chinese banks suspending trading of the currency pair.

The 10% limit compares with 5% for most of the onshore yuan’s foreign exchange pairs. The last time China widened the trading band for a foreign currency was in 2014, when it doubled the permitted range for dollar-yuan to 2%. “It is the policy measure in response to volatile RUB trading,” said Ken Cheung, Asia FX strategist at Mizuho Bank Ltd. “The measure is to give market markers the ability to set the price and improve the RUB/CNY trading liquidity.”

The volatility has led to waning interest to trade the currency pair, with the gap between the bid-ask price hitting a record 197 pips Wednesday. The gap narrowed to 106 pips after the latest announcement. The yuan bought 13.6 ruble on Feb. 25 in China’s onshore spot market. Total bilateral trade between the two countries was valued at $112 billion in 2020. Presidents Xi Jinping and Vladimir Putin only last month signed a series of deals to boost Russian supply of gas, oil and wheat.

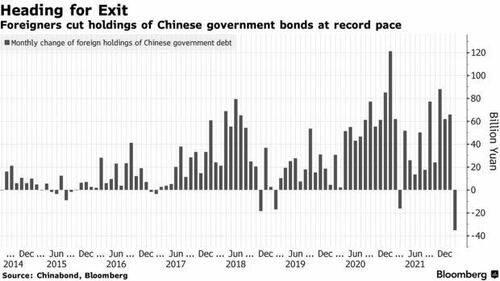

9. Foreigners dump Chinese bonds in record amounts

Foreign investors reduced their holdings of Chinese government bonds by the most ever last month. Overseas investors sold a net 35 billion yuan ($5.5 billion) of Chinese government bonds in February, marking the largest monthly cut on record and the first reduction since March 2021, according to data compiled by Bloomberg. Their holdings fell to 2.48 trillion yuan from a record 2.52 trillion in January.

The bond liquidation spurred talk that some may have come from Russia as sanctions from the U.S. and European Union cut off the Russian central bank’s access to much of its $643 billion in foreign reserves. As of June, China’s yuan accounted for 13% of those reserves, according to the central bank data. Analysts at Australia & New Zealand Banking Group estimated that Russia’s central bank and sovereign wealth fund probably own a combined $140 billion of Chinese bonds.

China’s narrowing yield premium over U.S. bonds, a result of diverging monetary policies, has also eroded the allure of the Chinese securities. At about 2.8%, yields on 10-year Chinese bonds are about 105 basis points higher than Treasuries, compared with a gap of more than 220 basis points at the end of 2020.

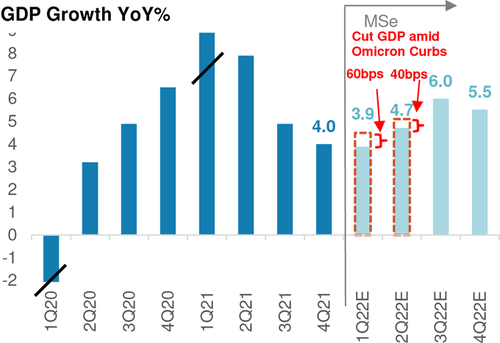

10. GDP on verge of contraction

In response to weaker consumption and an adverse impact on supply chains, as China doubles down on Covid-zero amid Omicron, Morgan Stanley has cut China's Q1 GDP by 60bps, to zero growth QoQ, and cut full-year GDP by 20bps, to 5.1%. It will cut more.

11. China to easing aggressively

As a result of all this relentless pain, the China Securities Journal, a mouthpiece for the PBOC and the place where Beijing leaks trial balloons on what is to come, says PBOC may cut RRR and interest rates to stabilize growth. A loose monetary policy is currently required to support growth, the report said echoing what we have been predicting since mid-2021. China is still expected to cut banks’ reserve requirement ratio and interest rates further to stabilize economic growth despite looming U.S. Fed rate hike, China Securities Journal said in the the front-page report Monday, citing analysts. A further cut in RRR and interest rates may have already been placed on the agenda of China’s central bank.

This begs the question: how long can US and China monetary policy diverge, with the former hiking and the latter cutting, before something terminally breaks. One thing is certain: for China to achieve its target of around 5.5% growth this year, with the property market slumping, coronavirus infections rapidly increasing, inflation still high and export demand threatened by the effects of the war in Europe, only a massive monetary stimulus will prevent China from falling into a catastrophic recession. It's why Premier Li Keqiang told reporters Friday that achieving the growth goal won’t be easy. He also told them he is quitting this year; the two are linked...

h/t Bloomberg's Sofia Horta e Costa

![]()

Putin: The World is Crazy, and I Love It!

![]()

SRH: It is an error to say that God never supports a war. Jesus is not a pacifist. In a world filled with evil people, sometimes war is necessary to prevent an even greater evil. If Hitler had not been defeated by World War II, how many more millions would have been killed? If the American Civil War had not been fought, how much longer would African-Americans have had to suffer as slaves?

War is a terrible thing. Some wars are more “just” than others, but war is always the result of sin (Romans 3:10-18). At the same time, Ecclesiastes 3:8 declares, “There is…a time to love and a time to hate, a time for war and a time for peace.” In a world filled with sin, hatred, and evil (Romans 3:10-18), war is inevitable. Christians should not desire war, but neither are Christians to oppose the government God has placed in authority over them (Romans 13:1-4; 1 Peter 2:17). The most important thing we can be doing in a time of war is to be praying for godly wisdom for our leaders, praying for the safety of our military, praying for a quick resolution to conflicts, and praying for a minimum of casualties among civilians on both sides (Philippians 4:6-7).

God knows that evil is not combated with love and understanding.

King David Had This Down:

The misfits. The rebels. The troublemakers, The Cowboys. The round pegs in the square holes misfits. The ones who see things totally differently. They’re not comfortable with the rules. And they have no respect for the status quo Pharisees “hypocrites”. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do–is ignore them”. Because they change things. They push GOD’s human race forward and that bothers the politicians and otherworldly liars. And while some may see them as the crazy ones, I see a genius. Because the people who are crazy enough to think they can change the world, are the ones who do. SRH…

Newsletter

Support Orphans

Editor's Bio

A Thrilling Ride

Every once in awhile, a book comes across your path that is impossible to put down. A Long Journey Home is not a casual book that you read in a week or earmark to complete at a later date. Once you begin, cancel your schedule, put your phone on silent, find a quiet place where you cannot be disturbed, and complete the journey. Click Here to Purchase on Amazon.com!

Recent News

Opponents of President Donald Trump Are Planning to Target His Supporters

By StevieRay Hansen |

Watchman: Businessmen Say They Will No Longer Invest in Hell Hole New York After Justice Engoron’s Trump Ruling–Satan Soldiers On The Move to Destroy America

By StevieRay Hansen |

Watchman Says Trump Should be Careful,There Will Soon Be a CIA Magic Bullet That Will Take Out a Lot of People–NWO is Getting Desperate

By StevieRay Hansen |

Watchmen: Do Not Mistake Consensus for Truth: Russia and the US Are Traveling in the Same Direction; Silence the Critics, Including Murder; Trump Needs to Pay Attention

By StevieRay Hansen |

Watchman: Our King Obama/Biden Has Spoken Through Weaponizing Government Agencies for the Use of Generic Terms Like ‘TRUMP’ and ‘MAGA’ Its Looking Alot Like Nazi Germany

By StevieRay Hansen |

Watchman:The Supreme Court Is Hesitant to Restrict the Biden Administration’s Interaction With Social Media. The First Amendment No Longer Exists. You Can Thank Google, Obama, and Others. Side Bar Trump Is in Peril and Will Be Unable to Save the Country

By StevieRay Hansen |

Reach People