Advisory: Be careful of what you read on social media. The algorithms used by these platforms have no regard for Biblical truth. They target your emotions to keep you engaged on their site so their advertisers can drop more ads. These platforms exist to enrich their stockholders. Consider God’s promise to Believers in James 1:5, “If any of you lacks wisdom, you should ask God, who gives generously to all without finding fault, and it will be given to you.”

Featured Story

Crisis, the Cost? Your Freedoms…

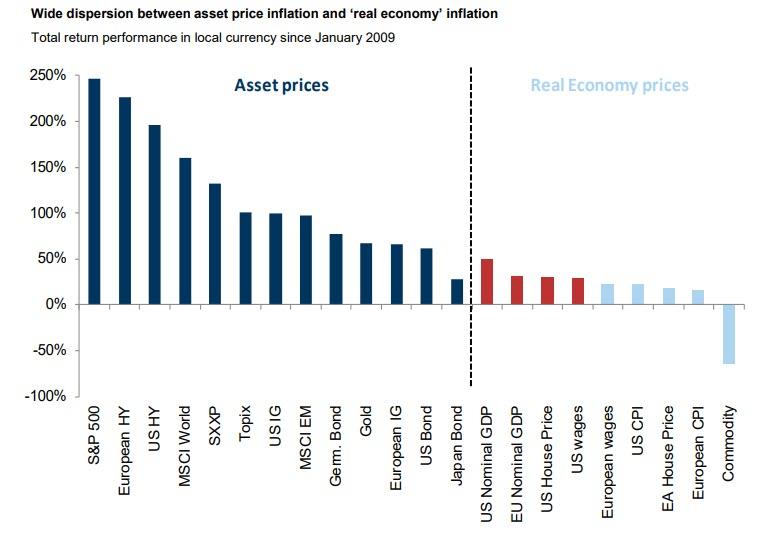

Over the past decade, the one common theme despite the political upheaval and growing social and geopolitical instability, was that the market would keep marching higher and the Fed would continue injecting liquidity into the system. The second common theme is that despite sparking unprecedented asset price inflation, price as measured across the broader economy (at least using the flawed CPI metric) would remain subdued (as a reminder, the Fed is desperate to ignite broad inflation as that is the only way the countless trillions of excess debt can be eliminated and yet it has so far failed to do so).

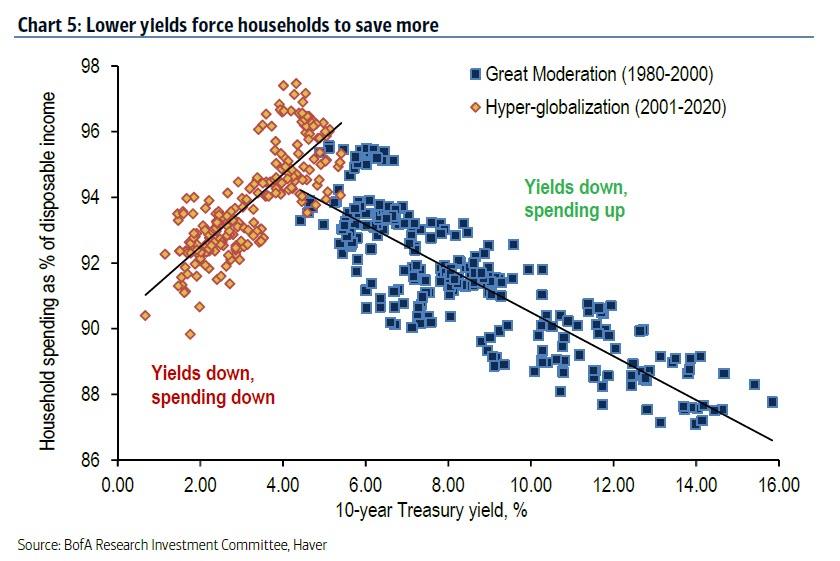

The Fed’s failure to reach its inflation target has sparked broad criticism from the economic establishment, even though as we showed in June, deflation is now a direct function of the Fed’s unconventional monetary policies as the lower yields slide, the lower the propensity to spend. In other words, the harder the Fed fights to stimulate inflation, the more deflation and more saving it spurs as a result (incidentally this is not the first time this “discovery” was made, in December we wrote “One Bank Makes A Stunning Discovery – The Fed’s Rate Cuts Are Now Deflationary“).

In short, ever since the Fed launched QE and NIRP, it has been making the situation it has been trying to “fix” even worse, all the while blowing a massive asset price bubble.

And having recently accepted that its preferred stimulus pathway has failed to boost the broader economy, the blame has fallen on how monetary policy is intermediated, specifically the way the Fed creates excess reserves which end up at commercial banks instead of “tricking down” all the way to the consumer level.

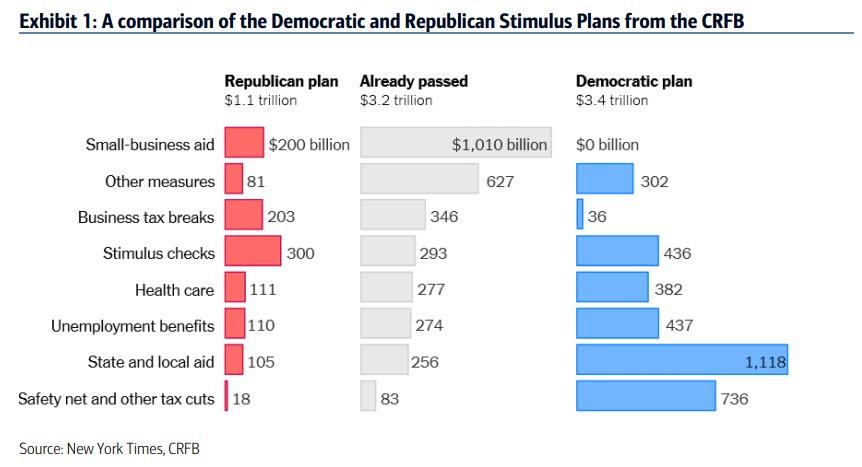

To be in the aftermath of the covid pandemic shutdowns the Fed has tried to short-circuit this process, and in conjunction with the Treasury it has launched “helicopter money” which has resulted in a direct transfer of funds to US corporations via PPP loans, as well as to end consumers via the emergency $600 weekly unemployment benefits which however are set to expire unless renewed by Congress as explained last week, as Democrats and Republicans feud over which fiscal stimulus will be implemented next.

Ad yet, the lament is that even as the economy was desperately in need of a massive liquidity tsunami, the funds created by the Fed and Treasury (now that the US operates under a quasi-MMT regime) did not make their way to those who need them the most: end consumers.

Which is why we read with great interest a Bloomberg interview published on Saturday with two former central bank officials: Simon Potter, who led the Federal Reserve Bank of New York’s markets group i.e., he was the head of the Fed’s Plunge Protection Team for years, and Julia Coronado, who spent eight years as an economist for the Fed’s Board of Governors, who are among the innovators brainstorming solutions to what has emerged as the most crucial and difficult problem facing the Fed: get money swiftly to people who need it most in a crisis.

The response was striking: they two propose creating a monetary tool that they call recession insurance bonds, which draw on some of the advances in digital payments, which will be wired instantly to Americans.

As Coronado explains the details, Congress would grant the Federal Reserve an additional tool for providing support—say, a percent of GDP [in a lump sum that would be divided equally and distributed] to households in a recession. Recession insurance bonds would be zero-coupon securities, a contingent asset of households that would basically lie in wait. The trigger could be reaching the zero lower bound on interest rates or, as economist Claudia Sahm has proposed, a 0.5 percentage point increase in the unemployment rate. The Fed would then activate the securities and deposit the funds digitally in households’ apps.

As Potter then elucidates, “it took Congress too long to get money to people, and it’s too clunky. We need a separate infrastructure. The Fed could buy the bonds quickly without going to the private market. On March 15 they could have said interest rates are now at zero, we’re activating X amount of the bonds, and we’ll be tracking the unemployment rate—if it increases above this level, we’ll buy more. The bonds will be on the asset side of the Fed’s balance sheet; the digital dollars in people’s accounts will be on the liability side.”

And that, in a nutshell, is how the Fed will stimulate the economy in the next crisis in hopes of circumventing the reserve creation process: it will use digital money apps (which explains the Fed’s recent fascination with cryptocurrency and digital money) to transfer money directly to US consumers.

To be sure, the narrative is already set for how the Fed will “sell” this direct transfer of money to the rest of the world and the broader US population: as Coronado explains “it’s the most efficient from a macroeconomic standpoint in supporting spending and confidence. The fear of unemployment acts as an accelerant on a recession. There’s a shock—people are losing their jobs or worry about losing their jobs. They get very risk-averse. [By] getting money to consumers you can limit the depth and duration of a recession.”

And the kicker:

“you could actually generate real inflation. It could be beneficial for not only avoiding negative rates but creating a more healthy interest-rate market, a more healthy yield curve.”

So there you have it: the one thing that was missing from a decade of monetary tinkering by the Fed, the spark of inflation, will finally arrive as the Fed gives money to those most likely to spend it: the lower and middle classes of society.

But wait, there’s more: now that the Fed is implicitly focusing on racial inequality, and soon explicitly with Joe Biden going so far as to urge the Fed to fight “racial economic inequality” and former Minneapolis Fed president Kocherlakota writing an op-ed in which he said the Fed “should have a third mandate on racial inquality“, the stage is now set for the Fed to specifically release funds for those who have “suffered from inequality”, and once the time comes when the narrative allows to deploy reparations or direct funding to minorities, the Fed will be ready.

* * *

Below we republish the Bloomberg Markets interview with Coronado and Potter because it lays out, very clearly, just what the next monetary stimulus will look like now that helicopter money is fully engaged and money is about to be sent by the Fed directly to those Americans the Fed finds to be “in need.”

BLOOMBERG MARKETS: How would recession insurance bonds work?

JULIA CORONADO: Congress would grant the Federal Reserve an additional tool for providing support—say, a percent of GDP [in a lump sum that would be divided equally and distributed] to households in a recession. Recession insurance bonds would be zero-coupon securities, a contingent asset of households that would basically lie in wait. The trigger could be reaching the zero lower bound on interest rates or, as economist Claudia Sahm has proposed, a 0.5 percentage point increase in the unemployment rate. The Fed would then activate the securities and deposit the funds digitally in households’ apps.Julia Coronado

And so instead of these gyrations we’ve been going through to get money to households, it would happen instantaneously.

SIMON POTTER: It took Congress too long to get money to people, and it’s too clunky. We need a separate infrastructure. The Fed could buy the bonds quickly without going to the private market. On March 15 they could have said interest rates are now at zero, we’re activating X amount of the bonds, and we’ll be tracking the unemployment rate—if it increases above this level, we’ll buy more. The bonds will be on the asset side of the Fed’s balance sheet; the digital dollars in people’s accounts will be on the liability side.

BM: Aside from speed, what are the main advantages of this approach?

JC: It’s the most efficient from a macroeconomic standpoint in supporting spending and confidence. The fear of unemployment acts as an accelerant on a recession. There’s a shock—people are losing their jobs or worry about losing their jobs. They get very risk-averse. [By] getting money to consumers you can limit the depth and duration of a recession. And you could actually generate real inflation. It could be beneficial for not only avoiding negative rates but creating a more healthy interest-rate market, a more healthy yield curve.

BM: What are the origins of the idea?

JC: The Bank of England has proposals for digital currency. And a number of people have talked about the need for monetary financing—the idea that the interest-rate tool is simply less effective in lower growth, slower credit growth economies. Helicopter money [making direct payments to the public] goes back to Milton Friedman, but Ben Bernanke revisited it. Some people proposed doing that through financing fiscal stimulus. We think going directly to consumers is more efficient than wading through that sticky fiscal process.

BM: This policy could be complementary to Treasury stimulus?

JC: It’s not a replacement for fiscal policy. It makes sense from a fiscal perspective, for example, to authorize unemployment insurance benefits for people who lose their jobs and other assistance for medical-care providers in the current situation.

SP: The central bank is not elected. It cannot make allocation decisions about fiscal transfers. It’s now being pushed to make allocation decisions around credit with the Treasury, because we believe this situation is so unique that the private sector cannot make those decisions itself. The simplest way to do this would be a lump sum. Not in the way Congress did it. We’d take the bluntness of monetary policy and say anyone who’s eligible should get the same amount of bonds.Simon Potter

Fiscal controls could use the same infrastructure. The imperative to invest in it is high. Nearly all Treasury payments at some point touch the Fed because it’s the Treasury’s bank. The digital payment providers—called interface providers in the Bank of England proposal—would manage these accounts and link them to the Fed and Treasury.

BM: What are the objections from the Fed, and other challenges?

SP: The reaction from some of my former colleagues a while ago to the notion of helicopter money was not the most embracing. Some of those concerns have disappeared.

The two objections were related to the switch of deposits in normal times from the traditional banking system into digital accounts and the extra stress in crisis times as people want to get safe. An account with the central bank is safe because the central bank can always print money to honor that claim. A private bank can’t do that because their asset side has all kinds of credit on it. What we’ve created is a narrow bank-type model [narrow banks only take deposits and invest them in the safest assets] that’s small and fit for purpose, with a cap of $10,000 [per person].

JC: One challenge is making it profitable for digital providers. We want strict limitations on the fees so we’re reaching people that are underbanked, but we also want a public-private partnership with a diversity of competitors jumping into this market. Privacy is just as important, because one thing that might induce them is access to people’s data. As the Fed, are you blessing that, and what structure do you put around that?

SP: We’ll all have to deal with deep questions of privacy in the digital world. One of the issues Congress had in passing the Cares Act is identifying who’s got mainly tip income, who doesn’t have sick days. If society wanted, you could use large datasets to direct fiscal transfers to those people. But that’s a job for Congress.

BM: Have you seen similar trials elsewhere?

SP: Sweden is a leader in thinking about this in part because they had a large decline in cash use. China is testing versions of digital currency. Fintech firms in the U.S. are interested in this—there’s a stable coin version of our proposal. There’s easily sufficient innovation within the U.S. to do this. How to do it in a way that’s well regulated and serving the public purpose is something the Fed should focus on over the next few years. It would be a key accomplishment of the Fed and Treasury to get this infrastructure in place.

At this point in the plandemic it’s pretty clear that plenty of governments are absolutely not letting this crisis go to waste. Here’s a roundup of what’s happening around the world:

Philippines: “Shoot them dead”

In 2016 the President of the Philippines, Rodrigo Duterte, was elected on a “tough on crime” platform.

He wanted to bring back hangings for criminals convicted of murder and rape.

After being elected, Duterte said that drug traffickers, drug dealers, and even drug users should be shot dead in the street.

Other government officials insisted Duterte was exaggerating, just using theatrics to get his point across.

But sure enough, thousands of alleged drug dealers and users have been killed since 2016. Some were killed by police, and others by vigilantes.

Now the Philippines, like most of the world, is on lockdown to try to prevent the spread of CoronaVirus.

And in Duterte’s own words, “if there is any trouble” enforcing the lockdown, or people who ignore the rules, police should “shoot them dead.”

Hong Kong: GPS trackers

Hong Kong’s government (which at this point is basically an extension of mainland China) is forcing some people to wear bulky GPS trackers on their wrists.

This is happening at a time when Hong Kong is experiencing its second wave of Covid outbreaks. So the government started requiring new arrivals to strap on a wristband in order to ‘geofence’ people into their quarantine areas.

Once you arrive to your destination (your hotel, apartment, etc.) you have one minute to walk around so that the GPS tracker can map out the perimeter. And if you leave the area, the authorities are immediately alerted.

Violators face up to six months in prison and fines up to USD $3,200.

This is probably going to become the standard in the West, and I’ve been told by a source in Hong Kong that the World Health Organization is trialing these bracelets for release in western countries.

Poland: Mandatory selfie photos

Poland’s government developed a special app where users are forced to upload selfie photos to prove that they are inside and not violating the lockdown.

It’s called the “Home Quarantine” app, and it’s required for people returning to Poland from abroad who must self-quarantine for 14 days.

When the app requests a photo, users have twenty minutes to upload a selfie from inside their home, or the police come knocking.

Russia: 100,000 cameras with facial recognition across Moscow

After Russia’s Duma (parliament) voted in early March to allow Vladimir Putin to defy constitutional term limits and continue to seek re-election as President, the government has now deployed a network of 100,000 cameras with facial recognition in the streets of Moscow to track individuals who are supposed to be in quarantine.

Violations in Russia can carry severe penalties, up to seven years in prison.

Furthermore, even spreading what the government deems as ‘fake news’ about Covid-19 could result in up to five years in prison.

India: Flights and trains suspended, supply chain breaks down

India’s government ordered its population to quarantine last month… and then shut down the country’s primary transportation systems.

The government suspended both domestic flights and train travel, apparently not realizing that millions of people would be stranded and unable to return home to self-quarantine.

Unsurprisingly, the Wall Street Journal reported earlier this week that supply chains in India have also started to break down, causing shortages of certain foods.

Singapore: tracking everyone else you meet

Singapore’s government is using bluetooth and GPS data from its citizens mobile phones to map who everyone comes into contact with. They at least have announced that they will publish the source code of the tracking app.

Land of the Free: Ankle bracelets on, medical privacy off

The Commonwealth of Kentucky has begun ordering house-arrest ankle bracelets for some citizens who they deem susceptible to violate curfew.

Massachusetts, Alabama, and Florida have abandoned medical privacy laws, and officials are now informing the police and paramedics which homes have a resident who tested positive for Coronavirus.

South Africa: Bride and Groom arrested at their own wedding

A wedding that took place despite a nationwide ban on public gatherings in the South African state of KwaZulu Natal was broken up by police last weekend.

All 50 guests, plus the minister performing the service, and the bride and groom, were arrested and hauled off to jail.

Understandably, I imagine many readers might think, “Well that was stupid and a little bit selfish to hold a public gathering at a time like this.”

I agree. But it’s hard to ignore the fact that basic freedoms: freedom of assembly, freedom of worship, freedom of speech, privacy, etc. have gone out the window, all over the world.

Laws and constitutions everywhere are being violated. And while most of the discussion about this pandemic is ‘when will the public health emergency subside,’ and ‘when will the economy go back to normal,’ there’s hardly any discussion about “When will our freedoms be restored?”

It’s hard to imagine they’re going to stop the GPS tracking, the facial recognition, the criminal ‘fake news’ penalties, and the countless other ‘emergency measures’ anytime soon.

Think about it– 9/11 was nearly two decades ago and we’re still dealing with the freedom-eroding consequences of that event.

So we have to be honest with ourselves about this pandemic– the longer these freedoms are restricted, the more unlikely they’ll ever be restored.

And to continue learning how to ensure you thrive no matter what happens next in the world, I encourage you to download our free Perfect Plan B Guide.

Because… If you live, work, bank, invest, own a business, and hold your assets all in just one country, you are putting all of your eggs in one basket.

You’re making a high-stakes bet that everything is going to be ok in that one country — forever.

All it would take is for the economy to tank, a natural disaster to hit, or the political system to go into turmoil and you could lose everything—your money, your assets, and possibly even your freedom.

Luckily, there are a number of simple, logical steps you can take to protect yourself from these obvious risks

Now It All Makes Perfect Sense, Bill Gates, Trump, and the New World Order Pukes Have Pulled off the Unthinkable and Hell on Earth Has to Begin, It Gets Un-godly Going Forward, The Mark Of The Beast Is In-Play, “Vaccination With Microchip”

If all goes according to plan, Gates plans to hold the world hostage until everyone – or at least everyone who wants to return back to a “normal” way of living – agrees to whatever he declares as the “remedy” for this coronavirus, which he’s already indicated will include mandatory vaccination and microchip.

The vaccines that Gates is planning to introduce will come with so-called quantum dot tattoos, a type of small microchip that will have to be inserted underneath the skin in order to function.

Much like – if not the embodiment of – the Mark of the Beast spoken about in the book of Revelation, Gates’ digital microchip vaccinations will be required for all people who want to open back up their businesses and participate in society. They’ll also likely store the “digital dollar” cryptocurrency that was included as part of the stimulus bill recently signed by President Trump.

The World Is In Big Trouble, for Those That Believe We Will Go Back to Some Sense of Normal Life Here on Earth, You Will Be Sadly Disappointed, Seven and Half Years of Hell on Earth Which Began January 1, 2020

“Our courts oppose the righteous, and justice is nowhere to be found. Truth stumbles in the streets, and honesty has been outlawed” (Isa. 59:14, NLT)…We Turned Our Backs On GOD, Now We Have Been Left To Our Own Devices, Enjoy…

While Mainstream Media Continues to Push a False Narrative, Big Tech Has Keep the Truth From Coming out by Shadow Banning Conservatives, Christians, and Like-Minded People, Those Death Attributed to the Coronavirus Is a Result of Those Mentioned, They Truly Are Evil…

StevieRay Hansen

Editor, HNewsWire.com

Watchmen does not confuse truth with consensus The Watchmen does not confuse God’s word with the word of those in power…

In police-state fashion, Big Tech took the list of accused (including this site), declared all those named guilty and promptly shadow-banned, de-platformed or de-monetized us all without coming clean about how they engineered the crushing of dissent, Now more than ever big Tech has exposed there hand engaging in devious underhanded tactics to make the sinister look saintly, one of Satan’s greatest weapons happens to be deceit…

The accumulating death toll from Covid-19 can be seen minute-by-minute on cable news channels. But there’s another death toll few seem to care much about: the number of poverty-related deaths being set in motion by deliberately plunging millions of Americans into poverty and despair.

American health care, as we call it today, and for all its high-tech miracles, has evolved into one of the most atrocious rackets the world has ever seen. By racket, I mean an enterprise organized explicitly to make money dishonestly.

All the official reassurances won’t be worth a bucket of warm spit. The Globals are behind the CoronaVirus, It Is a Man-Made Bioweapon.

For those of you who care, Google and your favorite social media platforms have misled you, and now we all pay a heavy price for trusting the ungodly, Google and company, They knew exactly what they were doing, removing our history while preparing you to accept the New World Order playbook, Enjoy.

Tagged In

Newsletter

Must Read

Other Sources

Latest News

Watchman: With This Frigid Weather, You’ll Turn Green and Then Lifeless Blue. Remember, You Are a Winner in Climate Change Because the Last One Living Wins!

Only God Controls Climate You Green Satan Soldiers From HELL HNewsWire: It specifically prohibits funding for the World Health Organization, the World Economic Forum, the…

Read MoreWatchman: God’s Actually Talking, But We Were Too Preoccupied With World View Nonsense, UN Elitist Climate Change Ungodly Garbage

HNewsWire: There have been reports of devastating devastation throughout Middle Tennessee as a series of tornadoes and strong storms slammed the area. In downtown Nashville,…

Read MoreWatchman: Al I’m God Gore Has a History of Making Climate Change Predictions That Consistently Prove to Be Inaccurate. It’s No Surprise That He Desires to Suppress Opposing Views

HNewsWire: Since the 1960s, modern doomsayers have predicted climatic and environmental disasters. They are still doing so today. As of today, none of the catastrophic…

Read MoreWatchman: Bill Gates Calls for Cows to Be Modified to Fight ‘Climate Change’. — HNW Calls for Bill Gates to Be Modified to Protect Christ Followers

HNewsWire: Bill Gates is yet again attempting to play god, this time he has yet again spoke of his plans to modify cows as part…

Read More

We make every effort to acknowledge sources used in our news articles. In a few cases, the sources were lost due to a technological glitch. If you believe we have not given sufficient credit for your source material, please contact us, and we will be more than happy to link to your article.